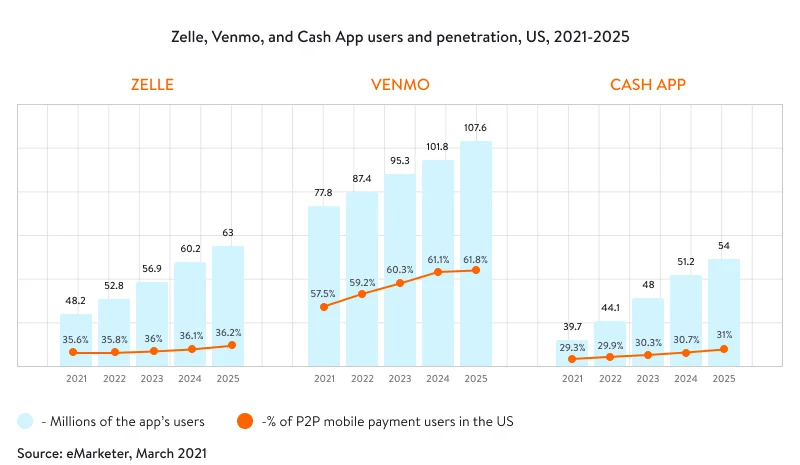

Demand for mobile peer-to-peer (P2P) payments is on the rise. Such payments are the most popular way of transferring money online. During the COVID-19 pandemic, people around the globe preferred non-cash transactions as part of efforts to reduce transmission of the coronavirus. Thus, consumers had an opportunity to appreciate the advantages of P2P payment apps. The numbers speak for themselves:

- According to Allied Market Research, the size of the international P2P payments market was estimated at $1,889.16 billion in 2020 and is predicted to reach $9,097.06 billion by 2030, increasing at a CAGR of 17.3 percent from 2021 to 2030.

- 42 percent of respondents participating in the Statista Global Consumer Survey 2022 said that they sent money to acquaintances in the past 12 months by means of a direct fund transfer service like PayPal.

- SEC.gov states that in 2021, Cash App subscription- and services-based revenue was $1.89 billion, a 63 percent rise compared to 2020. Cash App’s competitors such as Venmo and Zelle have also experienced a jump in demand for their services.

These statistics demonstrate the prospects of growing your P2P payment business with a well-thought-out mobile application. No wonder the query of how to create a mobile peer-to-peer payment app is popular among banking and fintech companies. This post is on how to develop a payment app and will be of interest for banking, financial services, and insurance market players, including:

- Banks that are building P2P payment systems to provide customers with accessible and convenient banking services. Thus, customers will be able to effortlessly transfer money and pay for multiple services (utilities, phone bills, insurance, fines, and more).

- FinTech companies that want to start a P2P payment app development from scratch or improve an existing solution.

Based on thorough research and our FinTech solution development expertise, we’ve compiled a list of ingredients so you know how to build a P2P payment app based on the example of three popular P2P apps: Zelle, Venmo, and Cash App. In order for you to know how to build a payment app, let’s get down to viewing these ingredients without delay.

Looking to build or impove your P2P solution?

Use our FinTech expertise to create high-performing and secure financial software

Common cybersecurity vulnerabilities, incidents, and approaches to ensuring top-notch security during online payment transfer app development

According to Allied Market Research, the acceleration of data breaches and security issues in P2P payments are predicted to impede market growth in the near future. Users of P2P apps often complain of money vanishing without explanation and having a hard time getting a refund after a mistaken payment. Venmo, Zelle, and Cash App have been criticized by security experts for having serious and unresolved privacy issues. Let’s check out some of these cybersecurity vulnerabilities and related incidents and find measures that could prevent them.

Employee-caused data breaches

In December 2021, sensitive data for over eight million users of the Cash App Investing platform was disclosed when an employee downloaded corporate reports after quitting the company. Exposed data included the value of some clients’ portfolios and particulars of their stock trades. To avoid such incidents, you can suppress external access to staff accounts and disable access as soon as a specialist quits.

Fraudulent activity

Fraud has become a serious issue for Zelle, Venmo, and Cash App. For example, a frequent Zelle scam involves scammers introducing themselves as bank fraud investigators and then persuading users to make payments to them. Zelle has taken steps to address its fraud problem: in April 2022, it launched Authentify, an identity verification service. One more step to fight scams on your platform is introducing a vigorous fraud detection and mitigation procedure.

