Big banks are heavily investing in generative artificial intelligence (GenAI), specifically focusing on innovations like OpenAI’s ChatGPT and Google’s Bard. It’s no surprise — serving as virtual assistants for banks, AI chatbots have proven to be powerful tools for enhancing internal productivity and elevating the customer experience.

Why the spotlight on AI-powered solutions? Because of their undeniable value. They bring solid benefits for banking institutions, including:

- operational efficiency

- competitive advantages

- higher profits

- large-scale personalization

Previously, achieving these goals demanded intricate and costly systems. But the ease and convenience of chatbots like ChatGPT has unlocked a world of possibilities.

If your bank hasn’t embraced AI-driven chatbots yet, it’s high time to do so. In this guide, we explore why banking AI chatbots are pivotal in today’s business landscape and explore the options to drive your bank’s success.

Drive business growth and customer engagement with novel AI technologies

Explore AI solutionsFirst, let’s find out why banking is among the industries seeing the biggest impact of AI.

The huge potential of AI adoption in FinTech and factors driving it

Widespread AI adoption in banking has the potential to add up to $1 trillion in extra value annually by elevating employee productivity, cutting costs, and creating new revenue streams.

AI implementation allows banks to:

- Avoid data overload. Banks generate vast amounts of transaction, operations, and customer data, which makes manual processing difficult. AI, specifically through natural language processing (NLP), handles structured and unstructured text data like customer inquiries.

- Automate tasks. Banks must juggle responding to high volumes of customer queries while also processing large numbers of transactions. Managing these vast arrays of simultaneous, repetitive tasks strains bank resources and allows room for errors. AI tools automate these tasks, easing the load.

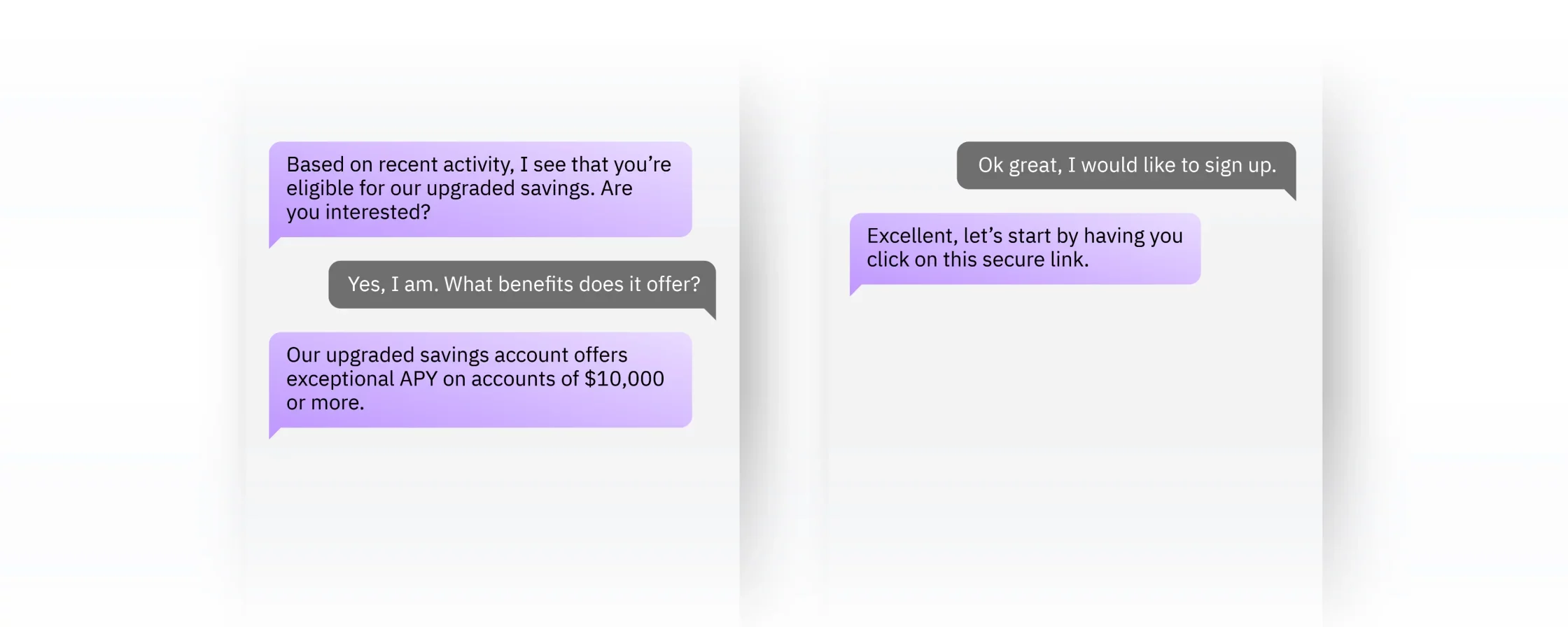

- Achieve a customer-facing workforce. With numerous service agents and support staff, banks need to efficiently scale customer service to address a constantly growing number of inquiries. AI chatbots and robo-advisors are instrumental in achieving this.

