Financial software development

-

Attract more customers with rich product functionality and accessibility

-

Stabilize your revenue flow by filling gaps in your monetization model

-

Implement convenient and secure payment alternatives for your customers

-

Reinvent and digitize manual processes including invoicing and reporting

-

Secure your business and customers from fraud, data breaches, and other risks

-

Increase customer engagement with automated loyalty and gamification tools

Financial software development

services we provide

-

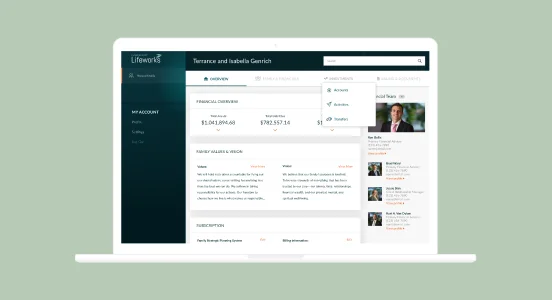

Banking software development

-

BaaS integration

-

ERP banking systems

-

Transaction monitoring

-

Customer behavior analytics

-

Customer portals

-

eBanking solutions

-

-

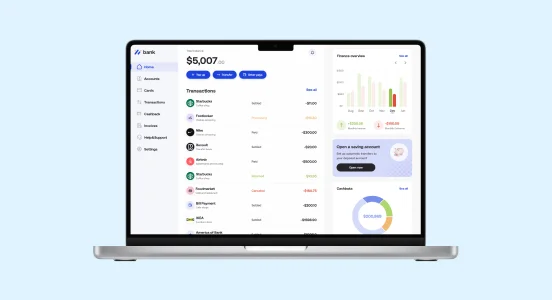

Payment app development

-

Online payments

-

P2P payments

-

ACH payments

-

Wire transfers

-

Billing and invoicing

-

Spending management

-

-

Mobile banking app development

-

eWallets

-

Personal finance management

-

Bank account management

-

Card management

-

-

Financial management software development

-

Investment management integrations

-

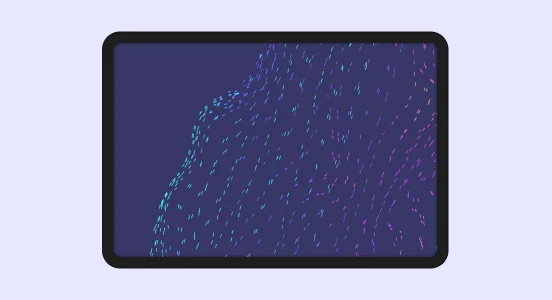

Investment activity data parsing and monitoring

-

Investment data visualization

-

-

Lending app development

-

Core lending solutions

-

Buy Now Pay Later (BNPL)

-

Loan management software

-

Loan processing automation

-

Mortgage automation

-

Money lending apps

-

Overdrafts

-

-

Cybersecurity services

-

KYC and KYB pipelines

-

Fraud prevention solutions

-

Risk detection

-

OAuth 2.0

-

Multi-factor authentication

-

Need software development for financial services?

Yalantis will help you develop a secure and high-performing solution with optimized business logic and streamlined processes for new revenue streams.

Benefits of our finance software development company

-

Improved revenue streams

Identify gaps in your business flows, analyze how they deprive you of additional revenue, and use this knowledge to monetize your business to the fullest. Convert more customers and expand your business by optimizing your offerings.

-

Business process optimization

Unburden your staff and reveal more resources for product enhancement by optimizing and automating your business and operating processes. Implement advanced analytics and business intelligence solutions to streamline your process efficiency and optimize operating costs.

-

User experience optimization

Analyze the user experience and identify and eliminate bottlenecks to deliver a user-centric and conversion-optimized solution to your customers. Shift from a design-first to a requirements-first approach to meet your customers’ needs. Design a frontend architecture that enables easy, rich, and smooth customization.

-

Flexibility and scalability

Prepare your software architecture for intensive financial operations and high user traffic by making it flexible, able to automatically scale, cost-effective, and easily maintainable.

Whether you are undertaking an architectural redesign or designing from scratch, we will ensure your solution is built with scalability and business expansion in mind. -

Third-party integrations

Speed up your solution development by implementing core and extra functionality from third-party providers. Integrate only with proven services, be technologically prepared for possible data management challenges, and ensure cost-efficient provisioning according to your requirements.

-

High load monitoring and maintenance

Get 24/7 Yalantis support with on-call teams monitoring your solution’s performance, eliminating any emerging issues, and designing risk assessment and management strategies. Implement disaster recovery plans and automated recovery procedures to protect sensitive financial data.

