Adoption of regulatory technology solutions including robotics in banking sped up during the COVID-19 pandemic. According to the AML Banking Survey by RiskScreen, 70 percent of respondents state that the pandemic has spurred digital transformation in the banking sector. However, user-friendly interfaces of modern mobile banking applications often mask bank processes that are full of manual operations and a reliance on paper.

Although a developer team with the right expertise can code an RPA banking solution to automate manual processes, some bank employees still use Excel, Access, SQL query-based tools, and Google for manual adverse media screening searches. Operations that are often performed manually by bank employees include customer onboarding to collect essential data on customers and execute regulatory, legal, and credit-related due diligence with identity checks. Combining, transforming, enriching, and reconciling data is also often done manually.

Relying on manual processes instead of financial process automation is blocking banks’ ability to generate income while at the same time exposing banks to unnecessary risks caused by human error. This problem can be solved if banks establish user-driven data control and automation. Robotic process automation in the financial industry is the way to go.

Robotic process automation for banks: the solution to streamlining operational management

Often called smart automation or intelligent automation, robotic process automation (RPA) refers to sophisticated software programmed to execute a chain of operations typically carried out by humans. Basic and rule-based tasks that specialists consider repetitive and mundane are perfect candidates for RPA.

More advanced financial services automation systems are empowered with machine learning (ML), artificial intelligence (AI), and cognitive computing capabilities. Take for example a combination of RPA with AI. RPA handles structured data, while AI is used to collect insights from semi-structured and unstructured data in text, scanned documents, webpages, and PDFs. In doing this, AI adds value by processing data and turning it into a structured format that RPA tools can understand.

That said, RPA technology is still useful on its own and brings financial firms many benefits.

Read also: What it takes for a traditional banking institution to go digital

Benefits of RPA technology in banking

According to Gartner, an RPA bot commonly costs just one-third of an offshore specialist’s salary or one-fifth of an onshore specialist’s salary. Add to this that the bot works accurately and without interruption — if programmed properly. Thanks to such capabilities, RPA has drawn the attention of organizations in many industries, including banking. Alongside the evident benefits of robotic process automation in retail banking, such as decreased human error and fewer repetitive tasks, RPA provides:

Fast implementation. Since many RPA solutions have drag-and-drop capabilities to automate banking processes, it’s easy to implement and maintain automation workflows with little to no coding.

Zero infrastructure cost. RPA doesn’t require any essential changes in infrastructure thanks to its UI automation capabilities. Hardware and maintenance costs are further reduced in the case of cloud-based RPA.

Compatibility with legacy data. By implementing RPA, financial institutions exploit legacy and new data to bridge the gaps between processes. Bringing together essential data in a single system helps organizations make better reports faster to support business growth.

Limited integration budget. Adopting RPA in the finance industry lets your organization invest in one platform instead of having to ensure that all software solutions are interoperable.

Enhanced security. A considerable volume of data is at the same time a blessing and a curse. RPA downplays the curse by entirely excluding manual processing by humans and thereby avoiding previously error-prone work — or even exploring sensitive data on payments and customers.

Having viewed the benefits of robotic process automation in banking, let’s look at how some financial institutions are already benefiting from RPA technology.

Check our latest case study on how to secure a software product.

RPA for banks: real-life examples of successful implementation

There are many successful robotic process automation examples in banking. Check out how implementing RPA in financial services has allowed enterprises to turn around their businesses in a short time.

Paycheck Protection Program (PPP) loan processing

One prominent example of a successful RPA implementation in recent years was for the processing of PPP loans. Community banks were required to upload huge amounts of documentation and lots of applications for PPP loans to the Small Business Association (SBA) loan system. Lots of participating financial institutions used RPA technology to replicate the information entry process performed by humans, eliminating manual data entry.

For example, Queensborough National Bank & Trust Company located in Louisville, Georgia, saw dramatic results by exploiting technology for PPP loan origination in 2020. As a result, the company managed to originate 1,780 loans for a total of $150 million. The following year, the company processed close to 1,000 additional loans. These impressive results ranked the bank fifth among competitors headquartered in Georgia for the number of PPP loans originated.