- Meet stringent regulatory requirements. The heavily regulated banking industry requires robust risk management and compliance. AI assists in efficiently monitoring compliance and updating employees on new requirements.

- Enhance security and prevent fraud. Banks must combat increasingly sophisticated fraud and cyber threats. AI tools swiftly identify patterns and anomalies, surpassing human capabilities.

Given these factors, many financial companies are significantly increasing investments to apply AI effectively. Amid recent advances, generative AI systems that can create original content like text, images, and audio have piqued the interest of company leaders.

Generative AI use cases, benefits, and real-life examples

Read the postExperts report that current investments in generative AI are heavily focused on text-based applications like chatbots. In the following sections, we explore the value and use cases of AI chatbots in banking.

Chatbots for banking to enhance the customer experience and improve in-house productivity: Key questions answered

Want to grasp the basics of AI chatbots before exploring their uses in banking? Take a look at our Q&A guide. We’ve included the most common questions our customers and partners ask about AI chatbots, both in the realm of banking and more broadly, including:

- Why are chatbots a valuable application of AI?

- What is driving the widespread adoption of AI chatbots in finance?

- How do banks benefit from AI chatbots?

- Where should banks start with AI chatbots?

You’ll find all the essential answers in one handy file for your reference:

Get answers to key questions about banking AI chatbots in one handy free guide.

Download Q&A guideNow, let’s see how chatbots for banks and financial services can revolutionize the industry.

Top use cases of chatbots in the banking industry and benefits they can bring to your business

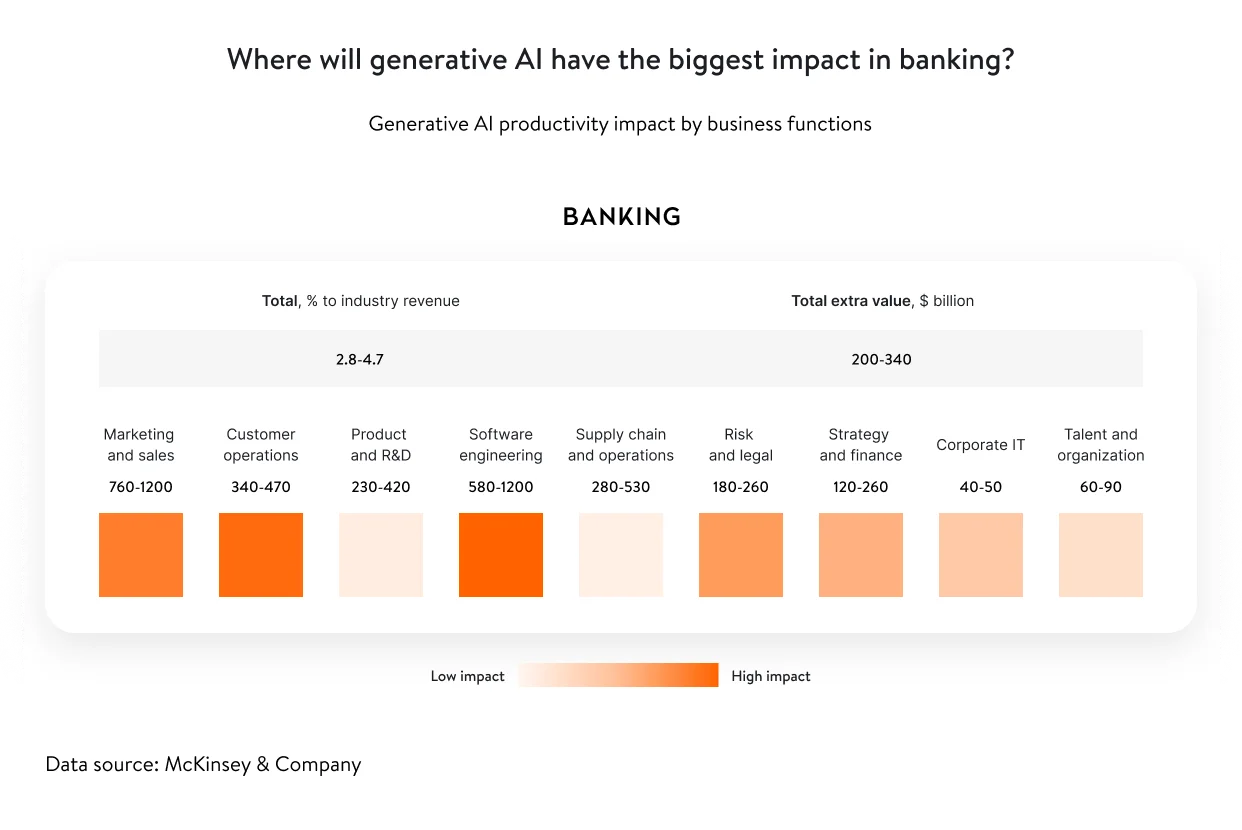

AI technology is set to benefit various business functions of banking. Experts predict that generative AI, in particular, could bring in an additional $200 billion to $340 billion in revenue and cost savings each year for banks, adding from 2.8 to 4.7 percent to the industry’s annual revenue:

This significant boost is mainly because GenAI applications like conversational banking chatbots enhance productivity while saving resources such as human effort, time, and money. In this section, we highlight some practical uses of banking chatbots that make it happen.

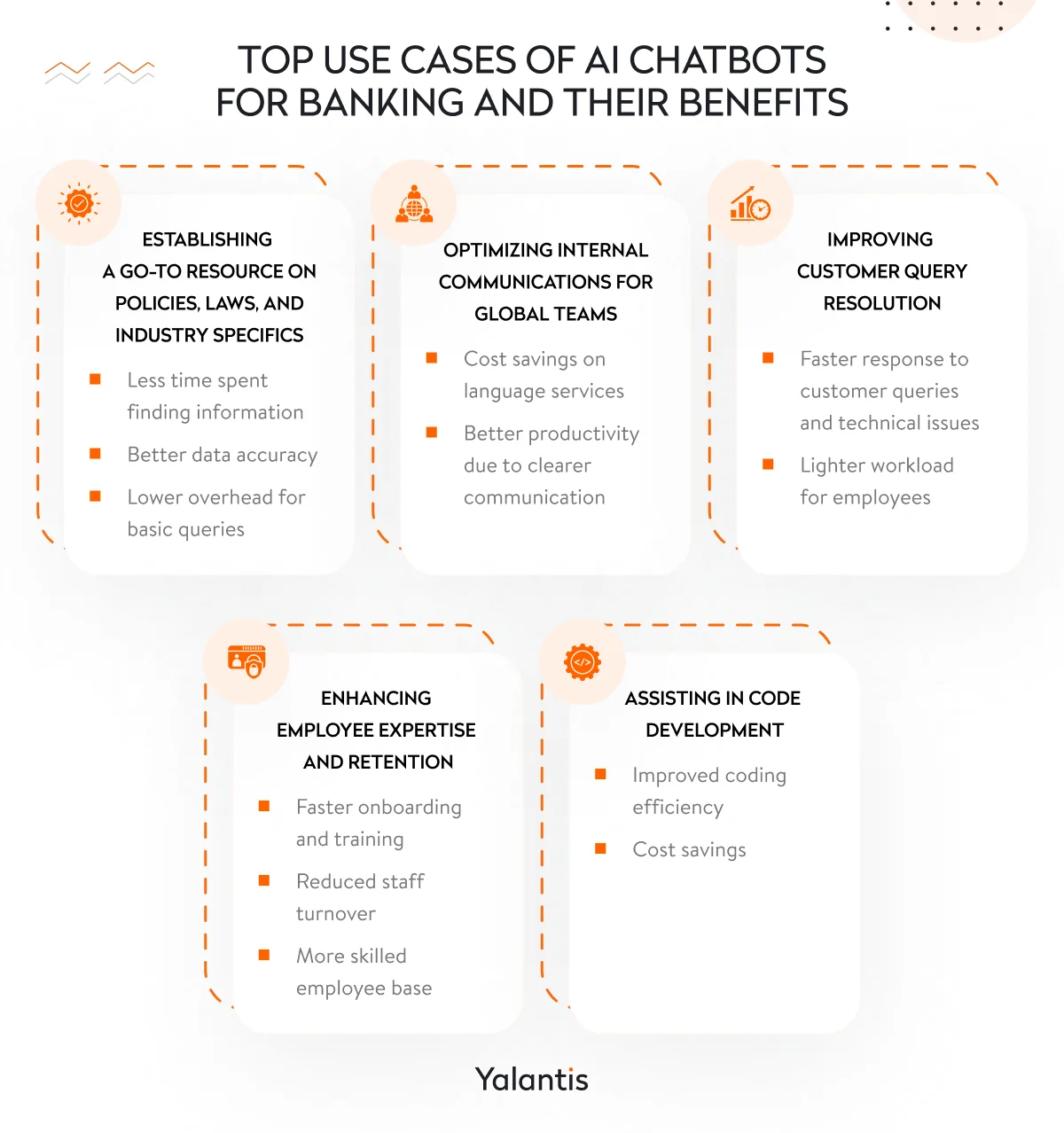

Establishing a go-to resource on current policies, laws, and industry specifics

In the heavily regulated banking sector, clear interpretation and application of policies and procedures is crucial. Bank employees navigate a vast amount of information, spending considerable time sifting through laws, regulations, corporate processes, and other documents to find what they need. This can result in a chain of negative outcomes:

- Manually searching for information consumes significant time

- Overburdened employees have limited time for accuracy checks

- Employee responses to colleagues and customers may contain inaccuracies

An AI chatbot in banking can help turn things around.

