Banking software development

-

Reduce operating costs with financial process automation and optimization solutions

-

Secure your business and customers with a compliant fraud and risk prevention system

-

Discover bottlenecks and create a conversion- optimized UX with advanced analytics

-

Expand your business with a scalable and stable banking product

Value we have delivered to our clients

-

1M

active users within a year of the software product launch

-

$100K

monthly transaction volume increase

-

250%

monthly growth in deposits

-

50%

faster banking software development with the ready-to-use Yalantis SDK

Yalantis banking software development services

Based on our experience creating software for the biggest neobank in America and other banking software products, we will help you build a top-notch banking solution.

-

Core and on-demand functionality

-

Core banking system integration

-

Mobile banking

-

Cryptocurrency trading

-

Wealth management

-

Investment

-

Lending

-

-

Banking operations

-

Account management

-

ACH payments

-

P2P payments

-

Wire transfers

-

Bill payments

-

Invoicing

-

Savings accounts

-

Virtual cards

-

Overdrafts

-

Cashback

-

Credit scoring

-

Transaction monitoring

-

-

Data and customer management

-

Data analytics

-

Data warehouse

-

Business intelligence

-

Robotic process automation

-

Customer portal

-

Customer support module

-

Loyalty program management

-

Referral program

-

-

Security

-

Biometric identity access management

-

OAuth 2.0

-

Fraud protection

-

Risk detection

-

Customer verification (KYC/KYB)

-

Looking for a banking software development company to build or enhance your FinTech solution?

Expand your business, streamline the user experience for higher user acquisition, and strengthen your security with Yalantis.

Case studies from a banking software development company

Need an experienced bank software development company?

Yalantis has experience developing secure, scalable, and customer-oriented FinTech products that deliver a high-class experience.

Insights into banking software development

What it takes for a traditional banking institution to go digital

Reveal the subtleties of digital transformation for banks: challenges you need to overcome, benefits you’ll get, technologies you can use, and success factors.

Security best practices for web and mobile app development

Application security is crucial. Learn how to apply security best practices at each stage of application development to protect your application.

Digital banking architecture: things to consider when building banking software

Learn what types of software architecture you can consider for digital banking, how to make your software secure, and how to choose suitable technologies based on your needs.

FAQ

What is your experience in banking software development?

During 5+ years developing banking software, we’ve worked on 20+ FinTech projects of various types, greatly enriching our FinTech expertise. Neobanks, traditional banks, wealth management platforms, stock operation management platforms, healthcare companies, real estate businesses, logistics enterprises, and e-commerce retailers have already benefited from Yalantis services.

Within our company, we’ve built a FinTech center of excellence with 100+ experienced engineers and other IT specialists working according to best practices and following reusable approaches to FinTech software development that help us build solutions in a time- and cost-efficient way.

How do you manage to cut in half the time for developing banking software?

We start with identifying your business needs and requirements and determining key stakeholders. This process normally lasts up to three weeks. Next, we proceed to development, using the Yalantis Banking Accelerator to speed up frontend development by 50% compared to other banking software development companies. This stage takes up to two months on average. Then we do product testing according to quality assurance best practices for about one week. Next come beta tests and pre-launch activities for about one month. Finally, we ensure a stable launch and provide IT and pre-sales support. At your request, we will further evolve your product according to market needs and customer feedback.

How do you ensure secure bank software development?

As an experienced and ISO-certified software engineering company serving the financial industry, we know that FinTech is a highly regulated field. To engineer and augment highly secure and high-quality banking software products, Yalantis complies with the following industry standards and regulations: ISO 27001, ISO 9001, PCI-DSS, PSD2, SOC2, and the GDPR.

What financial integrations do you have experience with?

We can diversify your functionality and augment your banking software by integrating with prominent third-party service providers:

Galileo, Mambu, Temenos, Unit, Solid, Marqeta, Lob, Stripe, TransUnion, Currencycloud, Wise, Jumio, IDology, Socure, Emailage, iOvation, LexisNexis, ComplyAdvantage, Tookitaki, Giact, InGo, Money, Plaid, Appsflyer, Segment.io, Firebase, Snowplow, Braze, AirFlow, Orbis, Apex, Polygon, Alpaca, Orion, Wyre, ZeroHash, Ujet, Salesforce, Intercom, Airflow, and Zendesk.

