Globally, financial transactions generate around 2.5 petabytes of data daily. Such large amounts of sensitive data require tools for efficient handling, migration, and protection.

One way to optimize data handling and make the process more secure is by implementing data retrieval solutions, which we talk about in this article. You’ll learn what data fetching is, how it can benefit your company, and how to build an effective querying data service using technologies like React app and GraphQL query management. We’ve also prepared a checklist of the best React query management and GraphQL practices for backend development, so make sure to download it.

What is data fetching?

Data fetching, or data acquisition, refers to the process of automatically retrieving or collecting data property from various internal and external sources to be used for various financial and operational purposes. Types of collected information include:

- financial transaction data

- customer account data

- market data

- economic indications, etc.

By acquiring and analyzing data, financial institutions can obtain valuable insights that they can use to improve their services, such as by:

- making predictions

- examining market trends

- assessing risks

- ensuring regulatory compliance

Insights obtained from data analysis can also be used to help financial institutions make their products more useful to customers and ensure a positive experience. Examples of products that can use this data include:

- digital banking platforms

- mortgage and real estate investment platforms

- wealth management platforms

- crowdfunding platforms

- insurance applications

- personal finance management tools

Given the growing array of financial services and FinTech organizations benefiting from efficient data management, there’s an increasing need for establishing seamless data acquisition processes. Below, we explore how information retrieval can improve the relationship between financial institutions and their customers, as well as setup challenges.

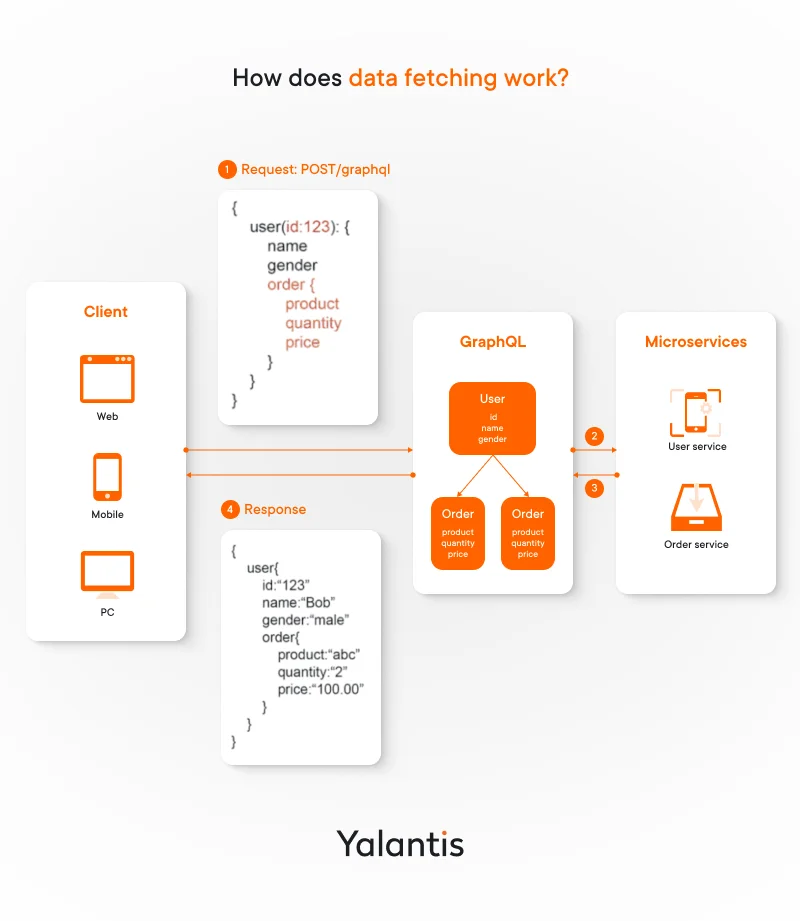

How does data fetching work?

In essence, data acquisition is a fairly simple process and consists of the following steps:

- Identify the data source. Determine where the data is located, whether it’s an API, file system, database, or cloud platform.

- Select the data retrieval method. The preferred data retrieval method depends on the data source and its supported protocols: SQL queries for databases, HTTP request for web or GraphQL API, file I/O operations for local files.