Case studies of our financial software development company

Video reviews of our clients

Insights on development for finance projects

Stripe, Braintree, Paypal: how to choose and integrate payment gateways with apps

Enable financial transactions in your app. Learn the differences in price, features, and geographical coverage between Braintree, Stripe, and PayPal.

Financial management software: get a holistic view of your organization’s financial health in real time

What it takes for a traditional banking institution to go digital

Reveal the subtleties of digital transformation for banks: challenges you need to overcome, benefits you’ll get, technologies you can use, and success factors.

Acquire new customers and stabilize revenue with Yalantis

Enhance your functionality, close gaps in your monetization model, and improve security and usability.

FAQ

What is your approach to delivering financial software development services?

Yalantis understands how important it is for our clients to deliver financial software solutions that meet their customers’ needs, are highly secure, and are ready for active scaling in the event of rapid business expansion. That’s why our priorities include providing secure and cost-efficient application development that starts with proper architecture design (considering all possible loads and innovations), as well as providing a top-notch customer experience, technological flexibility, and a short time to market.

We guarantee our clients an uninterrupted development process. To make this possible, we create knowledge bases so any team member can go through a quick onboarding process and start working as soon as possible. In addition, we create product families and functional teams that can work independently of each other.

What are your strategies for accelerating finance software development?

We have drawn on our years of experience in the FinTech industry to create a software development kit (SDK) that helps businesses reduce their time to market and reuse proven strategies, libraries, and components. This helps our clients reduce development and operating costs.

The Yalantis Banking Accelerator consists of a UI library and a pluggable layer that allows for integration with core banking systems and third-party services. These ready-to-use components enable us to provide 50% faster software delivery compared to other financial software development companies.

What do your operating processes look like?

Yalantis is an ISO-certified company. We care about the all-around security of financial services software development and compliance with industry-specific standards and financial regulations. Our goal is to provide full process transparency. Our clients often take part in meetings with development and project management teams, business analysts, and delivery managers, receive regular reports, and participate in scope planning and task prioritization.

How will I benefit from hiring your financial software developers?

Yalantis has years of experience in FinTech software development, and we’ve created solutions for many types of companies. Moreover, we have experience developing solutions in many industries beyond FinTech. We’ve learned techniques, strategies, and approaches to solution design and development that we can customize for any industry to improve product quality and functionality. Our cross-industry expertise helps us deliver innovative high-quality FinTech solutions on time and helps our clients realize the full potential of their solutions and create user-centric, conversion-oriented products that win the competition.

We not only deliver solutions according to your requirements and needs; we also assist you in making your initial solution vision more functional and tailored to users’ needs and industry trends by offering relevant recommendations, ideas, and integrations that will make your product even better.

How do you ensure scalability and performance in financial software development?

In financial software development, Yalantis teams follow industry best practices to ensure that the software we develop is scalable and performs stably under different usage scenarios.

Our team of experts conducts load testing, performance optimization, and scalability assessments to identify and eliminate bottlenecks. We also utilize architectures that allow for seamless scalability as well as design principles to ensure that software can handle an increased load without sacrificing performance. With our expertise in developing high-performance financial software solutions, we can help you achieve the scalability and performance your business requires.

What is Yalantis’ goal in delivering a FinTech solution?

Yalantis takes a complex approach to delivering FinTech software solutions to our clients. We strive to deliver solutions that help our clients become prominent industry players and deliver value to their customers in the long-term perspective.

As a rule, we establish the following goals for developing a FinTech solution:

Delivering technologically scalable and flexible solutions

Yalantis’ priority is to develop financial software that is capable of adjusting to fast-paced trends in the FinTech industry. We prepare our clients’ solutions to be quickly enhanced with new functionality, scale in pace with business expansion, and be able to withstand high loads while demonstrating stable performance.

We achieve this through:

- designing an architecture that is scalable and flexible enough to serve the client’s needs and future plans

- using cloud-based infrastructure to effortlessly monitor and manage resources

- implementing Agile-based management and development processes

Improving revenue streams for business sustainability and expansion

We help our clients improve their revenue streams whether they come to us with an existing solution or simply a business vision. To do this, we help our clients identify hidden monetization opportunities, design and develop functionality that attracts users, and create a UI/UX that is seamless and easy to use.

Optimizing business processes to improve efficiency

Yalantis ensures business process optimization by analyzing and identifying resource-intensive and unoptimized flows and processes. We use modern technologies including:

- Robotic process automation (RPA)

- Artificial intelligence (AI) and machine learning

- Data science

- Big data analytics

- Business intelligence (BI)

Enhancing the user experience to meet users’ needs and expand the customer base

Throughout the whole course of FinTech app development, the Yalantis team focuses on ensuring a user-centric and seamless user experience by:

- conducting user research and simplifying the user experience in response to identified difficulties and cumbersome financial processes

- ensuring customization and personalization to meet customers’ needs and expand the customer base

- enhancing accessibility and ensuring continuous improvement

We focus on achieving a responsive design, an intuitive and easy-to-navigate interface, and quick task completion with minimum effort. During development, we use big data analytics and apply business intelligence tools to analyze user behavior, streamline the user experience, and improve performance.