Publicly available user data

Venmo payments are public by default, since Venmo is both a payment app and a social network. The transparency of the app’s transactions and other user information has been called out by privacy experts for years. One of the most recent and highly discussed examples of where this transparency can play a nasty trick is an incident that happened in May 2021. It took Buzzfeed journalists 10 minutes of searching in Venmo to discover President Joe Biden’s, his family members’, and his friends’ Venmo accounts.

In response to the Buzzfeed report, the money transfer app implemented new privacy controls enabling users to make their list of contacts private. A bit later, the company gave up the global feed previously displaying users’ payments in real time. Currently, the app’s social network components are limited to users’ friends in the “friends feed”.

Experience has proven that when it comes to cybersecurity, P2P apps are likely not foolproof. We urge you to create a payment app implementing the following measures to minimize the possibility of cybersecurity incidents:

- Create a Cash App-like application compliant with PCI requirements from the start. PCI DSS (Payment Card Industry Data Security Standard) certification is a requirement for any company that processes credit or debit card transactions.

- Use encryption to protect user account data and track users’ account activity to identify unauthorized transactions.

- Avoid one-click transactions and instead ask users to double-check payment details prior to hitting send.

- Use artificial intelligence tools to reveal irregular user behaviors that could indicate fraud.

- Inform users by means such as pop-up alerts about the risks associated with peer-to-peer payment transactions to persuade them that they should avoid transferring funds to unfamiliar parties.

In addition to the above-mentioned, you can implement multi-factor authentication (MFA). This will guarantee that hijacked password and username combinations alone won’t be enough to give intruders access to user accounts. Money transfer apps adopting MFA request that users provide at least one extra factor of authentication to confirm their identities.

Despite periodic fraudulent activity involving Zelle users, one of the app’s key selling points is the common opinion that it’s more secure than Venmo and Cash App. Zelle was launched by dominant banks, while Venmo and Cash App are independently operated companies. So what governed the success of Venmo and Cash App? Mainly, it’s their great user engagement strategies.

Security best practices for web and mobile app development

Read the postHow to make a payment app user-engaging

It’s no surprise that most individuals don’t consider financial management a hobby. Managing your savings can be tedious if you aren’t financially literate or don’t have access to easy-to-use and engaging financial tools. That’s why during mobile payment app development you should prioritize intuitive and convenient user experience flow (we’ll discuss how to ensure this a bit later) and have proper user engagement components in place.

The rate of user engagement indicates the frequency and duration of interactions with your app. This metric allows you to determine if users find value in your services. Businesses measure engagement by monitoring user actions including clicks, downloads, and shares, and then analyze this data. The more people engage with your app, the more it becomes a matter of habit for them. Let’s view how Cash App and Venmo succeeded in ensuring high rates of user engagement.

Cash App’s user engagement strategy

The key to the colossal success of Cash App is its one-of-a-kind viral and influencer marketing strategy.

Cash App Friday campaign. Taking place on Twitter and Instagram, Cash App Friday is a unique social money giveaway that starts on Fridays. The particular Fridays are chosen at random by the company. Cash App Friday may happen several times a month or not once. To participate in the promotion campaign, users need to follow the company on social networks so as not to miss the next Cash App Friday. To win the giveaway, users have to like, share, and leave a comment on a post in addition to sharing their $Cashtag identifier (a unique identifier for people and businesses that use Cash App). Such posts get hundreds of thousands of retweets and comments.

Collaboration with brands and celebrities. Cash App has partnered with brands for charitable causes and to hold raffles. One instance is a joint campaign with Burger King – the companies offered to pay off the student debt of chosen Twitter users. Campaign-related posts on Twitter gained 89,000 retweets and 40,000 likes. Moreover, Cash App ran analogous promotional campaigns collaborating with stars including Travis Scott and Lil B. Such partnerships helped the company advertise the app among these celebrities’ fans.

Educational content for improved financial literacy. To attract Generation Z to the app, Cash App provides content streams aiming to enhance users’ financial literacy. This content is presented in hip hop aesthetics. “Cash App Wisdom” is a series of explanations devoted to financial topics including the basics of investment and account protection. Various classes on money management are conducted by Meghan Thee Stallion, an American rapper. Content delivered in collaboration with Red Bull Racing Honda helps teach users about crypto operations. Such educational content results in an enormous following and distinguishes Cash App from other money management apps.

Venmo’s user engagement strategies

What has contributed to the tremendous success of Venmo is that it’s a payment app with rewarding components and a social network all in one.

Social network component. Over 90 percent of all the app’s transactions are visible to a user’s acquaintances or network and receive reactions in the form of emoji or comments. If someone wants to know what their friend is doing or recently did, they can go to the Venmo feed. This social media element not only makes Venmo alluring among younger users but also contributes to great user engagement. Users open Venmo several times a week just to check what their friends are doing.