- Set up the environment. Make sure you have the necessary tools, libraries, and dependencies installed for the chosen data retrieval method. These can include database drivers, HTTP client libraries, or file handling modules.

- Form and send the request. You can type queries in SQL, create an HTTP request with specific parameters, or a command to read a file. Then, send this request to the data source.

- Retrieve and process the response. Handle the response from the data source. This step involves parsing the data (e.g., decoding JSON, reading rows of database queries) and handling errors for any issues that arise during fetching.

- Use the retrieved data. Once you’ve fetched and processed the data, use it as required in your application – display it, analyze it, or store it for future use.

How does data acquisition empower relationships between banks and their customers?

When it comes to financial institutions, data acquisition becomes a great analytics tool for the following processes:

- Customer account management: retrieving and displaying balances and transaction history; providing access to online banking

- Loan organization: retrieving credit reports and financial statuses; credit scoring; getting data for background checks

- Investment management: fetching real-time market data and stock prices; automating trading and investment decisions

- Fraud prevention: collecting data for fraud pattern recognition; implementing real-time fraud alerts and blocking mechanisms

- Compliance and risk management: gathering economic indicators for risk assessment; automating anti-money laundering (AML) and know your customer (KYC) checks

Data retrieval can also help to build customer trust in financial institutions in various ways:

#1 Enhanced customer experience

By facilitating access to remote data from various sources — such as transaction histories, account balances, and spending patterns — data querying allows banks to offer personalized and timely services to their customers. For example, banks can provide tailored financial advice, recommend suitable products, or send alerts for unusual transactions. This personalized approach enhances the overall customer experience, fostering a stronger and more trusting relationship between a bank and its customers.

#2 Improved security and fraud detection

A 2022 survey of 800 risk and fraud executives by LexisNexis Risk Solution found that the average volume of monthly fraud attacks for banks earning more than $10 million in annual revenue increased from 1,977 in 2020 to 2,320 in 2022. Bigger banks receive even more fraud attacks, which makes manually managing fraudulent activities unsustainable and inefficient.

By using data querying to monitor transaction data and compare it to historical patterns, banks can quickly detect and respond to any suspicious or fraudulent activities. Customers appreciate these proactive security measures, which increase their confidence in a bank’s ability to protect their assets. Such trust is fundamental for maintaining a strong customer–bank relationship.

Take a look at how Yalantis handled security challenges for a traditional banking institution

Explore the case study#3 Streamlined onboarding for new customers

Data acquisition automates many manual processes within banking institutions, reducing the need for customers to provide redundant information or paperwork. For instance, when customers apply for loans or open new accounts, the bank can retrieve necessary information directly from external sources, such as credit bureaus or tax authorities. This streamlines the onboarding process, making it more convenient for customers and improving the efficiency of the bank’s operations.

#4 Personalized financial planning

By implementing data acquisition techniques, banks can offer sophisticated financial planning tools and services. For example, they can analyze a customer’s financial history, goals, and risk tolerance to provide personalized investment and savings strategies. This level of customization empowers customers to make informed financial decisions, reinforcing trust in their bank as a valuable partner in achieving their financial goals.

However, creating and implementing this technology often comes with challenges. Below, we explore the most common culprits and see how you can address them.

Challenges in data fetching for financial applications

Financial applications, whether they are banking apps, trading platforms, or investment tools, often have unique data requirements that can make data retrieval a complex task. Here are some of them:

- Ensuring real-time data. Financial markets operate in real time. Stock prices, currency exchange rates, and other financial data can change rapidly. To provide users with up-to-date information, financial apps must fetch and display data in real time or with minimal delay.

- Processing large datasets. Financial applications deal with large datasets, including historical market data, transaction records, and customer profiles. Retrieving, processing, and presenting this data efficiently requires substantial resources but is crucial for a smooth user experience.

- Making complex calculations. Financial calculations involve various factors such as interest rates, risk assessments, and investment portfolio management. These calculations often include complex algorithms that take into account interest rates and compound percentages. Assessing risk often means analyzing historical data, complex statistical models, and market trends. All of these calculations rely on hardware capabilities and data management, as even slight fluctuations impact the system’s response rate.