A bank chatbot can serve as a go-to resource for employees, providing information on current policies, laws, and industry specifics. Designated employees can update it with the latest regulations or company policies, ensuring it remains up to date.

Business benefits include:

- Fewer hours spent on locating needed information

- Unburdened employees

- Improved data accuracy

- Minimized overhead for basic inquiries

FinTech compliance: What it is, why it matters, and how to address it

Read the postOptimizing internal communications for global teams

Multinational banks often face language barriers that hinder effective communication between global teams. This impacts written and verbal exchanges, leading to misunderstandings and slow decision-making across multiple channels including email, chat, and calls.

In the meantime, a chatbot can boost collaboration, enhance efficiency, and provide a competitive edge through:

- support for real-time written translation and spoken interpretation

- multilingual support

- contextual understanding

- integration with communication tools such as Microsoft Teams, Skype, and Slack

- scaling to accommodate a growing user base

Business benefits include:

- smoother collaboration among teams

- cost savings on language services

- increased productivity through clearer communication

- reduced compliance risks and financial errors through accurate translations

Enhancing employee expertise and retention

In banking, effective onboarding and ongoing training are crucial due to high turnover and complex regulations and internal bank policies. However, banks often face hurdles related to:

- Scattered training resources across disconnected systems

- One-size-fits-all onboarding that doesn’t adapt to roles or skill levels

- Budget and time constraints leading to rushed programs

- Weak employee progress monitoring, delaying gap identification and improvements

- Lack of post-onboarding refresher courses on the latest solutions and policies

A chatbot can streamline these processes by:

- serving as a central resource for human resources data

- guiding new hires through onboarding and tracking their progress

- quizzing, assessing, and suggesting learning materials

- creating personalized learning paths based on strengths and weaknesses

- tracking individual and team progress for human resources and management insights

- providing admin tools for managing employee learning curves

Using an AI chatbot for human resources processes is proving efficient for banks (hr chatbot). For example, Dutch AMRO Bank’s AI virtual assistant helped them slash attrition by 40%, while US SouthState Bank managed to transform summer interns into proficient professionals with their corporate ChatGPT.

Business benefits include:

- quicker onboarding and training of new and existing employees

- reduced staff turnover

- greater employee expertise

Improving customer query resolution

Using chatbots for customer service interactions allows support teams to focus on more complex queries. Chatbots quickly access vast databases to resolve customer issues. This approach offers two valuable scenarios:

- Implementing a smart pre-screening and automatic querying bot to reduce the workload for human agents

- Deploying a self-service bot that retrieves knowledge base information, enabling customers to resolve queries independently, regardless of language or location

For instance, Morgan Stanley’s GPT-4-powered AI assistant helps financial advisors swiftly locate and synthesize answers from an extensive internal knowledge base.

Business benefits include:

- reduced response times for customer queries and technical issues

- decreased employee workload

Assisting in code development

According to McKinsey, generative AI has one of the biggest impacts on software engineering in banking. It’s no wonder, as AI virtual assistants can help by suggesting the next lines of code, akin to how email apps can finish sentences.

This lets software engineers quickly put together a first draft of code, tweak it to their liking, and boost productivity. Wells Fargo and Goldman Sachs are already using generative AI for software development, with Goldman Sachs’ CIO foreseeing a 30% to 40% increase in developer productivity and up to $100 million in savings.

Business benefits include:

- greater coding efficiency

- cost savings

These are some of the most effective applications of chatbots in banking. Need a recap? Here’s a summary of major banking chatbot use cases and their business benefits:

Do any of these use cases resonate with your business needs? If they do, it’s time to consider a banking chatbot development service. In the next sections, we showcase potential options for you to explore. We compare ready-to-use versus custom solutions to help you find the provider that best meets your business requirements.

Overview of banking chatbot examples: Ready-to-use solutions for quick but limited implementation

Before exploring ready-made chatbot solutions, remember that it’s not just about purchasing or subscribing. Your team still needs to prepare for successful integration. For example, you may need to:

- migrate data

- set up backups

- integrate a chatbot into your system

- make sure a product complies with industry-specific security requirements

- implement security controls and mechanisms

- train your staff to use the new chatbot

If you lack the technical expertise in-house, consider relying on Yalantis’ IT consulting services (machine learning consulting services). With hands-on artificial intelligence and machine learning experience, we can ensure you’re well-prepared to navigate complex AI operations. And with the right preparation and support, you and your bank customers can fully leverage the benefits of an off-the-shelf chatbot solution.