Please note that this list is not exhaustive, and we are ready to implement any other third-party service you may need for your business success.

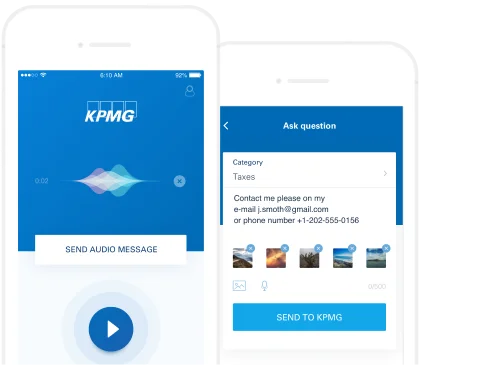

Who are your clients?

KPMG, Lifeworks Advisors, and other FinTech companies have already trusted us with developing and enhancing their solutions. We’ve helped our clients build their banking software products from the ground up, enhance their existing solutions, integrate with core banking systems, implement streamlined banking operations, efficiently handle their business and custom data, and ensure top-level software security.

What is the Yalantis Banking Accelerator and how does it streamline bank software development?

The Yalantis Banking Accelerator is a software development kit (SDK) that pulls together Yalantis’ extensive experience in FinTech solution development, business analysis, UI/UX design, financial integration, and security best practices.

Initially, Yalantis designed this SDK to speed up software development and ensure smooth performance and relentless scalability. Based on our experience building numerous FinTech products, we worked through the business and technological challenges that financial institutions often face when entering the market with a new solution.

With the Yalantis Banking Accelerator, the time required for banking software development is often cut in half thanks to:

- The SDK’s modular architecture that enables flexibility in developing functionality

- A pluggable integration level that allows rapid API-based integration without interference with the BaaS provider’s back end

- A UI component library that speeds up development of end-user-facing functionality

- Administrative tools for configuring the UX and feature set

- Streamlined CI/CD pipelines for frequent and stable releases

The SDK allows developers to streamline one of the most resource-intensive processes in terms of building FinTech solutions — integration with third-party services.

Simplified integrations with third-party services

Why is it impossible to imagine banking software development without integrating with third-party services? Such services allow for:

- Providing core functionality and banking operations that are critical for the solution’s existence

- Augmenting the solution with innovative functionality to win the competition

- Ensuring automation of internal and customer-oriented operating processes

- Allowing for advanced analytics and business intelligence

- Following market trends and satisfying customer needs

- Attracting more customers and revenue

Time and significant effort are required for implementing integrations, setting up the right data management processes, and testing each process that communicates with a third-party service. With the Yalantis Banking Accelerator, our development teams will be able to:

- conduct a smooth and seamless integration with third-party providers via APIs

- leave third-party providers’ back ends untouched, as the integration process will be carried out through the Yalantis pluggable integration layer

- optimize data management processes and conduct comprehensive solution performance testing

- enrich your user experience with prominent functionality, meet your customers’ needs and expectations, and follow market trends

Alongside integrations, the user experience is crucial as well. Yalantis knows this better than most thanks to all the projects we’ve worked on and followed on their road to recognition. Your solution’s success and its ability to attract customers hinge on the UI/UX. But don’t worry; we have an ace up our sleeves to support you even here.

UI library focused on customer acquisition

Together with Yalantis’ senior business analysts, our UI/UX designers have built user interfaces that ensure customer satisfaction, convenience, and user acquisition. With the ready-to-use UI library, you can choose and configure user interfaces that correspond to your company’s corporate style.

The Yalantis Banking Accelerator’s UI library was created with a focus on:

- solving key user experience needs and problems of your target audience

- providing top convenience for everyday banking operations with a minimal number of clicks and screens

- reducing the number of steps users have to take to complete an operation

- gamifying non-core functionality to please end users with a positive experience

- delivering stunning visuals that will attract younger audiences and have all chances to go viral

Contact us

got it!

Keep an eye on your inbox. We’ll be in touch shortly

Meanwhile, you can explore our hottest case studies and read

client feedback on Clutch.

Lisa Panchenko

Senior Engagement Manager

Your steps with Yalantis

-

Schedule a call

-

We collect your requirements

-

We offer a solution

-

We succeed together!