In recent years, digital transformation in banking has accelerated due to many factors:

- Impact of COVID-19 on the global economy

- Changing preferences and expectations of modern consumers

- Growing number of FinTech startups that make the market more competitive

These and many other factors have drastically changed the FinTech digital transformation (DT) landscape and brought into question the flexibility of traditional banking systems.

More and more traditional banks are adopting technological innovations and looking for financial software development services to stay competitive and meet the needs of modern customers. If you are among them, explore our financial software development services.

By the end of 2022, Lloyds Bank plans to shut 60 branches across the UK, as it reported a 12 percent increase in regular online banking users and a 27 percent increase in mobile app users over the past two years.

Digital transformation doesn’t just mean the adoption of new cutting-edge technologies and IT services for banks, however; it also means a change in people’s mindsets. Workforce digital literacy plays a significant role in successful digital transformation and the emergence of innovative banking. In our article, we give detailed guidance on how to prepare for the first step of digitalization in banking — building a roadmap.

In the first section of this article, we analyze the current state of the banking industry in terms of its readiness to go digital.

Need experts in FinTech digital transformation?

We will help you eliminate bottlenecks and implement process automation

See our expertiseReadiness of the current traditional banking system for digital transformation

According to the BDO’s 2021 Financial Services Digital Transformation survey among 100 C-level executives across diverse financial institutions, only 30 percent were already implementing a digital transformation strategy. But 77 percent were planning to increase their investment in digital technologies in 2022.

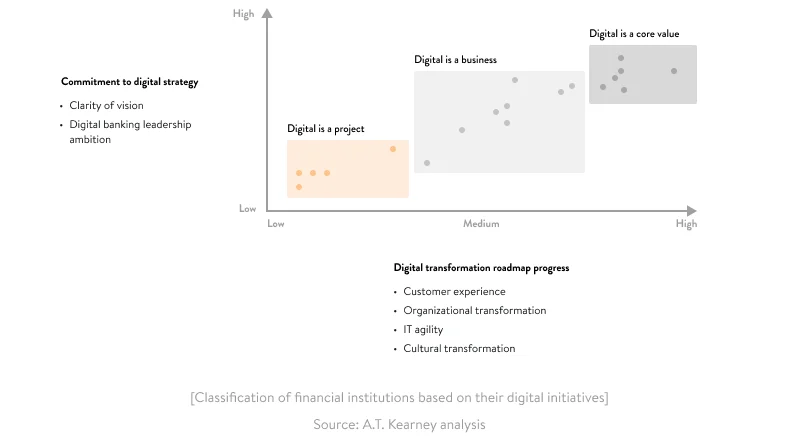

These figures prove that even though DT initiatives are accelerating, they still haven’t picked up enough speed to become a steady movement. As Kearney puts it, there are three types of financial institutions in terms of their commitment to their digital strategy and progress on the DT roadmap:

Companies for whom

- digital is a project

- digital is a business

- digital is a core value

Those with digital initiatives only in project form are ready to adopt mainstream technologies but aren’t ready for substantial transformation on the business and mindset levels.

Financial institutions that have a digital banking strategy in the form of a separate business are seeing this business as a subsidiary under their control, or more like a separate department with its own rules that may differ from those in the rest of the company.

The last group of financial institutions are those that are digital from top to bottom and can be perceived as digital leaders in the financial domain. Each stage is important in your journey of digital transformation in banking. No matter which stage of digital transformation you are at, we can help you get to the next digital transformation level.

The financial world is witnessing the emergence of more and more digital leaders, who set the pace for the whole industry and help it grow.

6 benefits of digital banking innovation

Any move towards digital transformation should be justified. It’s important to define which advantages your banking institution can derive from it. A few common benefits of digitalization are as follows:

- Improved customer experience. This is an obvious benefit, but the most important. As many businesses are now becoming more customer-centric than they were in pre-pandemic times, it’s critical for the banking industry to do its best in meeting volatile customer expectations. For instance, digital solutions may allow customers to save time on carrying out transactions and receiving services due to a lower level of bureaucracy and simplified documentation.

- Decreased operating costs. Digitalization helps to switch most banking services online, making many brick-and-mortar banks redundant. Thus, business owners can save money on the maintenance of physical bank branches and invest that money into further digitalization of their business assets.