Venmo rewards program. Venmo credit card holders receive cashback on all purchases, which instantly goes to the app’s balance. Throughout all statement periods, users automatically earn three percent on their top spending category, two percent on their second spending category, and one percent on all other eligible purchases. The eight spending categories are trackable by means of the Venmo app. They include grocery, bills and utilities, health and beauty, gas, entertainment, dining and nightlife, transportation, and travel.

It’s obvious that even thoroughly thought-out user engagement strategies won’t be effective if your Cash App clone’s user experience is poor. Let’s check what makes the most popular P2P apps user-friendly.

Ensuring a smooth user experience during P2P payment app development

The UI and UX of your money transfer app should be alluring, intuitive, and simple. Keep in mind that consumers aren’t willing to spend much time figuring out how everything works. In order to create a payment app that will be appreciated by users, make your UI/UX as clear and minimalist as possible.

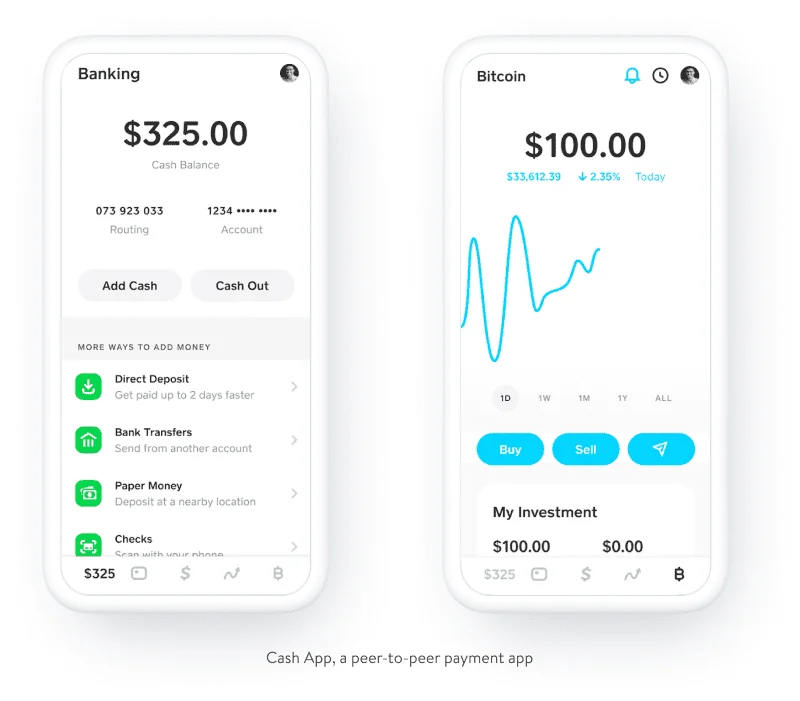

Make Cash App features built by Cash App developers and its user experience. The app has a modern and user-friendly interface. The Cash App application brilliantly uses bold colors and large text to provide users with a fresh and dynamic experience. Here are some Cash App design ideas you can get inspired by.

- The app’s onboarding process is easy and fast. Users receive a verification code, enter it, and provide personal information including their name, zip code, and debit card details. Then the app asks users to make a “$Cashtag,” a name used by those who want to send them money. The entire onboarding procedure is performed through several bold green screens where a user enters the required details.

- The app’s further use. The default home screen encourages a user to insert a sum of money and choose either “request” or “pay” to transfer money or get a payment. You can find a person by name, $Cashtag, email, and SMS. Moreover, you can use Bluetooth to locate users if they are in close proximity. The convenient account screen lets you see your personal data and change preferences, including enabling auto cash out or security lock. There’s also a private activity feed allowing only you to see your payment history.

Why and how to redesign your existing P2P app

If you already have a fully functioning P2P payment app, you might consider custom financial software development to revamp and redesign it for several reasons:

- Low rating on the app stores (three or fewer stars, or lower than your usual rating)

- Numerous and frequent negative user reviews

- Specific issues that users notify you about in their reviews

- Negative feedback on social media

- Frequent security issues

- Expanding the set of services provided by your app

In 2021, Venmo announced a redesigned app. The redesign was in response to the need for providing improved security and attracting attention to the app’s broader set of services beyond P2P payments. Updates included:

- Improved social feed. As we mentioned above, the company gave up its global feed. The friends feed is currently the only social feed available in the app.