Commercial loan agreement processing

JP Morgan Chase provides another instance of successful RPA adoption. As is the case for lots of companies assigning duties to RPA bots, Chase had to come up with a solution to perform higher-quality work in less time.

In 2017, the bank created a program called COIN (Contract Intelligence). This program involves the use of digital workers for automating administrative tasks. COIN exploits machine learning to interpret, analyze, and derive information from commercial loan agreements. As a result of its implementation, an operation that formerly took loan officers and lawyers 360,000 hours per year is currently performed in seconds.

Multiple banking operations

ICICI Bank adopted RPA for 10 operations, which increased to 200 operations during the first year to support numerous businesses such as those in the retail, corporate, treasury, agribusiness, trade, and forex spheres. To date, ICICI Bank has automated 1,350 processes with 750 bots performing over two million transactions a day.

As we can see from the examples above, RPA technology can automate various manual processes. Let’s define the main use cases where this technology is helpful.

Some banking processes that can be automated by RPA

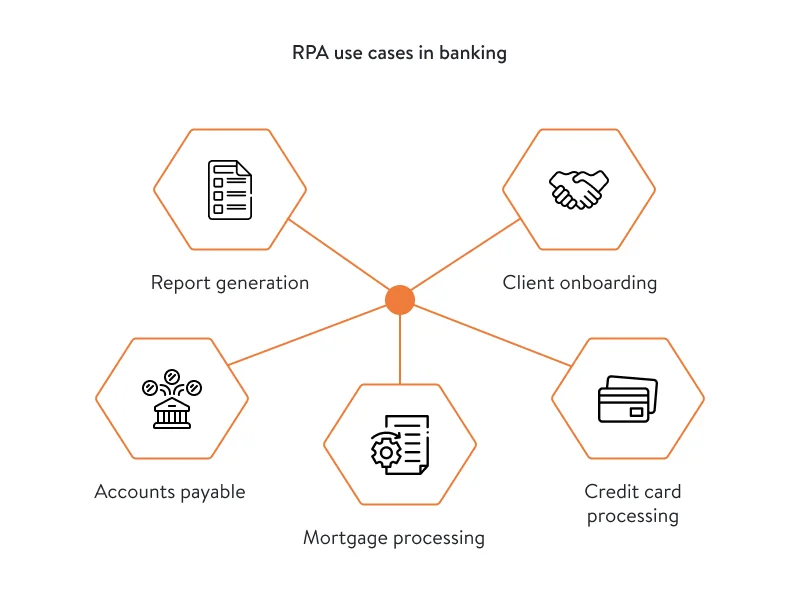

RPA boasts plenty of use cases in the banking, financial services, and insurance (BFSI) industry, releasing workers to focus on more complicated tasks. Some of the robotic process automation use cases in banking include:

Report generation

To comply with regulations, laws, and guidelines, financial institutions must compile reports on their performance to inform the board of directors. Such reports often contain human-introduced errors and are time-consuming to create, as they are based on enormous volumes of data.

RPA is good at collecting information from multiple sources, putting it in a coherent format, and generating reliable reports. RPA helps to automate a broad cluster of reports such as reconciliation, closing, and management.

Accounts payable

Accounts payable is a simple but repetitive activity that requires obtaining vendor information and approving it to process payments. RPA complemented by optical character recognition (OCR) technology helps to automate the accounts payable process.

Optical character recognition extracts vendor information from a digital copy of a physical form and provides this data to the RPA system. The RPA system then validates the data against data available in the system and processes the payment. In case of an error, the RPA system alerts the assigned person to resolve it.

Client onboarding

Client onboarding activities performed by financial institutions are complicated, mainly because of manual authentication of multiple identity documents. Know Your Customer (KYC), a key part of onboarding, requires substantial operational efforts for document validation.

According to a report by Thomson Reuters, the cost of running KYC compliance and customer due diligence may range from $52 million to nearly $384 million a year. An AML Study by RiskScreen reveals that eight in ten compliance professionals consider their compliance activities too labor-intensive.

