Financial management software helps businesses manage all of their regular financial operations, which include managing, planning, analyzing, and predicting revenue, expenses, and assets. It’s no wonder that the global financial management software market is expected to reach $24.4 billion by 2026.

In this article, we explain the necessity of implementing financial management software and the benefits a business may get from doing so, including process automation, cost optimization, and risk predictions.

NEED A FINANCIAL MANAGEMENT SOLUTION?

We have experience developing and implementing complex FinTech products

Contact usTypes of software products for the solution of financial management tasks in 2023

There are three main types of software for financial management: accounting software, financial management software, and enterprise resource planning (ERP) software. They can be considered stepping stones as your company’s financial intelligence needs and market size grow. All of them help your business achieve new goals in the course of the company’s development. And as you move from one type of financial management software to a more sophisticated type, they help your company’s departments or divisions work together more cohesively.

Let’s consider these types of software as a financial solution pyramid:

Stage 1: Accounting software

Accounting software assists finance departments in keeping track of billing, invoicing, record-keeping, expense tracking, accounts payable and receivable, and other financial operations. It is mostly used by small businesses whose financial operations are relatively simple.

Stage 2: Financial management software

Financial management solutions help midsize and large companies with all accounting operations and more advanced financial affairs such as asset management. This includes forecasting and planning future expenses, analyzing expenditures with data visualization, ensuring compliance with regulatory requirements, automating operations, and monitoring the business’s overall financial stability.

Stage 3: Enterprise resource planning

Enterprise resource planning, or ERP, systems are more complex all-in-one solutions that, in addition to helping with financial operations, assist users with managing human resources, finances, projects, customer support, and other aspects of the business. All insights about operation of these departments are considered and integrated to enable business owners to effectively manage the business.

ERP systems can be too costly and complex at the earliest stages of a company’s growth. That’s why we recommend you rely on our financial software development services to gradually move from accounting software to financial management software and to ERP systems as your business grows to build successful financial processes in accordance with your business capabilities and potential.

What benefits will you get from financial management system software?

Finance management software actively assists businesses in building effective financial operations and switching to a paperless office. Among the benefits of financial management solutions are:

- Full financial transparency. With a financial management system, all financial operations in your company will become transparent, as all documentation will be synchronized and visualized, and possible errors or inconsistencies will be highlighted. Also, financial management software offers smart reporting with insights on all financial operations.

- Greater operational, time, and cost efficiency. Financial management software for businesses provides vast opportunities for process automation. With smart automation, your staff won’t spend a huge amount of time on basic but resource-intensive operations that can easily be completed by the system itself. For example, the system can generate financial reports or carry out recurring transactions.

- Elimination of human errors. With a financial management system, your specialists will only need to create the right automations scenarios for completing specific tasks. This way, you will avoid human errors in calculations and data inconsistencies that can critically damage financial statements.

- Data-driven decision-making. Thanks to the advanced analytics and data visualization available in financial management solutions, your financial specialists can see the company’s current financial performance and suggest ways to improve performance. Moreover, financial digitalization and historical data analysis will allow the director of the finance department to plan and forecast future expenses more accurately, help identify poor decisions or ineffective strategies, and avoid them in the future.

See how we developed a wealth management platform for Lifeworks

READ CASE STUDYChoosing the right finance management solution for your business

It’s common to believe that mobile application development for banking requires to pay particular attention to user experience and functionality set but, in fact, any financial software needs this. Here are a few aspects you have to consider when purchasing or subscribing to a financial management solution:

- Functionality

- Convenience of the interface

- Maintenance and support

In this section, we discuss must-have functionality for financial management systems and discuss the financial management solutions with the most user-friendly interfaces, constant support, and regular product updates.

Criteria for successful finance management software

To maximize business efficiency, you will have to choose a solution with a feature set that supports:

- Basic accounting operations. A financial management solution should provide you with convenient record-keeping functionality for expenses, revenue, assets, liabilities, and so on. Additionally, you should be able to monitor all transactions, generate reports, and work with financial statements.

- Process automation. To achieve efficient financial management, you should be able to automate fundamental operations such as payments and report generation.

- International financial operations. If your business is international, your financial management solution should support multiple languages, international transactions, operations with multiple currencies and conversions, and compliance with location-specific financial requirements.

- Financial planning. Make sure the solution you want to implement will support accurate financial planning and allow for comprehensive planning with historical data and complex analysis of trends, patterns, and fluctuations.