- New funding sources. Thanks to digitalization, a retail bank, for instance, can reach more customers who weren’t within reach of physical banks, ensuring more revenue streams. The same retail bank can also start engaging in commercial and investment activities, expanding its services and again ensuring additional revenue streams.

- Increased business efficiency and productivity. Digitalization means abandoning old legacy systems and software architectures that may restrain digital growth strategies for banks and slow down the delivery of banking services. Innovative technologies, in turn, allow for efficient business scaling and quick service delivery.

- Possibility to take up a new market niche. Even though FinTech startups are now filling the market, incumbent financial institutions still have the financial trust of their customers, as they’ve been in this market long before startups. Therefore, if traditional banks decide on digitizing their services, they can achieve even higher customer satisfaction and acquisition rates than those of emerging startups.

- Enhanced data protection capabilities. New technologies are often more reliable, stable, and secure, ensuring that your customers’ data is safe. According to the 2021 NextWave Consumer Financial Services research, among 5,369 financial services consumers, the majority of respondents chose protection of their data as the biggest driver of trust in a financial institution.

But you shouldn’t be deluded by all those benefits, as DT is a challenging undertaking and you should be prepared to tackle many obstacles, transforming them into opportunities.

Digital disruption in banking: challenges

In this section, we briefly discuss typical challenges banks face on their digital transformation path. Risks and challenges are faithful partners of DT, as digital disruption in banking, even if done well, requires getting rid of old business patterns and adapting to the new reality.

Challenge #1. Huge upfront investments

Transitioning from legacy systems and technologies requires huge investments, and not every banking institution will agree on such terms, as there is no clear forecast of when those investments will pay off.

Challenge #2. Competitive pressure

A competitive financial market not only motivates the traditional banking system to grow and opt for digitalization but also creates great pressure. This pressure can make financial institutions quickly rush into change that can be risky if not well-thought-out.

Challenge #3. Changing compliance requirements

Regulations and laws regarding the delivery of financial services often change, especially on the local level. This is especially relevant for digital banks expanding their services to other countries, and it’s necessary to always be in the loop on local regulations.

Challenge #4. New ways of communicating with customers

As customers’ expectations change with the rapid pace of digital innovation, customers look for financial institutions that offer convenient and modern means of communication like social media. This poses another challenge for banks, as it’s important to ensure that bank-related communications are secure and compliant.

Challenge #5. Leading technology that might suddenly turn obsolete

Software development teams may sometimes fall for popular and yet not tried-and-true technologies. With such solutions, there’s often a risk that they lose their popularity and that it will be impossible to maintain them in the future. Thus, for financial digital solutions, it’s better to choose industry-proven technologies. Traditional financial institutions aren’t the best playground for experiments, as they usually have a long-established client base and can’t risk their trust.

Challenge #6. Investing in staff training

Digital transformation also requires additional financial and time investments in workforce training. New technologies and business processes challenge old ways of work. It’s clear that not all employees will be ready to adapt to the new working format, and it may be necessary to hire new people. That’s why staff training can be a time-consuming process with lots of hidden risks.

We believe that the time, money, and effort necessary to cope with the above challenges are worth the benefits that come along with DT. Now, we can also discuss technologies that enable the efficient digitalization of banking services.

Read also: Our mobile banking app development services

IT for banking: common technologies to digitize banking services

Each banking service has a corresponding core technology that suits it best. We present some of these pairings in the table below. But of course, the use of the listed technologies isn’t limited to certain services, as the listed services aren’t limited to just one or two technologies. Check out our technological solution for a wealth management platform.