To cut costs and automate the client onboarding process, you can create a software system powered with RPA, computer vision, and OCR technologies to retrieve important data and validate client identities.

Credit card processing

Without proper automation, it took a bank weeks to approve clients’ credit card applications. The long wait led to clients’ disappointment. Now, thanks to RPA technology, the bank can approve and grant credit cards rapidly.

Within several hours, RPA allows for collecting a client’s documents, performing credit and background checks, and deciding if a client is eligible for a credit card according to established criteria.

Mortgage processing

According to the Mortgage Reports, settling a mortgage loan can take a financial institution between one and two months. Mortgage loan officers have to take several steps to verify an applicant’s employment, check the applicant’s credit score, and perform other types of inspections. During this process, a minor mistake made by a bank employee or the applicant can substantially slow down the case. RPA can shorten loan processing times by 80 percent, since automation of loan processing can speed up tasks from origination to post-closing.

These are only examples of where RPA can be applicable in banking and finance. Banks should consider using RPA in all their functional areas to improve the customer experience and achieve a competitive advantage. Implementing RPA might seem a costly investment, but taking into account the value the technology brings to the business, RPA can ensure a good ROI within just months of adoption. Explore more of our digital banking expertise and check out our banking as a service case study.

When deciding on your RPA adoption approach, you’ll face the choice between ready-made solutions and custom RPA software development.

Overview of ready-made RPA solutions

There are many off-the-shelf RPA solutions. We’ll consider a few that are popular among BFSI market players.

Aiwozo. This intelligent process automation platform incorporates RPA capabilities with AI and ML to achieve a high degree of automation. Although the platform can be applied for large-scale automation projects, its flexibility allows for fast deployment. Organizations of all sizes can benefit from its extensive functionality set. By using tools provided by Aiwozo, BFSI institutions can automate their processes related to consumer lending, consumer banking, and asset management.

Kofax. This business process automation platform helps customers record, map, and analyze applications, including desktop, internal, and external. For the BFSI sector, Kofax’s RPA and accounts payable features enable organizations to automate invoice data capture, check invoices, process payments, and integrate with ERP systems. Kofax is great for small to medium-sized businesses.

UiPath. This platform enables any assigned employee in your organization to create and utilize robots. Experienced programmers can use the rich development environment. Business users with little to no coding experience can automate day-to-day activities using StudioX. BFSI organizations can use the platform’s RPA and AI technologies to enhance performance and processes with multiple tools for process mining and automation. UiPath is a great solution for small to midsize projects.

How to choose the right banking automation software

To choose the most suitable RPA tool, you need to consider your organization’s objectives and requirements. In addition, we provide some guidelines for selecting the right RPA solution.

User-friendliness. An RPA software solution has to provide easy-to-grasp features, clear and informative graphics, smooth navigation between disparate modules, understandable text, and enough flexibility to easily automate basic processes. For example, Aiwozo users praise the platform for being user-friendly and state that the tool almost doesn’t require coding knowledge. Therefore, non-tech users can learn and adapt to the technology fast.

Simplicity of bot setup. There have to be multiple approaches to set up bots for different types of users. Non-tech users should be able to set up bots in a graphical user interface and those with a bit of programming knowledge should be able to do so using a low-code environment. For example, Aiwozo Studio contains pre-built activities and allows for developing bots fast thanks to its drag-and-drop development flow.

Security. RPA bots deal with sensitive data, moving it across systems. If it’s not secured, this data can be exposed and consequently cost your organization thousands or millions of dollars. Therefore, check the security functionality of your solution. For example, UiPath encrypts data in transit and at rest. All information stored within UiPath cloud products and services is encrypted in transit over public networks, protecting data from unauthorized disclosure or modification.

When choosing a ready-made RPA tool, also take into account such aspects as ease of implementation, compatibility with existing legacy systems, and machine learning capabilities to extract information from unstructured data with ease.

To create or to buy: how to get the most from RPA

Prior to making a decision in favor of custom RPA software development or purchasing an off-the-shelf product, answer these questions:

What processes require automation?