- Cash flow monitoring and management. Double-check if your finance management software will help to simplify and unify cash flow management tasks and activities such as consolidations, budgeting, and allocations and provide a real-time view of the organization’s cash flow.

- Analytics and reporting. Software should allow for financial reporting including balance sheets, profit and loss statements, budget allocations, and ad-hoc reports. More advanced systems may offer AI-based insights and optimization suggestions based on your company’s historical financial data.

Besides having a great feature set, your financial management solution should enable your business to scale. It’s impossible to manage the finances of an enterprise-level company with a solution that’s only capable of serving small businesses. Also, you won’t be able to achieve maximum business efficiency if your finance department doesn’t have a convenient enough working environment. There are a few aspects we recommend paying close attention to when choosing software for financial management:

Seamless integration and scalability. Your financial management solution has to be flexible enough for seamless and quick implementation, provide all necessary documentation, and easily integrate with other systems. Also, it has to manage rapid scaling and keep pace with your business expansion.

Product updates. To be sure that you’ve chosen a solution capable of serving you well in the long run, check its history of updates. A software provider should regularly deliver new functionality or product updates to support your business workflows and any new financial operations.

Customer support. You have to be sure bugs and feature requests conveyed to the support team will be considered and resolved as soon as possible so that your business can operate smoothly. Read product reviews and forums to learn whether people are satisfied with the system you’re interested in.

User experience. The system’s user interface (UI) and user experience (UX) should be convenient enough for daily operations, intuitive to reduce the time for onboarding, and streamlined to complete tasks with a minimum number of screens and clicks.

Top 5 financial management solutions on the market

Before getting into the list of solutions we’ve prepared, it’s important to note that just purchasing or subscribing to a financial management solution isn’t enough. The IT department needs to migrate all available data, set proper data backup procedures, and prepare onboarding for the whole finance department.

If you don’t have an IT department or if they need some assistance from an experienced team, you can rely on outsourcing software development companies like Yalantis to make sure you are all set for handling complex financial operations. And in case you need any other services such as payment app development, we can always have your back and even manage parallel projects.

NEED PROFESSIONAL HELP?

Yalantis will design an implementation roadmap and assist in implementing the solution

Having analyzed a variety of options, we are ready to present the top five financial management solutions for businesses:

1. QuickBooks

QuickBooks is financial management software for small and medium-sized businesses. It provides an easy-to-use interface and allows businesses to streamline their accounting processes, increase accuracy, and save time and money. Its key functionalities include:

- Invoicing and billing

- Expense tracking and management

- Payroll processing

- Bank account and credit card integration

- Inventory tracking

- Sales and tax calculation

- Financial reporting and analysis

- Time tracking

- Mobile access and integration with other apps

- Multi-user access and permissions

2. SAP Financial Management Software

SAP Financial Management is enterprise-level financial management software that helps businesses streamline their financial processes, optimize their cash flows, and reduce financial risk. It offers advanced automation and analytics capabilities and can be customized to meet specific business needs. Key functionalities of SAP Financial Management:

- General ledger and accounting

- Accounts payable and receivable

- Cash management and forecasting

- Treasury management and risk analysis

- Financial planning and budgeting

- Asset accounting and management

- Tax management and compliance

- Real-time financial reporting and analysis

- Multi-currency and multi-language support

- Integration with other SAP modules

3. Oracle NetSuite Cloud Accounting Software

Oracle NetSuite Cloud Accounting is cloud-based accounting software that helps businesses manage their finances, accounting, and compliance requirements in a secure and scalable environment. It offers advanced security and disaster recovery capabilities. Key functionalities include:

- General ledger and financial management

- Accounts payable and receivable

- Bank and credit card integration

- Expense management and tracking

- Multi-currency and multi-language support

- Tax management and compliance

- Real-time financial reporting and analysis

- Customization and scalability

- Integration with other NetSuite modules

- Mobile access and collaboration tools

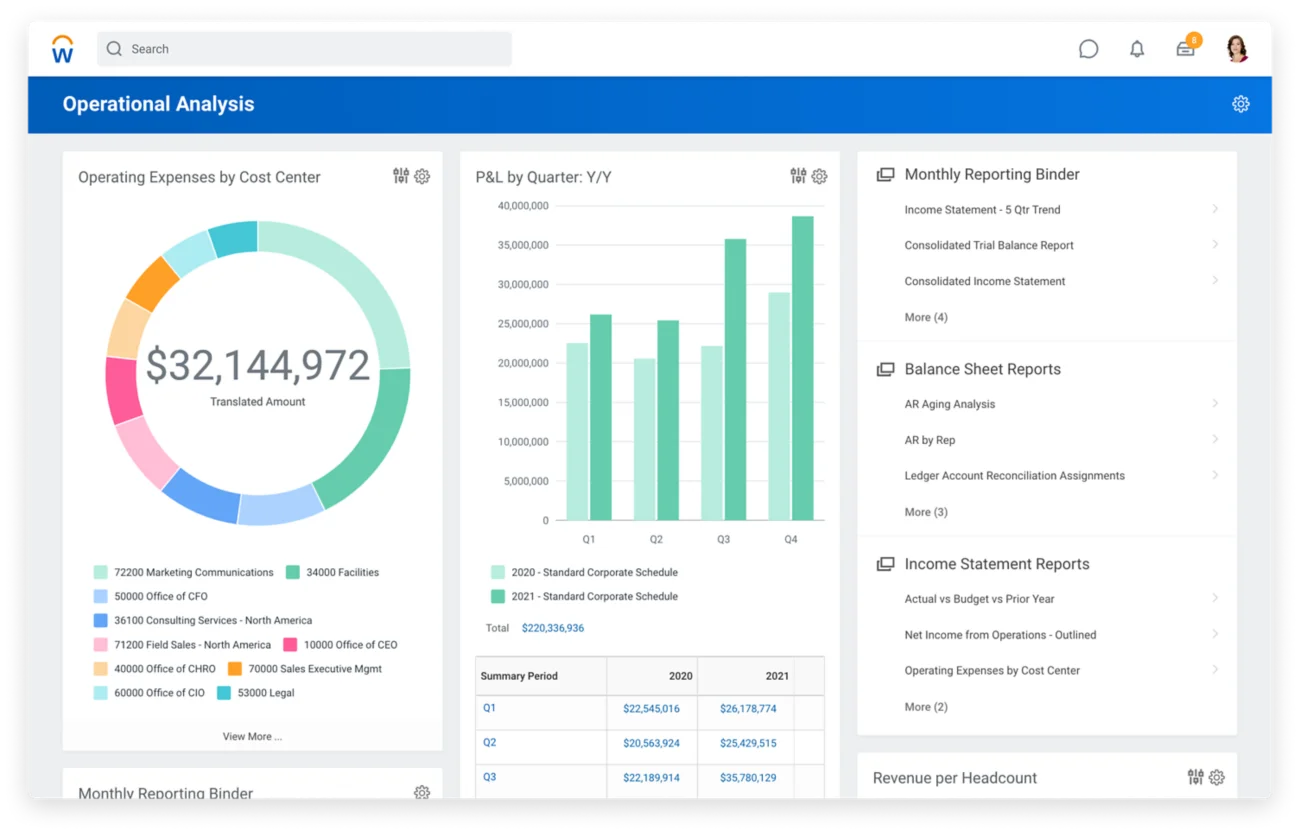

4. Workday Financial Management

Workday Financial Management is cloud-based financial management software that helps businesses manage their accounting, procurement, and expenses in a single system. It offers advanced automation and analytics capabilities and can be customized to meet specific business needs. Its functionalities include:

- General ledger, accounts payable, and accounts receivable

- Procurement and inventory management

- Asset management and depreciation

- Expense management and tracking

- Revenue management and billing

- Financial reporting and analysis

- Audit and compliance management

- Multi-currency and multi-entity support

- Integration with other Workday modules

5. Sage Accounting

Sage Accounting is cloud-based accounting software that helps small businesses manage their accounting and financial needs. It offers personalized dashboards, insights, and notifications to support decision-making, and it can be accessed from any device. Its key functionalities include:

- Invoicing and payment processing

- Expense tracking and bank reconciliation

- Financial reporting and analysis

- Inventory and project management

- Multi-currency and multi-language support

- Tax management and compliance

- Customization and scalability

- Integration with other Sage products and third-party apps

Imperfections users face when implementing ready-made financial management solutions

There are a few reasons why ready-made solutions aren’t always the best option:

- Legacy code. This is a common problem with financial management solutions for businesses, as most of them have been developed since the 2000s and contain outdated technologies. In the future, such systems may not be capable of providing your company with the performance, stability, and functionality you need.