Read also: The technical aspects of digital banking software development

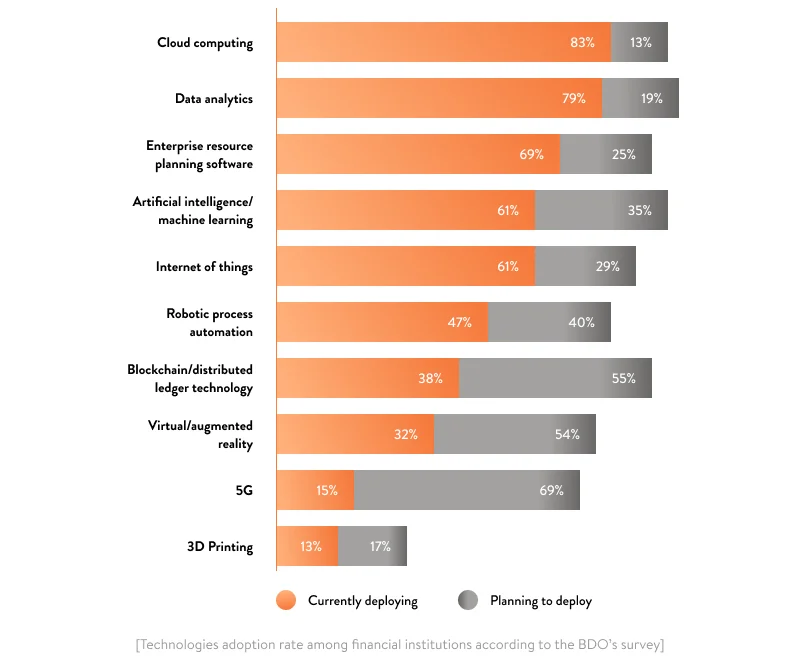

When it comes to the technologies that are most popular among financial executives, the BDO’s 2021 Financial Services Digital Transformation survey shows the following numbers:

Cloud computing and data analytics have been undisputed leaders in many industries for a few years in a row. These technologies are popular, as after adoption they can quickly create tangible value for the business, such as by decreasing capital and operating expenses and generating immediate insights into customer behavior.

Let’s overview the top five technologies from the above statistics in terms of the financial services they best fit.

Cloud computing

This technology lays the grounds for modern banking digitization initiatives, as it allows for the creation of a unified and highly scalable information base. Cloud solutions provide financial institutions with many opportunities including:

- smart settlements that don’t require customers to be physically present to sign documents

- simplified data access for efficient real-time intraday liquidity and risk management as well as regulatory reporting

- flexible and scalable trade surveillance that allows for monitoring trading depending on whether trading volumes go up or down

- centralized information sharing for anti-money laundering and fraud detection programs

You can opt for either cloud-native software development from scratch or cloud migration of your existing software solutions. For professional cloud development and consulting services, contact our cloud and DevOps team.

Read also: Cloud migration checklist: 7 steps to successful cloud migration

Data analytics

Data analytics is another necessary technology for the banking industry. It covers business intelligence, advanced analytics, and big data analytics. Depending on the needs and capabilities of your financial business, you can choose either some solutions or all the current data management tools we’ve listed above. Learn about our approach to data analytics and the tools we prefer to use in our projects. Data management is closely interwoven with cloud computing, as a cloud environment is best for unleashing the full potential of data analytics. Data analytics use cases in the banking industry include:

- all-round customer data analysis to define customer behavior patterns and provide customers with personalized banking services

- composing elaborate compliance reports and performance dashboards that reflect the actual real-time status of the financial institution

- backing up business decisions with data to allow for efficient use of company resources and improve the quality of service delivery

To make the most of data analytics, it’s important to gather and store data correctly and efficiently. For this matter, you should consider building a data warehouse, a data lake, or a data mart depending on the types and volume of data your bank generates.

Read also: How to develop an enterprise data warehouse from scratch to foster a data-driven culture

Enterprise resource planning (ERP) software

An ERP software system improves data management in the enterprise. This software can serve as a central system for all banking processes. It helps to maintain company departments on the same information level and can become one of the main sources of critical company data to enable insightful data analytics. ERP software can be of different types, and there are as many modern solutions as outdated ones. Often, it’s much easier to implement a new ERP software solution from scratch to meet the demands of the current banking industry than to update an existing and outdated one. For instance, cloud-based ERP software is currently one of the best options, as it has high-performance metrics, allows for proper security maintenance, and proves more cost-effective than most of its on-premises counterparts.

The Canadian TD Bank Group has decided to migrate its services to the cloud to be able to deliver exceptional services to its demanding customers. Cloud migration has allowed the company to get a 360-degree view of its customers and improve data analytics capabilities. Along with migrating to the cloud, the company has adopted all-around cloud-based ERP software to integrate bank data within one system and enable a seamless data flow within the enterprise.

Thus, we may see co-dependency between these three technologies we’ve already discussed, as they complement each other and facilitate further digital transformation.

