Influence of technology on route management systems

Let’s say you’re a construction company that values customer loyalty and prides yourself on your logistics. You try to design your processes so that no matter what happens, products are delivered to the client on time.

The key factor in the timely delivery of goods is high-quality route management. To find the optimal delivery route, a transportation management system (TMS) must take into account many parameters.

The success of all measures taken to optimize route management can be measured by the reduced cost and time required to deliver the goods. Many transportation management systems use modern technologies like the blockchain and artificial intelligence (AI) to optimize delivery business. These and other technologies enable transportation processes to be fast, accurate, and automated.

At Yalantis, we have experience optimizing route management with transportation management systems. In this article, we share our insights into optimizing route management based on market research and our own software development experience.

The importance of technologies in route management optimization

Let’s think about a local business that produces homemade dairy products. Small and medium-sized companies have the potential to scale, so delivery to local shops, cafes, and restaurants may eventually develop into regional delivery. Then there are no longer 5 to 10 stops per day but a minimum of 40 to 50 per vehicle.

When planning a route for such deliveries, it isn’t enough to simply indicate the destinations. For instance, dairy products must be maintained at a specific temperature and transported as fragile goods.

Many technologies such as AI and the Internet of Things (IoT) can prevent a driver’s route from turning into a nightmare by taking into account traffic jams, weather conditions, and other factors when managing a route.

Find out more info on IoT predictive maintenance in our expert article.

Route management can either improve the overall logistics process or harm order fulfillment by delivery delays and spoilage of transported items of goods. Route management technologies allow a company to:

- Choose the most suitable or closest driver for a route

- Account for the number of intersections and turns on the route

- Avoid crossing lanes when turning left

- Track traffic jams based on the time of day

You may still not be sure if you need big data or AI in route management. To help you make up your mind, we’ve gathered a few more advantages of using technology for route optimization.

1. Reduce costs

Route management software using data analysis and AI can significantly reduce travel times. This, in turn, greatly reduces logistics costs. There are two main parameters that technology can influence to reduce costs: fuel consumption and required maintenance as a factor of time on the road.

2. Help to reassess resource spending

Technology can help determine how many resources a company uses and what resources are actually needed to transport cargo. We will describe in more detail the technology that helps with this below.

3. Determine the most efficient routes

Modern algorithms take into account such external factors as construction and road repairs, traffic jams, and weather conditions. All this data helps to optimize the route for the driver.

4. Increase drivers’ productivity

By leaving complex tasks to algorithms, you can allocate the time saved to other business tasks. Since optimized route management means drivers spend less time on the road per order, logistics efficiency is increased as drivers can fulfill more orders.

Route management may need automated optimization. For example, technology can improve a route in terms of optimizing the overall route length, truck travel time, unloading time, and loading time. But before we look at specific technologies, let’s start with the main type of logistics software that help in route management optimization.

TMS as basic logistics software for route optimization

The need for an automated system that will track, regulate, and control logistics processes has led to the emergence of transportation management systems. A TMS minimizes the impact of human error and fatigue and reduces the time spent on planning and finding the causes of errors.

This is how a TMS works:

- The system automatically distributes deliveries among a fleet of vehicles based on data such as occupancy and transport opportunities.

- Considering cargo parameters, the system chooses the most suitable mode of transport for each load.

- The TMS then composes the optimal route, taking into account road situations.

- The TMS collects data on fuel consumption and other costs and offers suggestions for optimization.

- Tracking tools allow you to control the movement of vehicles and predict delivery times.

When building a route, a TMS takes into account criteria specified by a user, which can include:

- vehicle assignments

- maximum number of unloading and loading stops

- maximum driving time and route length without return

- optimization of delivery within time windows, especially if some customers charge late delivery penalties

- minimizing vehicle refueling

Now that we have figured out how technology optimizes route management and what the role of a TMS is in the optimization, it’s time to find out what technologies are available.

Technologies for route management optimization

Innovations in route management optimization include solutions that go beyond conventional automation. To improve the fulfillment of logistics orders, artificial intelligence technologies, IoT devices, and big data analytics are being introduced into logistics tools.

- IoT devices connect the digital and physical worlds. Such devices provide significant assistance in tracking vehicles, reduce fuel costs thanks to route management optimization, control driving through traffic control systems, find parking spots, and notify clients about the status of cargo being transported. For transporting dairy products and other perishable goods, for instance, IoT technology allows you to install a special tracker to collect up-to-date information about the temperature and humidity inside a container.

- Big data analysis. Services in which big data analysis is used are capable of collecting and processing a large amount of information and, based on it, making predictions and building connections between events in logistics chains. By integrating big data services into route optimization systems, businesses can enhance the accuracy of predictions, adjust strategies based on weather patterns, order trends, and market dynamics, and improve overall operational efficiency. With the help of big data analysis, route optimization algorithms can be optimized to correctly predict the speed with which customers place orders on a given day and market trends. Information on the weather, order trends, and even the state of the economy can be collected to predict future orders and prepare an algorithm for order processing. Big data can also be used to determine the most efficient vehicle speed and the amount of fuel needed.