Need professional support?

Yalantis will design your AI implementation roadmap and help you implement the solution.

Now, let’s take a look at four real-world chatbot examples within the financial services industry and explore their benefits and drawbacks.

1. Watsonx Assistant from IBM

Watsonx Assistant is a cloud-based conversational AI from IBM that suits various industries, including banking. It allows companies to create AI-powered chatbots, providing quick and accurate answers to customers and empowering customer self-service.

Key functionalities of Watsonx Assistant:

- Customization to align with the brand’s visual identity

- Drag-and-drop interface

- Banking-specific templates and documentation

- Dialog flow templates

- Omnichannel experience

- Integrations with telephony and interactive voice response (IVR) systems

2. KAI from Kasisto

KAI, developed by Kasisto, is a conversational AI platform tailored for the financial services industry. Kasisto’s first generative AI application, KAI Answers, uses the KAI-GPT large language model to empower teams at financial institutions with the knowledge to provide relevant responses to customer inquiries using existing content and information sources.

Key functionalities of KAI:

- Omnichannel delivery

- Multilingual support

- Integrations with additional data sources

- Targeted searching

- Content sorting and pinpointing

- Natural language summaries

- Source referencing

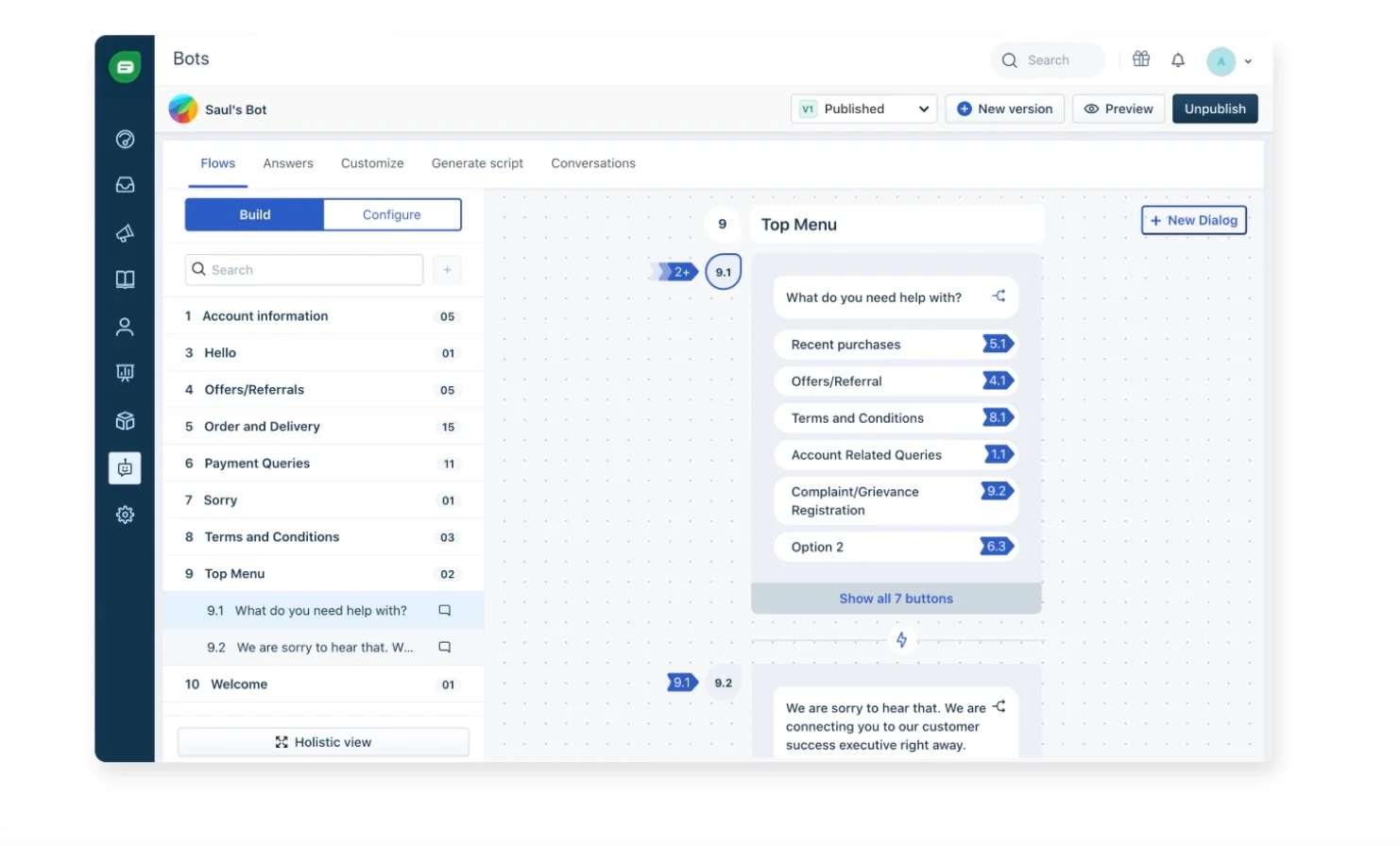

3. Banking chatbot from Freshworks

Customer-facing chatbot software from Freshworks lets banks customize the chatbot to match their branding, language, and messaging guidelines. Freshwork’s chatbot can answer FAQs, provide proactive support, apply for financial products, and resolve suspicious activity.