Read also: How to ensure robotic process automation in banking

Artificial intelligence / machine learning

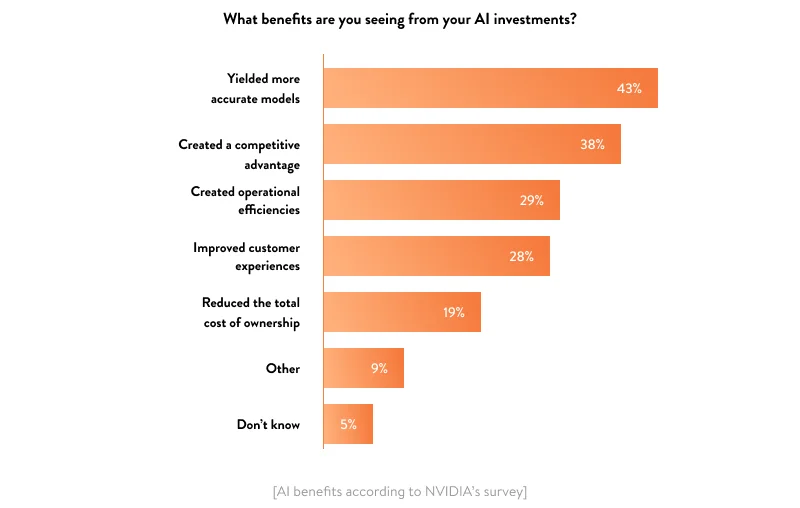

Artificial intelligence and machine learning solutions are another way to automate and streamline digital banking services. Nvidia conducted a survey among 500 financial services professionals globally to define the state of AI in 2022. The survey revealed the following benefits financial executives expect from implementing AI and machine learning:

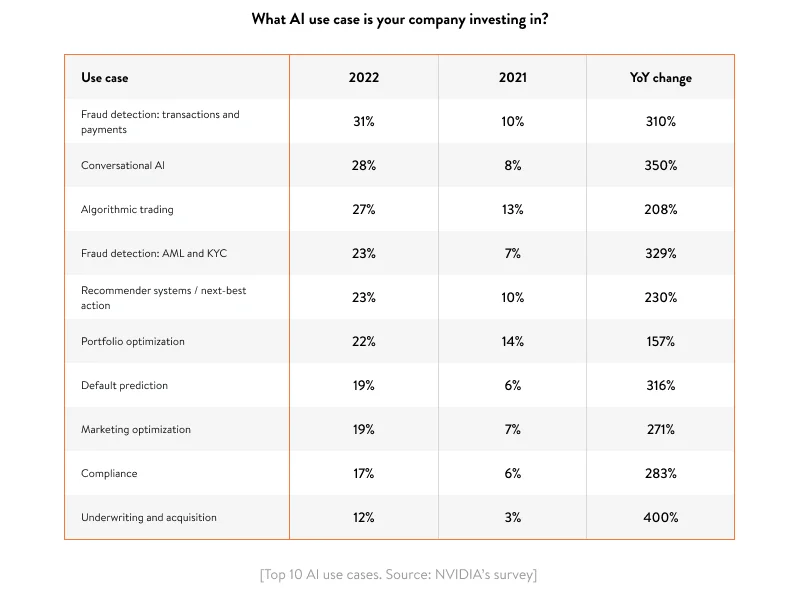

The findings show that 91 percent of respondents expect significant improvements in their business operations thanks to AI. The survey also defines common use cases and services for which financial institutions choose AI adoption. We’ve picked the top 10 use cases, which you can see in the table below.

Fraud detection, communication, and trading are the top three use cases. Financial executives believe that these services can benefit the most from AI and machine learning adoption.

Internet of Things (IoT)

Some industries like healthcare and manufacturing can find lots of ways to use IoT solutions, but the traditional banking industry can also benefit from IoT. For example, movement sensors in banks can provide data on the number of daily visitors to help executives make important decisions on which branches to close and which to leave. Modern automated teller machines (ATMs) can also be equipped with sensors and cameras that may detect fraud, predict cash shortages, or submit maintenance requests. Thus, IoT devices can help traditional banks keep their physical facilities in sync with digital infrastructure, gaining more control over the whole banking network.