- Legacy UX. One consequence of legacy code is non-optimized processes that can affect the finance team’s user experience and efficiency. This may result in multiple steps to complete a single task, time-consuming processing of database requests, or simply the necessity to manually monitor data consistency in various software modules.

- Lack of flexibility. Some financial management software isn’t flexible enough in terms of integrations with third-party providers or the ability to make changes to its codebase quickly without affecting the whole platform’s operation.

What other options do you have besides ready-to-use financial management solutions?

Building a custom financial management solution can be an alternative to choosing from ready-made solutions. By opting for custom solution development, companies can address two main concerns: proper data security and long-term technological stability. With custom solutions, companies can:

- Customize and strengthen their data protection ecosystem

- Avoid switching to another solution provider or integrating with third-party services if the initial solution isn’t capable of covering all their needs

You might say these aren’t sufficient reasons to go for custom solution development and that everything can be solved by choosing a technologically suitable solution. However, there are crucial business benefits to building custom financial management software:

- No dependence on an external solution provider. When you build a custom solution, you own the software and are its main stakeholder. With full rights to change anything within your solution, you won’t have to depend on the off-the-shelf solution provider and wait until the desired functionality is implemented. For that matter, functionality you want might never be implemented if it’s only required by your business.

- Long-run cost efficiency. B2B financial management software is costly, as pricing is based on the number of users. The bigger your finance department and the faster your business grows, the more money you will have to pay each year. It may turn out that your overall expenses on ready-made software will be enough to cover custom end-to-end solution development.

- Ability to perfectly cover all of your current and future needs. With custom solution development, you won’t have any gaps in your solution’s functionality. Your software will be perfectly tailored to your business’s needs and requirements. And if you need new functionality, the development team can deliver it to you on demand, customized to your new needs.

- Easy and affordable support by a small IT department. You won’t need a big development team once your custom system is completed. It will be enough to work with a small support team that can monitor and maintain your system.

- Improved data security. When developing a cloud-based solution or integrating with third-party services, software engineers can ensure maximum security of data in transit and in storage based on your business’s specific requirements.

Outsourcing accounting services: building a data automation bridge between companies with hybrid software development

It’s common to leave financial matters to accounting outsourcing companies that carry out all bookkeeping operations. This helps to reduce labor costs and avoid the necessity of maintaining a huge finance department. The only challenge accounting companies have to overcome to ensure smooth collaboration is setting up proper data interchange between their clients’ systems and the software they use themselves.

Most of the time, accounting companies have to manually upload data about the accounts they work with, which is highly inefficient and time-consuming. Needless to say, this also affects their clients. In this case, the best option will be to integrate both solutions through a custom unified interface.

This way, both sides will achieve maximum efficiency in managing information. All financial data about the company will be automatically uploaded to the accounting software, and, in the event of sudden changes, the information will be synchronized across both systems to maintain its integrity. Such hybrid software development is less costly than custom developing a solution from scratch and can be of great help when it comes to outsourcing financial services.

What about personal financial management solutions?

The financial management software market contains more than just IT financial management software. Ordinary people also want to keep their finances in order.

As younger generations become more interested in financial knowledge and control over their finances, investments, and wealth management in general, they are also becoming a lucrative target audience for businesses delivering personal financial management solutions. It’s predicted that the size of the global personal finance software market will reach $1.57 billion by 2027.

Applications for personal finance are usually not that complex, as their focus is far from business accounting operations and enterprise-level financial planning. If you want to become a financial management software vendor but aren’t sure about building a B2B solution, consider developing a personal financial management solution. This way, your business may spend fewer resources on development.

Yalantis has experience building products for young audiences. Learn about how we delivered a high-quality neobanking product for one of the top American neobanks.

Conclusion

Financial management is complex and resource-intensive. Financial management solutions should be directed towards making this process smoother and less complicated. If you want to get an efficient and long-lasting solution that’s able to meet future needs, consult with an experienced team if you don’t have subject matter experts in your company.

Over years of actively developing solutions for various industries, including FinTech, Yalantis has come up with a unique software development strategy that helps our clients save resources. We can provide you with functionality for each process in your financial department. With our help, you can build a solution for rapidly scaling and quickly implementing new functionality.

Looking for developers to build a financial management solution?

Yalantis has the needed expertise

Rate this article

5/5.0

based on 1,588 reviews