The main purpose here is to figure out if ready-made RPA software is capable of meeting your automation needs. Evaluate all processes you want to automate, taking into account your business requirements and the needs of all departments. An effective approach is compiling a list of operational issues your company is facing. Those that are repetitive or rule-based are great candidates for automation.

As a result, you might come to the conclusion that your business processes are too peculiar to use a ready-made solution. In this case, creating a custom solution will help you save money and implement RPA effectively.

Are there RPA solutions tailored to the tasks I want to automate?

Ready-made RPA solutions are created with particular workflows in mind. For instance, you can find lots of bots tailored to scraping emails and entering information into systems. But to identify the perfect fit, you need to consider all the variables and systems involved in the process requiring automation. The more complicated the workflow, the greater the need for custom RPA software.

What will be the total cost of ownership and development?

Although developing custom RPA software might require higher initial costs, it will result in lower ongoing expenses and no continuing license fees. On the other hand, ready-made smart automation solutions require less initial investment.t As a result, however, you’ll have to pay more if there’s a need for using more functionality, and you’ll be obliged to pay an annual license fee. Moreover, if you need to scale, license costs will scale as well.

The main advantage of creating custom RPA software is that you pay only for needed functionality. Whereas ready-made RPA products are tailored to solving common problems of an average organization, a custom solution is designed to satisfy your unique needs. Lots of ready-made solutions provide general functionality, and most won’t let you adapt their features meaningfully.

As a result of this preliminary analysis, you might come to the conclusion that custom RPA software development is the way to go for your organization. If that’s the case, finding the right software development provider will be the next issue to address.

Read also: How to create digital banking software

How to choose an RPA software development company

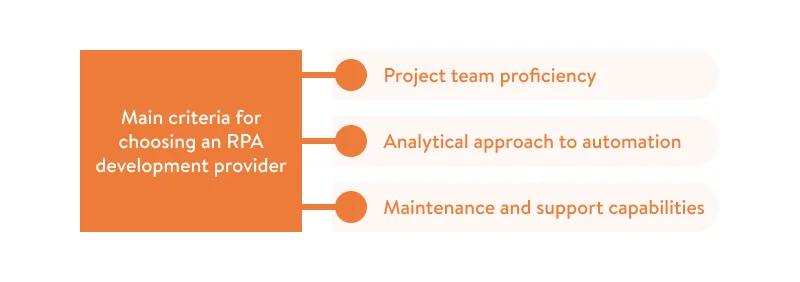

You should be guided by the following criteria when choosing your RPA technology partner:

Project team proficiency. Make sure the project team provided by your software development partner includes skilled subject matter experts. They should have knowledge of and expertise in both banking processes and RPA technology. Such specialists will ensure the success of your RPA customization efforts by developing bots tailored to your organization’s business requirements. Your project team members should establish and maintain close collaboration with you and others in your company concerning what processes to automate and in what order. This will allow your organization to capitalize on RPA technology as fast as possible.

Analytical approach to automation. Automating a deficient and ill-conceived process will result in even poorer workflow efficiency. Also, processes that change or don’t follow a predictable path are a bad match for RPA. Your software development partner should help you conduct a complex business analysis to structure business processes for high performance and RPA compatibility and establish a strategy for RPA implementation.

Maintenance and support capabilities. Your RPA adventure doesn’t stop at the implementation stage. Bots will necessarily require some adjustments to comply with unexpected changes in processes. And continuing maintenance and support require a different set of RPA skills than development. Keep in mind that some providers overlook the volume of support required to provide smooth RPA operations. When choosing an RPA provider, prefer those who can ensure 24/7 operation of your RPA software by means of a strong support structure.

To conclude, make sure that your partner can provide you with professional implementation services, beginning with idea definition and requirements collection, continuing through planning and implementation, and extending to support and maintenance. Yalantis has extensive expertise in RPA software development and also in financial software development services. We’ll be glad to help you reap the benefits of RPA in banking and automate and digitize your banking processes.

Rate this article

5/5.0

based on 1,120 reviews