Read also: All you need to know about IoT testing

However, IoT solutions can also open new and unexpected collaboration opportunities between industries. For example, US Bank’s management is considering different ways to embed financial services into other industries, such as by integrating fitness scales that connect to a banking account and provide financial rewards once weight loss goals are achieved. Another interesting innovation is driverless cars with embedded financial capabilities that not only drive automatically but can automatically pay for various services.

Read also: Case study about IoT network management

Digitalization doesn’t necessarily mean applying all popular technologies at once. You can begin with a few projects to digitize the most critical services based on your prioritized goals. If your primary goal is to acquire new customers and retain existing ones, you can focus on the digitalization of services directly related to this goal.

In the next section, let’s discuss how you can make your DT initiatives run smoothly.

How to ensure successful digital transformation

It may be difficult to measure the success of DT, especially over a short period of time. One of the approaches to building successful digital solutions could be analyzing your competitors’ success strategy.

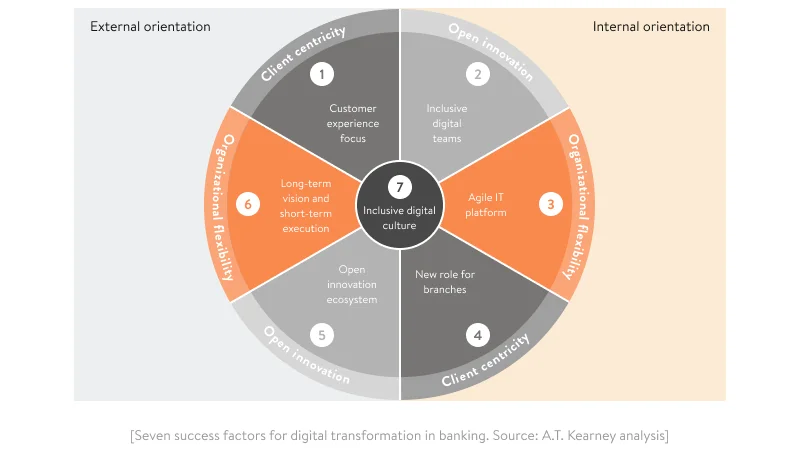

Kearney’s analysis offers seven success factors of DT. We’ll cover each of them in detail. Basically, there are three core factors:

- client centricity

- organizational flexibility

- open innovation

These factors get split into two components depending on the external (financial market) or internal (organizational level) orientation. The seventh factor is an additional and central one, it is inclusive digital culture.

Client centricity. This factor requires a constant focus on customer experience at the external level and defining a new role for branches at the internal level.

- Focusing on customer experience means a close interaction with clients on your DT journey to get relevant feedback on whether innovations you implement find an expected response.

- Redefining the role of physical banks requires changing the method of service delivery with regard to changing customer expectations.

Openness to innovation. A combination of efforts of the internal IT team and the externally oriented marketing team can help create innovations that will be necessary and relevant to customers. All innovations in the banking industry have to meet current market needs. Thus, digital products often appear first in the form of a proof of concept (PoC) to test their relevance on the market. Plus, analyzing competitors and emerging FinTech startups helps traditional banks create unique solutions while considering useful partnerships that may help them quickly evolve.

Organizational flexibility. The rapidly changing technological and business landscape of the financial market requires traditional banks that have DT initiatives underway to be extremely flexible. Thus, the choice of an in-house IT team or an outsourcing software development partner is of the utmost importance for the success of the DT journey. With a flexible IT team, it’s possible to deliver innovative solutions quickly so they will still be relevant to customers.

Read also: What to choose: in-house software development vs outsourcing

Inclusive digital culture. Digitalization is meant to break data silos and legacy systems that suspend the development of the traditional banking industry. DT is an incremental process, but in the long run, it can’t happen only in certain departments or branches. It requires digital inclusiveness on all company levels and, most importantly, in people’s mindsets. And once you step on the DT path, you can only move forward.

A combination of the above factors can’t guarantee the ultimate success of your digitalization. You’ll succeed if you’re determined enough to become a digital leader by proceeding with digital growth with the help of these factors. The Yalantis team would be eager to support and streamline the digital transition of your traditional bank and help you take a stable position in the changing financial market.

Rate this article

5/5.0

based on 1,121 reviews