- Bottom navigation. Now users can smoothly switch between their social feed, various features (operations with credit/debit cards, recently added cryptocurrencies, etc.), and their personal profile. Before the redesign, users had to comb through a menu to find services not related to peer-to-peer payments.

- Cards button. Venmo credit and debit card holders can access controls and functionality to use and manage their cards, rewards, and offers in an easily accessible place.

- Crypto button. Users can easily delve into the world of cryptocurrencies, analyze trends in real time, and purchase, sell, or keep four types of cryptocurrencies right in the app.

- Enhanced personal feed. Users now have a holistic view of their wallet, activity, and settings right in their personal feed. Users see their balance, view the history of transactions, and manage and monitor expenditures in a central place.

Regardless of the appearance of new functionality and new ways to manage your money, the app remains easy to use and preserves its entertaining social network components. Users can still see other users’ transactions and leave emojis to demonstrate what payments are for.

To effectively redesign your app as Venmo did, conduct user interviews by asking users the following questions:

- When, where, and how do you access the app?

- What is your purpose for using the app?

- How fast are you able to achieve your goal with the app?

- What do you love and hate about the app?

- What else would you like to be able to do with the help of the app?

Collecting such user feedback will help you figure out what users think about the app with precision and determine exactly where and how the app can be enhanced.

More insights on how to create a P2P money transfer app and run a successful P2P payment business

These are all important factors to be considered when planning to start P2P payment app development, improve it, or while growing your paper-to-peer payment business.

Define your competitive advantage

The experience of leading P2P payment app development proves that differentiation is likely to be a key determinant of your app’s continued growth. For example, people consider Zelle as the best service for instant transfers. Venmo is surely best for groups of friends. Cash App is regarded as best for investors. In its turn, PayPal, the oldest P2P player, keeps holding its own in ecommerce. Lastly, Google Pay is preferred by people using digital wallets.

Wisely adopt proven business strategies

Emerging P2P apps often successfully follow the example of popular services with proven business strategies. Take London-based VibePay, for example, which was inspired by Venmo’s social network component. As with Venmo in the US, VibePay is striving to target Generation Z and Millennials in the UK by means of its social media-like functionality that enables users to leave a message or an emoji about each transaction.

Expand functionality beyond peer-to-peer payments

Cash App has expanded its services beyond P2P payments. Consumers can receive direct deposit and Automated Clearing House (ACH) payments in addition to buying cryptocurrency and trading stocks.

For the record, Cash App was among the first popular P2P apps to offer users cryptocurrency operations. Block, the company behind Cash App, began enabling users to purchase, sell, and hold Bitcoin in 2018. In comparison, PayPal launched a similar service only in 2020. Cash App keeps making it easier to invest in Bitcoin. The company has recently introduced new Paid in Bitcoin, Bitcoin Roundups, and Lightning Network Receives services.

To date, over 10 million individuals have purchased Bitcoin using the app, as stated in Block’s Q1 2022 shareholder letter. In the first quarter of 2022, Cash App generated $624 million in gross profit, $43 million of which was gained from Bitcoin sales.

Expand your target audience to the business segment

Having a Venmo business account lets businesses get payments from their clients online or in person using a unique QR code. A business can create a business profile free of charge. However, there is a 1.9 percent plus $0.10 fee per transaction. Consumers can transfer money to businesses the same way they do when sending money to their acquaintances. The Venmo app allows for one-tap switching between personal and business profiles.

In terms of business transactions, Zelle keeps up with Venmo. To achieve its growth in the business segment, Zelle has also introduced a QR code function that enables consumers to effortlessly pay businesses. Albert Ko, CEO of Zelle, says that the majority of the app’s transactions are peer to peer, but businesses are increasingly using the app. He states that in 2021, payments made via the Zelle app for small businesses grew 162 percent over 2020 totals.

Adopt technologies that simplify the payment process

The COVID-19 pandemic spurred demand for mobile banking app development with NFC (near-field communication) payments and QR codes. In response, PayPal, the owner of Venmo, decided to take advantage of both trends for the app’s first credit card. Now Venmo users can receive a credit card that combines a contactless payment chip and a printed QR code. By using this card, consumers can get peer-to-peer payments and split bills with others. In addition to the physical credit card, consumers obtain a virtual card used for online shopping even when the physical card is frozen due to loss or theft.

Afterwords

Don’t know how to make a payment app? The quality of your app and its subsequent success primarily depends on the expertise of your payment app development partner, so take your time to choose. Yalantis experts have experience building digital financial solutions. We help financial institutions and FinTech companies build sophisticated and engaging software products. We will gladly help you implement your idea.

Rate this article

3/5.0

based on 10 reviews