Platform overview

Yalantis Payments is a corporate platform for comprehensive employee compensation management. It provides a set of tools for financial operations and a complete overview of the company’s employees, including personal and job information outlined in employee profiles as well as levels of expertise (junior, middle, senior) and departments. In addition to employee information, the platform handles benefits provided by the company and generates financial reports for custom time periods.

Common challenges with internal financial operations that Yalantis Payments solves

Managing compensation in big companies is a chore for the finance department, considering all the benefits, undertime, overtime, unpaid sick leaves, and vacations that impact final compensation amounts. Moreover, processing all this information involves multiple people, leading to the following:

- A substantial amount of time-consuming and error-prone work that overwhelms employees and hampers their performance

- Questionable security of employees’ personal information due to poor data protection measures of paper-based and file-based document management systems

- A need for additional manual efforts to recalculate compensation and benefits for each employee in the event of unpredictable overtime or sudden benefit submissions

- Difficulty in obtaining financial reports and documents for the entire company when necessary, as they are usually generated on a monthly basis

Benefits of Yalantis Payments that fill the gaps existing in similar platforms

-

01

Ability to integrate systems in compliance with specific government or company rules. Yalantis Payments was developed with flexibility in mind, which means that its architecture allows you to change or customize anything in the business logic according to local or company-based requirements (such as new types of compensation, additional tax types, etc).

-

02

Comprehensive integration with banking systems, enabling operations with multiple currencies and support for multi-country teams. Through such an integration, the system receives up-to-date currency exchange rates from banks on a daily basis. This allows for creating payouts in required currencies based on employees’ locations. API-based integration with new banks and establishing all needed processes may take up to four weeks. The final implementation time depends on the complexity of the integration.

-

03

95% reduction in the amount of manual and routine work. Yalantis Payments eliminates paperwork by automating manual document management. It also abolishes the number of human errors when calculating compensation and extra fees. For providing real-time data on extra fees, the platform gathers information from the HRM system and Jira Tempo.

-

04

35% reduction is development and implementation costs. Due to its flexible architecture and ready-to-use UX library, Yalantis Payments allows companies to accelerate implementation time, avoid financial intricacies, and at the same time save resources on developing custom solutions.

-

05

70% improved operational efficiency. Yalantis Payments ensures the real-time updating of employees’ data (extra fees, raises, overtime, undertime) aggregated from multiple integrated services. Together with the form autofilling feature, it allows financial specialists to generate payouts for the entire company in just a few clicks. Additionally, the system provides invoices and reports for all completed operations.

Functionality that streamlines financial operations and employee profile management

The platform provides end-users with the following feature set:

Employee profile management:

- Up-to-date employee listings. The profile displays active, new, and archived employee profiles, each containing necessary information including electronic contracts and passport scans. An aggregated profile dashboard also indicates employees’ profile completeness and identifies those who lack important documents in the system.

- Updates tab for urgent modifications. This tab indicates whether any necessary changes need to be made to a specific employee’s profile. The system sends notifications based on information added to the HRM system or Jira Tempo and allows accountants to view and accept these details.

Functionality for financial operations:

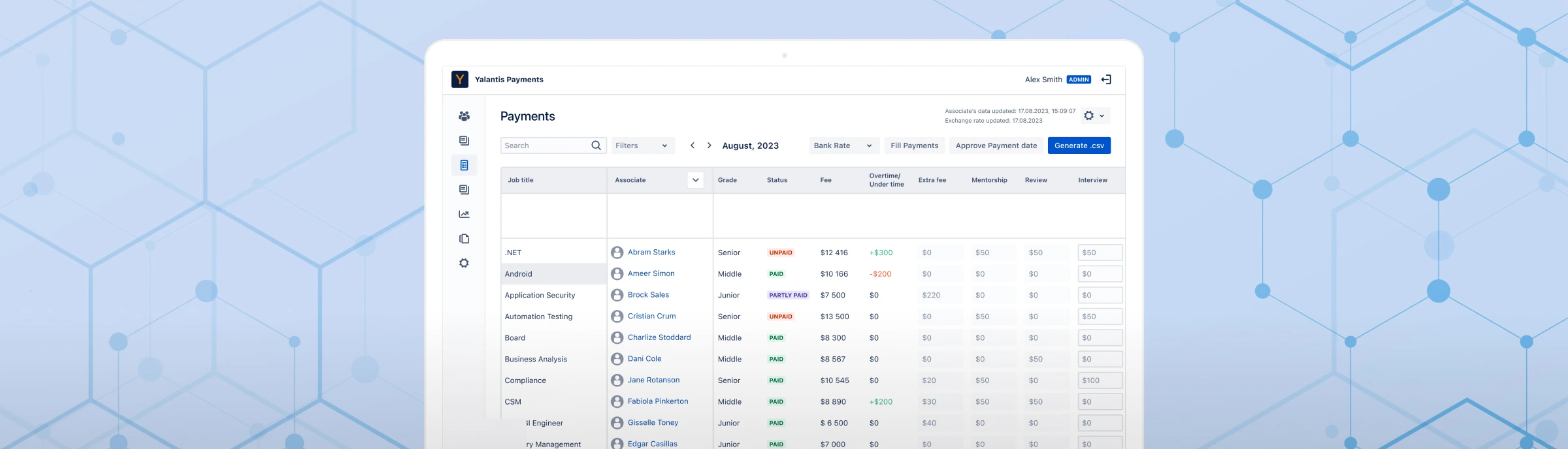

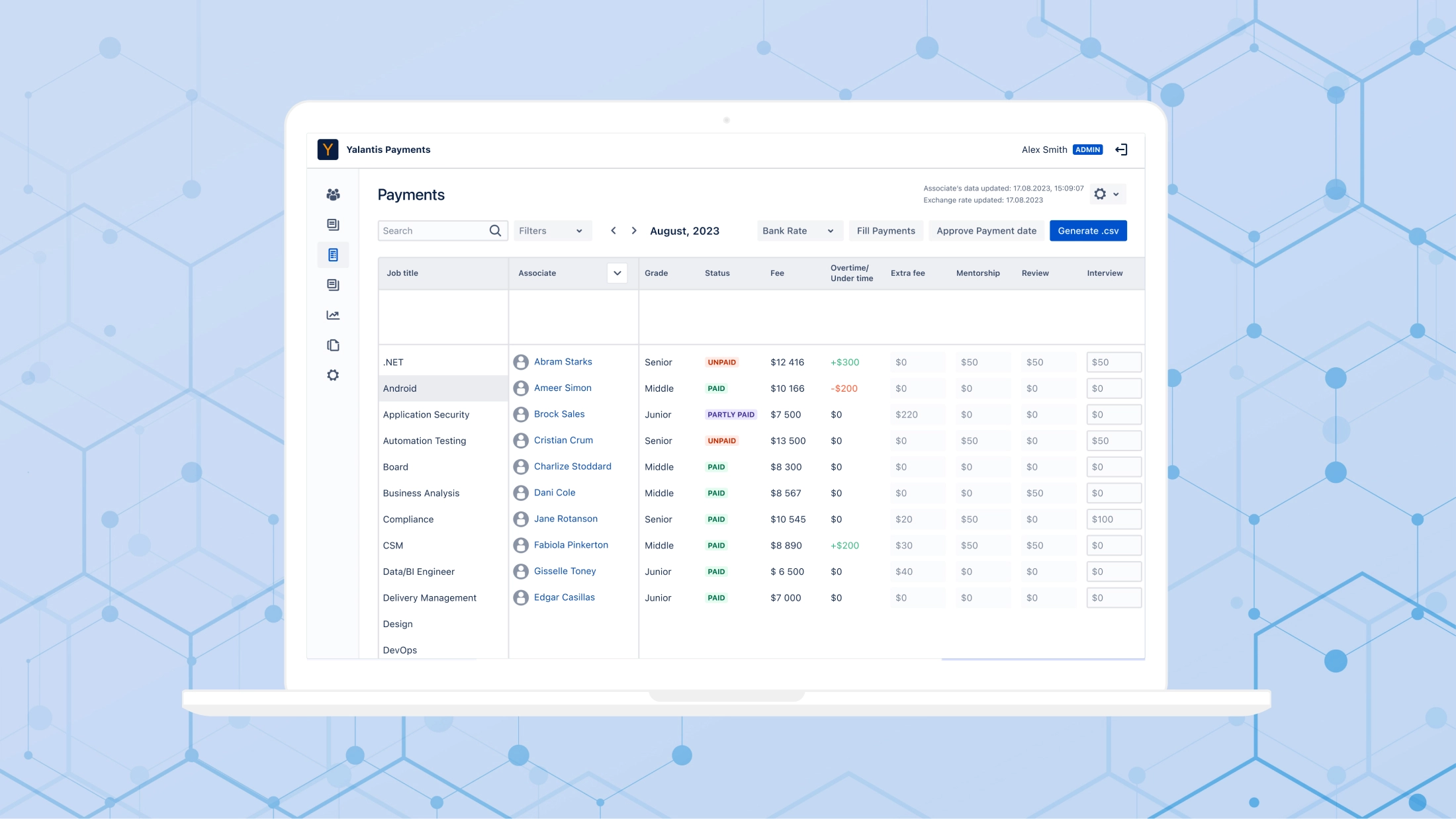

- Payment table. A payment table is the primary tool for the finance department to automate the calculation of employees’ payments. It allows finance specialists to see the compensation that should be paid to employees at a department level. These calculations are based on an employee’s rate, overtime/undertime remuneration, leadership activity reimbursement, margins (if employees have received a loan that needs to be repaid), compensation for coworking, insurance, or sports. All fields can be filled and edited manually or pulled from integrations with tools like HRM systems.

- Multi-currency support. An employee’s final compensation amount can be converted to the payout currency according to the current exchange rate. Exchange rates are synchronized with banking systems and are always up-to-date. If necessary, an accountant can set a custom rate.

- Payout management. The finance department can set a payout date, create in-advance payments, select a payment provider, approve payments, and see totals left to pay and net pay.

Reporting and documentation management:

- Analytical module with a comprehensive reporting system. Users can generate and download monthly and quarterly payment reports (with data on the status and number of payments per employee over a selected period), compensation types (with data on social compensation per employee and department), overtime and undertime of each employee, and totals for salaries and raises by department.

- Document management. The system stores documents such as coworking acceptance certificates, a documented fee description for each employee, employee–company invoices, and company acceptance certificates.

Secure platform management:

- Role-based access control (RBAC) module. Users with administrator rights can assign roles with a specific set of permissions to other users. This allows administrators to limit access to functionality according to a user’s role in the company so all financial and legal information is available only to the responsible person.

- Single sign-on (SSO) for secure authorization. Users can sign in to the platform using their corporate Google accounts. This eliminates the need for password management.

Use cases of Yalantis Payments for simplified finance management

-

Optimized compensation management for employees in multiple locations allows for accelerated and automated compensation calculations, quick payout generation, and integration with local banks for employees’ convenience

-

Efficient handling of taxes and invoices from previous months reduces the amount of paperwork for the finance department during calculations and enables on-time provision of tax documents

-

On-demand hassle-free compensation calculation allows the finance department to easily adapt to changing circumstances within teams and recalculate compensation on demand

-

Automated generation of reports on on employees’ payments provides management with full financial transparency and helps them make data-driven decisions based on the organization’s financial condition