- Maintaining data privacy and security. Financial data is highly sensitive and falls under various compliance requirements. Applications must adhere to strict security and privacy standards to protect user information and comply with legal requirements.

- Providing a customizable UX. Users of financial apps have diverse needs. Some may want to track specific stocks, while others focus on currency exchange rates or investment portfolios. Providing a personalized user experience requires more time for developing efficient data retrieval mechanisms that can address user demands.

- Handling scalability. As financial applications grow in popularity, they must scale to handle increased user loads. This can be challenging due to the limited capabilities of legacy systems and increasing user data volumes that put a load on servers. This leads to performance bottlenecks and requires a lot of resource-intensive modifications of existing infrastructure.

- Managing API overhead. Traditional RESTful APIs often over-fetch or under-fetch data, as clients are limited to predefined endpoints provided by the server. This can result in unnecessary data transfer and increased latency.

These challenges highlight the need for a more flexible and efficient approach to data querying in financial applications. This is where React components and GraphQL app come into play, offering solutions that can overcome these obstacles and provide a more streamlined development process.

In the following sections, we explore how React and GraphQL server can address these challenges and efficiently fetch data in financial apps.

Get a checklist of GraphQL client library practices that cover every aspect of developing a stable backend foundation for financial applications

Get the checklistHow does React app provide the required flexibility for data retrieval processes?

React app, a JavaScript library developed by Facebook, is widely known for its capabilities in building dynamic and interactive user interfaces. It simplifies UI development thanks to its component-based architecture, which breaks down complex interfaces into reusable elements. This modularity is invaluable for data-rich and interactive financial apps.

What best supplements React query management for data acquisition?

Even though GraphQL clients with React app create a flexible software development library, you can make it more efficient by combining it with other tools like TypeScript. TypeScript is a statically typed superset of JavaScript that is highly regarded in the banking sector for its role in enhancing code quality and reliability.

TypeScript’s type checking, annotations, and interfaces make code in banking applications more self-documenting and error-resistant, fostering collaboration among developers and ensuring the precision and reliability necessary in the financial domain.

Benefits of combining TypeScript with React-query GraphQL API

Aside from error-proofing, adding TypeScript to the React app ecosystem enhances development in several ways:

- Type safety. TypeScript brings strong typing to GraphQL data and React app native components. This means developers can define and enforce data types for prop, state, and function arguments, catching type-related errors during development rather than at runtime. In the context of financial applications, TypeScript’s type safety is a significant advantage, as it allows you to reduce testing time and quickly catch potential issues with applications.

- Code maintainability. The use of TypeScript leads to more self-documenting code. Type annotations and interfaces clarify expected data structures, making the codebase easier to understand, maintain, and refactor. In financial apps, these practices lead to more robust and maintainable code.

- Improved code quality. The combination of TypeScript and React query management encourages coding best practices, such as strict adherence to component contracts, better function parameter handling, and reduced reliance on runtime checks. In financial applications that rely on precision and handle lots of asynchronous operations, improved code quality is a significant benefit.

The combination of TypeScript and React application is particularly valuable in the demanding landscape of financial application development, where accuracy and reliability are essential. With React’s powerful capabilities for building dynamic and responsive user interfaces, financial applications have been able to offer users a seamless and interactive experience.

Start working with Yalantis to build your perfect financial service

Check out our domain expertiseWhile React and TypeScript can help you quickly create efficient solutions for the financial sector, they’re still not sufficient for the long run. Let’s focus on a complementary technology that will help you achieve an efficient retrieval process: GraphQL server.

What is GraphQL and why does it prevail over traditional techniques?

GraphQL is a query language for APIs originally developed by Facebook. It offers a flexible and efficient way to interact with your data sources, making it especially well-suited for the diverse data requirements of financial apps.

Along with React query management and GraphQL API, we have the Representational State Transfer (REST) architecture and Simple Object Access Protocol (SOAP). While REST and SOAP are prevalent in web apps, they have limitations when it comes to fetching data for modern applications, including financial apps. They often result in over-fetching or under-fetching of data due to rigid endpoints, necessitating versioning as APIs evolve. Additionally, they typically lack real-time capabilities, relying on polling for updates.