Key features of Freshworks:

- Multichannel access

- Conversational AI intelligence

- Data privacy and security

- Multilingual capabilities

- Integration with web, mobile, and messaging apps

- Multi-tier data security model

- GDPR and ISO 27001 compliance

These and other ready-made chatbot solutions come with some major perks. For example, they are quicker to implement compared to an in-house custom solution and require lower upfront costs since licensing or subscribing to an off-the-shelf chatbot is less expensive than developing a custom chatbot.

However, it’s crucial to weigh the benefits against the limitations.

Limitations of a ready-to-use AI chatbot for banks

Implementing ready-made chatbots is faster than implementing custom solutions, but they might not always be the best choice due to:

- lack of future flexibility. While ready-made solutions can be used immediately, there’s no guarantee that they’ll always meet the bank’s evolving business needs, forcing additional costs and time to adjust to new solutions later. Such chatbots can also have functionality gaps or redundant features that limit their applicability for many use cases.

- vendor dependence. Relying on the vendor’s product roadmap is restricting. In this case, customizing features will require constant negotiation and be technically challenging.

- security risks. Employing third-party chatbots adds extra cybersecurity and data privacy concerns. For instance, deploying a chatbot in a separate cloud might lead to data leaks, as all requests and data travel between the bank’s environment and the third-party chatbot’s cloud.

- the need for additional technical expertise. Highly customizable chatbot options require a dedicated IT team for implementation, and a bank might lack assured resources. Besides, technical tweaks or updates in chatbot software might disrupt operations, once again necessitating the IT team’s involvement with extra spending.

- additional training. A bank will need to allocate resources for organizing workshops to onboard employees and ensure smooth chatbot adoption.

While you can easily integrate with a third-party AI vendor, this process may involve additional complications, like increased effort and operational delays. However, you can avoid those if you go for a custom chatbot solution.

Why custom chatbots in banking are relevant and cost-efficient

Simply using AI banking chatbots won’t cut it. You have to stay on the cutting edge of AI as it continues to evolve and be able to adapt. Here’s where custom chatbots help. Many organizations are now turning to AI development services to create more sophisticated, tailored chatbot solutions that meet specific industry demands.