Maintaining and managing high loads to provide users with top-notch performance

As financial software developers, we help financial institutions prepare for business expansion. In order to maintain high loads, we utilize:

- load testing techniques to accurately calculate and estimate the resources needed for the system to properly perform under low, medium, and high loads

- cloud-based solutions to provide system flexibility and scalability, such as Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure

- vertical and horizontal scaling to enable the system to scale server resources and handle increasing loads

- Content Delivery Networks (CDNs) to distribute content across numerous servers and speed up content delivery to users

- database and code optimization techniques to reduce the amount of processing power needed to complete a task

In detail: What helps Yalantis achieve their goal of delivering successful FinTech software solutions?

To achieve our clients’ goals, our plan of action consists of:

Engaging top-class IT experts to deliver top-notch FinTech solutions

Our specialists have gained valuable expertise through years of working on numerous FinTech projects that have included developing financial software for traditional banks and neobanks; building wealth management and stock operations management platforms; implementing payment functionality in e-commerce, driving, and healthcare applications; integrating with BaaS solutions; and more.

With this experience, Yalantis’ teams of professionals help our clients create solutions capable of:

- bringing maximum value to their customers

- scaling their business

- generating a higher return on investment (ROI)

We also ensure that our experts are able to provide your company with high-class consulting services as well as to lead and participate in large-scale projects. We support our specialists in their professional development and make sure they are aware of the latest industry trends and requirements as well as ways to satisfy these requirements with workable solutions.

Thoroughly examining your product vision or existing FinTech solution to identify what it lacks

Before starting financial software development or enhancement (or legacy code redesign), we make sure to examine every piece of information we have, whether it’s an undocumented solution vision, an idea that needs some blanks to be filled in, or an existing FinTech solution that you want to modernize. Such an approach helps us accomplish three things simultaneously:

- Clearly understand your objectives, business goals, and long-term plans and how we can make them real

- Make sure the team that will work on the project knows how the solution works, the specifics of its business processes, and the technologies they will need to use

- Enable our business analyst team to help you understand the full potential of the solution and undiscovered opportunities (for example, unobvious revenue streams or functionality that will attract various audiences), bringing even more value to your business

At the end of the investigation stage, we usually provide the client with artifacts that summarize their objectives. These can be a product vision board, user story maps, user flows, and other deliverables. The list of artifacts varies depending on the project’s specifics.

This way, both the client and the Yalantis team will see the approximate scope of work, be able to assess our input, and have a better understanding of all deadlines and needed resources.

Providing expert insights to advance your FinTech solution

We’ll investigate your existing solution or solution vision from multiple perspectives to close possible gaps in business logic or expand the solution’s potential in order to deliver valuable and demanded software.

For years, we’ve been working on various FinTech solutions and keeping a close eye on how the FinTech market in different countries develops and what trends this development brings to the international FinTech landscape. Based on the demand for and relevance of trends, we will consult you on what audiences of different ages, educational backgrounds, and professions need.

We will also keep you updated on emerging customer needs in light of external circumstances and whether it’s worth implementing new solutions that would satisfy these needs.

Additionally, our experience outside the FinTech realm will help us solve possible security gaps (which is critical in FinTech software development), ensure compliance, and even provide anti-fraud protection from the initial stages of solution development.

How Yalantis utilizes modern technologies to deliver cutting-edge financial solutions

Innovation and excellence are central to FinTech development. We leverage the latest technologies to deliver solutions that exceed expectations.

Enabling data-driven decision-making and smart process automation

Data-driven decision-making and business process automation are ambitious goals for any business that are possible to achieve thanks to innovative technologies. However, without expertise in the proper implementation of such technologies, they won’t bring the expected results or will require additional resources to finish the task.

In order to make your financial software capable of delivering valuable insights so you can make informed decisions, automate resource-intensive tasks, and ensure proper protection from external threats and fraudulent activities, you will have to work with data: accumulating it, visualizing it, analyzing it, and using it for your benefit.

To help you with this, our range of financial software development services includes:

- Business intelligence. Implementing business intelligence tools helps companies analyze large amounts of data, generate reports with insights on any possible activity, and make data-driven decisions regarding solution enhancement, business expansion, and more. As well, such insights assist and back up business analysts when they design functionality that depends on accurate data analysis.