In contrast, GraphQL operations offer precise data retrieval, query flexibility, and real-time support, making it a more efficient choice for applications where data accuracy, responsiveness, and adaptability are paramount.

Let’s delve into what GraphQL API is and why it’s gaining favor:

As you can see, for the banking sector, GraphQL API emerges as the superior choice for data acquisition when compared to traditional methods like REST and SOAP.

Retrieving data from a GraphQL endpoint ensures that only necessary information is requested, minimizing data over-fetching and under-fetching — common pitfalls in REST. It also eliminates the need for versioning by allowing the client to request specific fields, offering unparalleled flexibility in adapting to evolving data requirements.

Additionally, GraphQL server client support for real-time data through subscriptions and its self-documenting schema further enhance its appeal. As the banking industry increasingly adopts modern technologies, GraphQL’s growing ecosystem and rapid evolution make it the optimal solution for fetching data in this highly regulated and dynamic sector.

In subsequent sections, we explore how a GraphQL client integrates seamlessly with React apps to tackle the unique challenges of data fetching in the financial sector.

Need a scalable, secure, and responsive data management solution?

Book a consultation with us

Explore our expertiseBenefits of combining React components and GraphQL API for data fetching

When combined, React applications and GraphQL data form a potent toolkit that has numerous advantages, particularly for financial applications. Here are only a few benefits of this combination:

- Seamless integration. React components and GraphQL APIs seamlessly integrate with existing databases and architectures, simplifying development. React applications can effortlessly send GraphQL queries, handling loading of HTTP requests and related data. This integration streamlines development and reduces redundant code in applications.

- Precise data acquisition. GraphQL’s ability to specify precise data requirements aligns seamlessly with React’s component-based structure. Each React component can articulate its data needs, ensuring only essential data is retrieved.

- Responsive UI. React DOM and component reactivity combined with GraphQL queries helps building user interfaces that are updated in real time as market data changes. Additionally, React query flexibility extends to mobile app development with React components, while GraphQL query language serves as a consistent data-fetching solution across web and mobile platforms.

- Reduced server load. GraphQL queries reduce the number of network requests to the server compared to traditional REST APIs. This cut in server load can lead to cost savings and enhanced scalability, ensuring your financial client can handle growing user demands and a growing number of server requests.

- Simplified error handling. GraphQL queries offer rich error states information in client responses. When combined with React application, it ensures stable application performance and prompt error handling. If a local error occurs, React ensures the functionality of the main application.

- Efficient caching. In the context of mobile devices, efficient caching mechanisms become crucial for minimizing data transfer and reducing latency. React’s ecosystem offers libraries like Apollo Client, which integrates seamlessly with GraphQL server and provides sophisticated caching strategies. Caching optimizes data retrieval and enhances the mobile user experience.

In the following sections, we delve into real-world examples and practical strategies for leveraging React application hooks and GraphQL in financial app development.