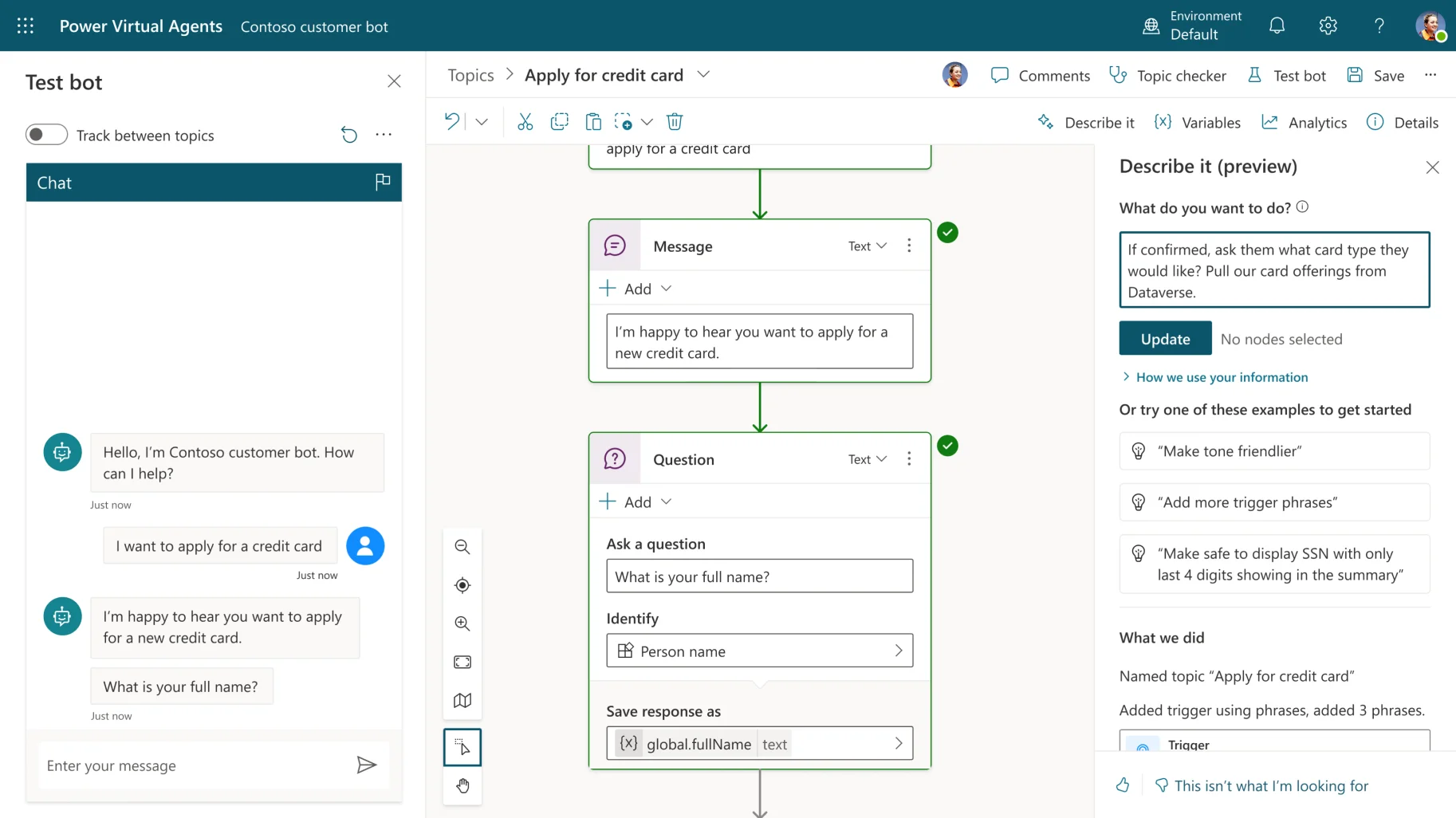

The most effective way to develop a custom chatbot is to fine-tune an existing generative AI model like Open AI’s GPT, which leverages NLP techniques as part of producing high-quality text. Building a custom chatbot unfolds as follows:

- The base model is fine-tuned, customizing conversation flows, domain knowledge, and integrations to suit banking needs.

- Further training fine-tunes the base model’s weights to match the bank’s data and use cases, leveraging the model’s general linguistic capabilities.

- Custom-built banking components, such as security, authentication, and transaction processing, are also integrated into the chatbot system.