- Artificial intelligence and machine learning. These aren’t new on the market, yet not all businesses implement AI and ML to improve business and operational efficiency by automating operations. These technologies will help you save time and resources on tasks that can be easily done without human intervention, such as generating reports and analyzing data based on predefined patterns.

- Robotic process automation. With RPA, we help businesses automate repetitive and rule-based tasks, such as customer onboarding, KYC (know your customer) checks, data entry, and report generation. By automating these tasks, FinTech organizations can improve efficiency, eliminate errors, and unburden employees to focus on more complex tasks.

Addressing critical security issues via integrations with complex anti-fraud solutions and custom fraud prevention and detection

Security concerns are critical in the finance industry, both for our clients and their end users. That’s why we put maximum effort into building reliable protection against fraudulent activities so that our clients can avoid:

- substantial financial losses

- damage to their business reputation

- customer losses

- extra spending on third-party security systems

Instead, we enable our clients to build trusting relationships with their customers.

Yalantis prioritizes complex protection from external and internal threats at the initial stages of custom financial software development. Among our priorities are:

- Preventing possible internal harm caused by employees who lack education on scam techniques. For this, we implement role-based mechanisms that restrict access to critical information and limit rights to conduct specific actions.

- Preventing external fraud attacks by implementing rule-based fraud detection and prevention mechanisms and integrating with various anti-fraud solutions that help identify and block suspicious activities.

When working on custom fraud prevention mechanisms, we actively use the insights we get from our business intelligence team. In order to identify fraudulent activities and automatically block them, we thoroughly analyze suspicious activities and behavioral patterns, and our software development team implements tools for blocking suspicious activities based on the BI insights.

Why opt for outsourcing to financial software development companies like Yalantis for banking software development?

Outsourcing FinTech software development companies provide a lot of benefits over traditional in-house IT departments. Among them are:

Cost saving solutions and development techniques

By hiring an outsourcing software development company, you won’t spend resources on anything except developing your solution. After the solution is delivered and launched, it’s up to you to decide if you need ongoing support or if you’d rather conclude the partnership.

If you do need additional functionality or modifications to your financial software solutions, you can always come back to us and pay only for a specific amount of work. Yalantis will create thorough project documentation, so it won’t be a problem to quickly start working on your solution and onboarding specialists in the future.

A large talent pool constantly updated by Yalantis staffing specialists

With a specialized FinTech software development partner, businesses can access a vast pool of experts with specialized financial industry knowledge, stay up to date on the latest trends and technologies, and use flexible, scalable solutions that can help them achieve their unique business goals.

Yalantis has software developers of all levels who are experts in many technologies, so you won’t have to spend time gathering a team of the necessary IT experts. It also won’t be a problem to temporarily engage a new specialist on demand.

If it happens that Yalantis doesn’t have the required financial software developer for your project, we’ll find them fast. Our staffing department maintains and constantly expands a large talent database and is ready to find a specialist in any niche as soon as possible.

Reduced time to market without excessive resource consumption

Outsourcing financial software developers know how to ensure a high-quality development process while squeezing into tight deadlines in order to deliver a solution on time.

Moreover, software outsourcing companies take reduced time to market seriously and design whole strategies for effective financial software development and on-time product delivery. Yalantis is no exception: As a FinTech software development company, we prioritize well-timed solution delivery and high-quality results.

On-demand team augmentation

With outsourcing development, it’s always easy to scale teams up and down depending on current needs and the client’s objectives.

First, you don’t need to spend time looking for a specialist; we will do it for you. Second, you don’t have to permanently add specialists to your development team, allowing you to keep development costs within approved limits.

For these reasons, a lot of companies prefer looking for reliable outsourcing partners rather than searching for in-house specialists, interviewing them, onboarding them, and then maintaining a whole department.

Focus on marketing activities for financial institutions

With outsourced financial software development companies, you won’t need to spend much time monitoring all processes. Your company can focus on its main activities, such as marketing, financial management, and day-to-day operations. Yalantis will take on everything else:

- Project management

- Communication

- Specialist onboarding

- Reporting

Yalantis delivery managers, project managers, and customer success managers will keep you posted on intermediate development results, providing transparency into the development process. If there’s an emergency situation, they will immediately notify you and describe the details and solutions proposed by the team.

If you want to participate in management and closely monitor all processes, we will make sure you feel like part of the team and know every detail of the development process.

Make your solution a leader

got it!

Keep an eye on your inbox. We’ll be in touch shortly

Meanwhile, you can explore our hottest case studies and read

client feedback on Clutch.

Lisa Panchenko

Senior Engagement Manager

Your steps with Yalantis

-

Schedule a call

-

We collect your requirements

-

We offer a solution

-

We succeed together!