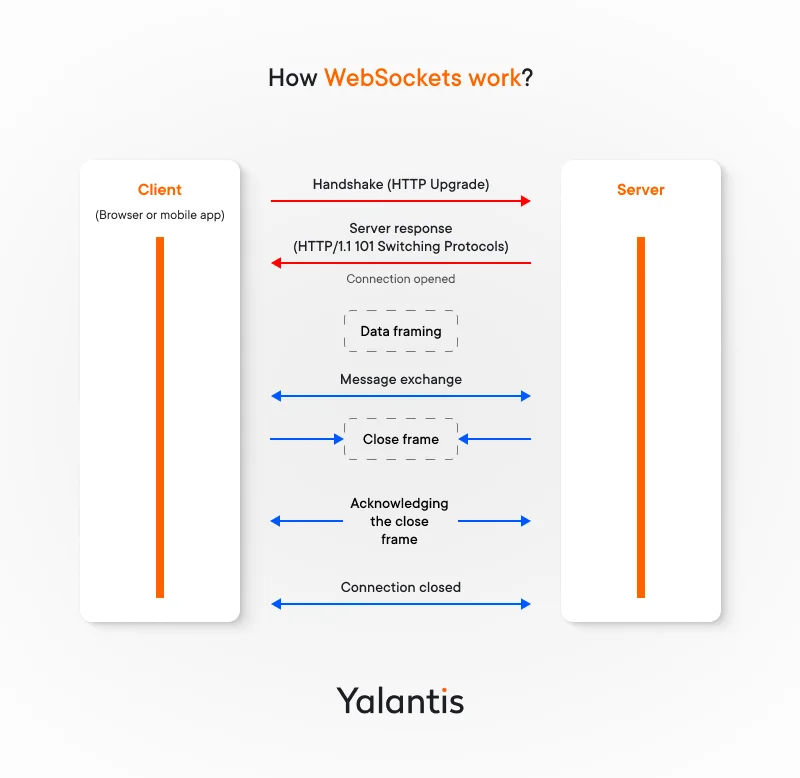

Displaying real-time data for financial institutions with WebSockets

Since it’s crucial for financial institutions to obtain and manipulate data in real-time, you should create an environment that allows for this to happen smoothly and efficiently. One way to ensure this is by using WebSockets.

WebSockets are a communication protocol and app component that enables bidirectional, real-time data transfer between a client and a server over a single, long-lived connection. Unlike traditional HTTP request, which requires initiating a new connection for each request, WebSockets maintain a continuous and low-latency connection for the entire process, allowing data to be pushed from the server to the client (or vice versa) without repeated connection setup.

This makes WebSockets a fundamental app component for achieving real-time interactivity in web applications, including financial apps.

Common use cases for React, GraphQL, and WebSockets in financial apps

React app and GraphQL, when coupled with WebSockets, provide an ideal solution for ensuring that users receive timely and accurate information. Let’s consider the following use cases:

|

Use case |

React capabilities |

GraphQL capabilities |

Can be coupled with Websockets |

|

Providing access to real-time market data |

Building platforms, dynamic charts, and graphs |

Fetching and updating market data in real time |

+ |

|

Building personalized investment portfolios |

Rendering tailored investment portfolio recommendations based on client data |

Fetching customer profiles and investment preferences |

– |

|

Banking and transaction notifications |

Displaying real-time transaction notifications for account activities |

Securely retrieving transaction data from backend systems |

+ |

|

Risk management dashboards |

Visualizing market data with interactive charts and graphs |

Retrieving data from varied sources for real-time risk management analysis |

+ |

|

Financial news and alerts |

Presenting financial news and market alerts in real time |

Fetching breaking news and market alerts from multiple sources |

+ |

|

Investment analytics |

Creating analytics dashboards for in-depth insights |

Accessing historical market data and performance metrics |

– |

|

Compliance reports |

Rendering compliance reports and visualizations |

Querying transaction data pertinent to regulatory compliance |

– |

|

Peer-to-peer lending platforms |

Facilitating user interactions on lending platforms |

Matching lenders with borrowers based on various criteria |

+ |

Conclusion

Streamlined data retrieval process plays an important role in developing modern financial applications. It helps enhance user experiences, ensure robust security measures, and facilitate seamless integration of various financial services.

You can make data acquisition even more efficient with the right technology stack. By combining technologies like React application, with its component-based architecture, and GraphQL, with its simple query language, you can efficiently address common fetching challenges such as handling large datasets, maintaining data security, and providing real-time data updates.

Thoughtful integration of React and GraphQL in data retrieval not only streamlines financial operations but builds a foundation of trust and efficiency between financial institutions and their customers.

Revamp your data management approach with Yalantis

Contact usFAQ

How does the FinTech sector use data fetching?

Financial institutions use data fetching techniques to access timely and accurate data, which is then used for activities such as risk assessment, fraud detection, customer service, reporting, decision-making, and regulatory compliance.

What is the most common way to fetch data in React?

The fetch method is well-known for easy data retrieval from a server’s API. It’s widely used due to its simplicity and flexibility in interacting with different APIs, allowing you to perform most common API requests: get, post, put, and delete.

What are use cases for big data in finance?

Applications of big data analytics in the financial industry are diverse and dynamic. The most common use cases include wealth and asset management, fraud detection, predictive analytics, credit scoring, and personalized banking.

Rate this article

4.8/5.0

based on 29 reviews