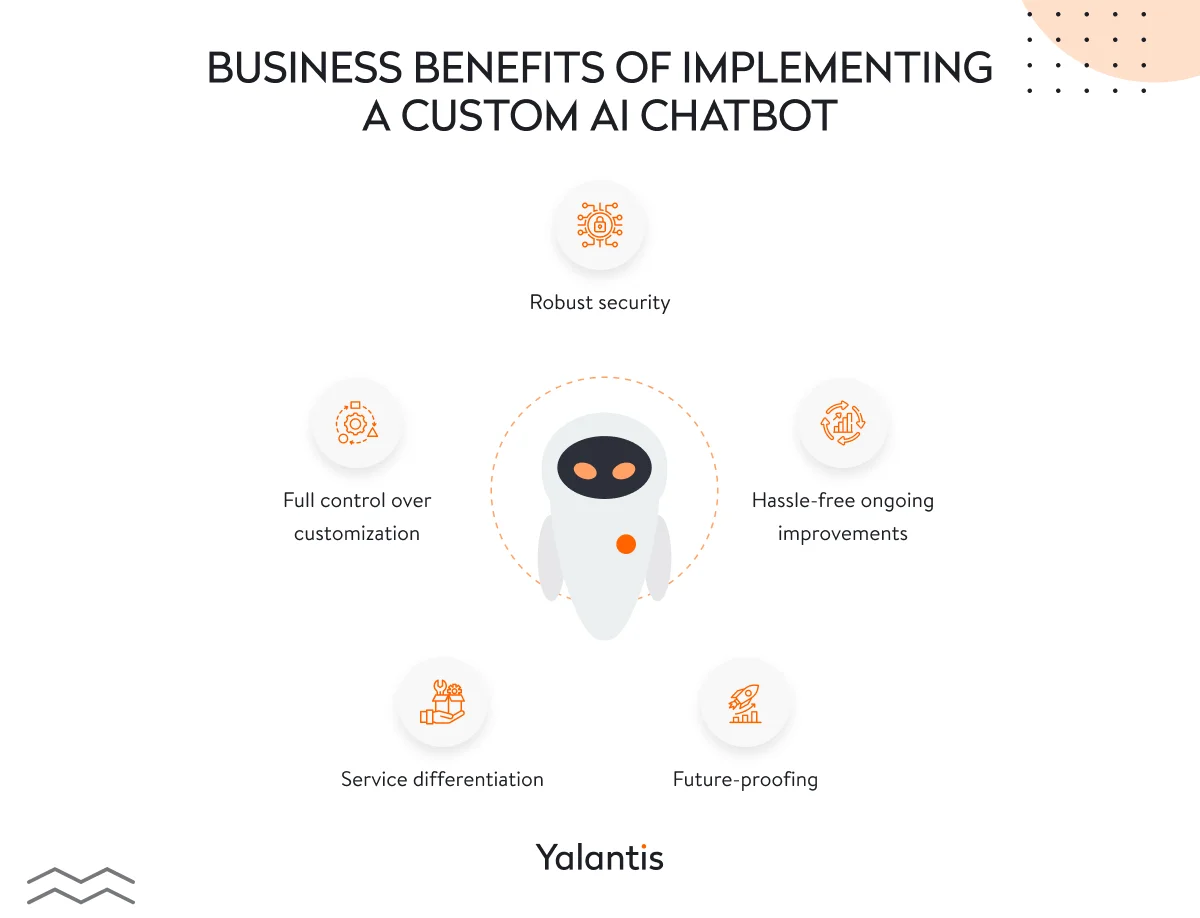

Custom development entails higher upfront investment and a longer implementation time. But for many banks, full control, differentiation, and other benefits outweigh the costs:

- Full control over customization. Banks can fully customize the chatbot’s capabilities, conversations flows, integrations, and features to meet their specific business needs.

- Robust security. Custom development ensures the chatbot is built to meet all security and compliance standards.

- Future-proofing. Custom chatbots allow banks to stay on the cutting edge of AI and conversational interface technologies as they continue to evolve.

- Hassle-free ongoing improvements. Banks can continually enhance the chatbot based on evolving customer needs rather than considering a vendor’s limitations.

- Service differentiation. A unique chatbot experience allows banks to differentiate their customer service offerings from competitors.

We realize that implementing such a solution might seem daunting due to talent shortages, compliance considerations, and integration challenges, all of which can deter banks from in-house development. However, this doesn’t mean they can’t enjoy the benefits of a conversational banking AI chatbot. Outsourcing to a company experienced in the field could be the solution.

Why not explore a conversational AI solution from Yalantis to save you the headache of in-house custom development?

How a chatbot for banking from Yalantis can address your bank’s internal needs

To achieve immediate business efficiency and cost savings when implementing a chatbot in banking, it’s best to start with internal use cases. This allows you to experiment, refine the chatbot technology, and pave the way for more complex use cases in the future.

With know-how in generative AI, deep FinTech expertise, and a cybersecurity focus, Yalantis can help you meet this goal by creating an AI-powered digital assistant similar to ChatGPT that is tailored for internal use. A chatbot includes the following components:

- Data parsing and storage. Using natural language processing, a bot structures and stores extracted information from uploaded documents in a searchable database.

- Robust AI engine. Machine learning models help a bot understand user queries and fetch relevant information from parsed documents and external sources (ai/ml use cases).

- User-friendly interface. Employees can seamlessly interact with a bot via a web app supporting text- and voice-based queries.

- Secure communication. The bot uses a multi-level access system that aligns with employee roles, ensuring secure access for the right staff members.

Get the most from an AI-powered chatbot for your bank

Discover an AI virtual assistant from Yalantis.

With its robust architecture, a chatbot will serve various business needs, such as enhancing employee onboarding and streamlining customer support. In one integration we handled, a bot showed the potential for increasing the productivity of a single customer support agent by up to 20%. Yet, AI chatbots for banking offer many ways of improving business operations.

Yalantis offers comprehensive support for your bank to maximize the benefits of a chatbot solution while implementing necessary security measures. Interested in further exploring this technology? Contact Yalantis and get the best fit for your needs.

Ready-to-use vs custom chatbot: Which is better for your FinTech business? Find out in our free guide.

Download guideFAQ

Should my bank partner with an IT infrastructure company for our chatbot project?

Partnering with an experienced IT infrastructure company is highly recommended. Such a company can provide you with critical services like cloud hosting, security, integrations, and ongoing management to ensure your chatbot’s performance and compliance. In this case, it’s crucial to team up with a software company with extensive AI experience and deep domain expertise.

What technology infrastructure services does my bank need to implement a chatbot?

To support chatbots, ensure your technology infrastructure includes cloud hosting, cybersecurity, integration with core banking systems, and 24/7 monitoring. Partner with an expert IT infrastructure company to assess and implement the required services.

How can an IT infrastructure consulting services provider help with chatbot adoption?

Reliable IT infrastructure consulting service providers can assess your infrastructure, recommend solutions to fill capability gaps, oversee integrations with core banking systems, and manage ongoing infrastructure services. Their expertise ensures your IT systems can smoothly support chatbot technology.