- Artificial intelligence solutions help you analyze existing routes, identify bottlenecks in the road trip planning process, and take the best route, reducing warehousing and shipping costs. AI-powered data processing tools help capture the details of moving goods in real time and accurately estimate delivery times.

- Blockchain technology in logistics helps ensure the accuracy and truthfulness of records on performance, service history, and various other vehicle metrics. All data is recorded in a distributed ledger record of multiple transactions. It reflects who transferred to whom, when and what amount of assets. This is called a block. Since this block can’t be deleted or changed, this is guaranteeing transparency of all processes.

When we talk about optimizing route management, it’s worth considering the variety of route types to choose the most suitable technological solutions. In this section, we give two simplified examples to illustrate which solutions are most appropriate when planning different types of routes.

1. Simple route with several stops

A simple route with several stops can be used as the basis for any planning. In this case, you enter the start and end points of the route, create a route manually, and have the platform optimize it if possible. Simple TMS solutions with predictive analytics capabilities are suitable for such routes.

2. Complex route with multiple loading and delivery points

Delivery services usually plan these types of routes, which include managing complex shipments with multiple loading and delivery points. To plan a route with several stops, a TMS creates a separate order for each loading and delivery address, specifies the start and end points to save the route in the system and then optimize it. A data analytics service provider can offer essential support in refining the data inputs for optimization. A service with AI, big data analytics, and blockchain technology is indispensable for this matter. Without these technologies, a system can’t calculate the exact delivery times. But with optimized route planning, loading times at each stop, delivery time frames, and fuel consumption are taken into consideration.

Using commercially available route management software

One of the easiest ways to automate route planning and management is to purchase ready-to-use software. You can quickly set up commercially available route optimization software and configure it to meet your needs. The market offers various solutions for every need and budget. Below, we list some popular ones.

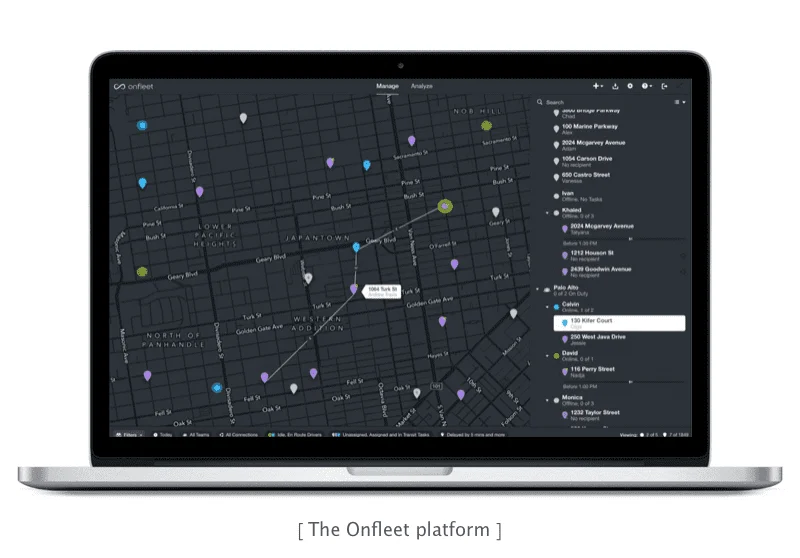

Onfleet

Onfleet is a SaaS product for delivery management and last-mile delivery that supplies companies with both a ready-to-use standalone platform and an API that can be integrated into a company’s own system.

This software is suitable for small fleets and startups looking to streamline delivery operations. Onfleet can be used to automate delivery routines, manage inventory, and generate delivery reports.

YaCu

YaCu is another transport monitoring system that has route optimization functionality and focuses on delivery management. It automates delivery routines and offers extra services like delivery analytics and vehicle monitoring.

There are a few more functionalities that YaCu has:

- Creation and assignment of requests for drivers

- Generation of links with vehicle locations for clients

- Auction for contractors

- Wage calculations for drivers and managers

- Driver prioritization by driving skills

- Integration with online cash registers

YaCu will be useful for:

- Transport companies

- Courier services

- Distributors

- Wholesalers

- Meal/water delivery services

- Online retailers

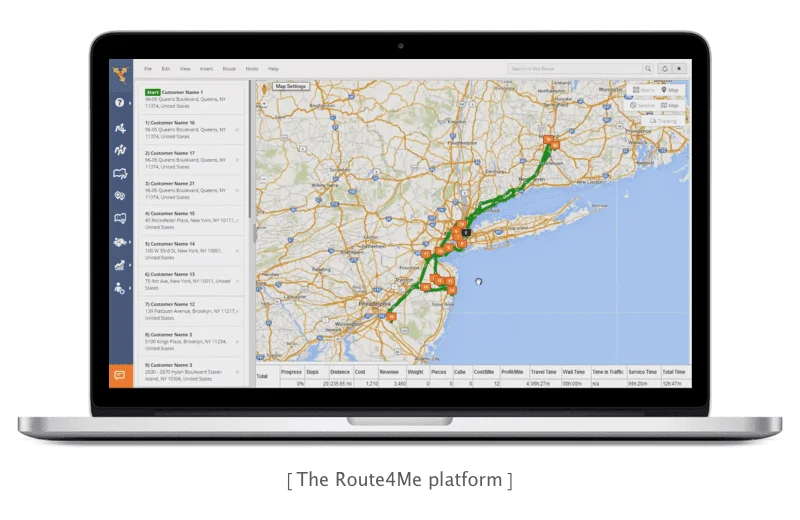

Route4Me

Route4Me is a user-friendly SaaS solution that offers route planning functionality, in-app voice-guided navigation, scheduled customer notifications, delivery analytics, and a customer relationship management system. Route4Me is more customizable than other options and is used by businesses in the transportation, food delivery, healthcare, and construction industries.

This solution is good for your company if you:

- visit more than 10 addresses/destinations per day

- plan to cut logistics spending by up to 30 percent

- need to access planned routes on a smartphone, at the office, or at home

Ready-made SaaS solutions have several constraints you need to consider.

First, it may take time for the software provider or development team to integrate route planning software with your logistics system. Also, there are no guarantees the solution will cover all your business needs and be able to build routes with custom rules.

On the contrary, you can invest more time and money at the beginning and build the functionality you need from scratch. This will eventually bring you more flexibility for application updates and allow you to easily adjust your software to your business needs and your company’s business processes.

Here is some software functionality to look for when choosing or building a route management optimization solution:

- Real-time traffic analysis. An estimated time of arrival function based on dynamic real-time data helps to save logistics costs and ensure on-time delivery.

- Dynamic route planning. When order data changes during delivery, the technologies within a route management optimization solution must be able to modify the current route and create a new route for the driver.

- Accurate geocoding. Almost every route management optimization software has a geocoder, which assigns coordinates to records with physical or IP addresses. However, it’s worth paying attention to the accuracy of converting latitude and longitude coordinates to specific points on the map. Understanding ambiguous addresses and local context significantly impacts overall route management optimization.

- Bypassing restrictions in the delivery of goods in different categories. Sending two different types of goods, such as electronics and perishable goods, is not possible without software that considers vehicle restrictions, such as containers with temperature controllers, and special fasteners for fragile goods. With this data, route management can be improved and optimized.

Solutions that intelligently plan routes and thereby increase logistics efficiency are becoming more and more complex. This allows businesses to choose transportation management services that precisely suit their needs. Below, we talk about the functionality of ready-made APIs for route optimization.

Integrating ready-to-use APIs

To build route management functionality, you need rich information about traffic situations, maps, and points of interest. Some big players on the mapping tools market provide convenient APIs with all the required information. You can easily integrate these APIs into your existing delivery management software. Let’s have a look at some of the top tools that provide APIs for route optimization.

Routes on the Google Maps Platform

The cloud-based Google Maps Platform has gained a strong reputation and is now used by leading logistics companies like FedEx for logistics automation. We used Google Maps to enable location awareness and route planning in Re-turnz, a unique solution for reverse logistics.

Routes is one of three products in the Google Maps Platform. It consists of several APIs that help you build and optimize routes based on traffic information:

- The Directions API is used for building the optimal route between locations by various modes of transportation. This tool can build multi-stop trips, taking into consideration traffic, the number of turns, and restrictions you set (avoids tolls, highways, and ferries, for instance).

- The Roads API first identifies the most likely road a vehicle is traveling by tracking multiple GPS coordinates. Then it returns the closest road segment for each point and information about speed limits on each road segment.

- The Distance Matrix API returns the travel distance (in imperial or metric units) and travel time as calculated by the Directions API.

Google uses a pay-as-you-go pricing model, and the price for each API depends on the number of monthly queries.

Take the Distance API as an example. Google Cloud calculates the price based on the number and type of requests. There are two types of requests: basic, if a route consists of ten or fewer waypoints, and advanced, when there are more than ten waypoints and the algorithm takes traffic information into consideration.

With up to 100,000 basic requests per month, you’ll pay $2 for every 1000 requests. With 100,001 to 300,000 advanced requests, you’ll pay $1.60 per 1000 requests, and with 300,001 to 500,000 requests, you’ll pay $1.25 per thousand. Prices for larger volumes are negotiated with Google Cloud sales representatives.

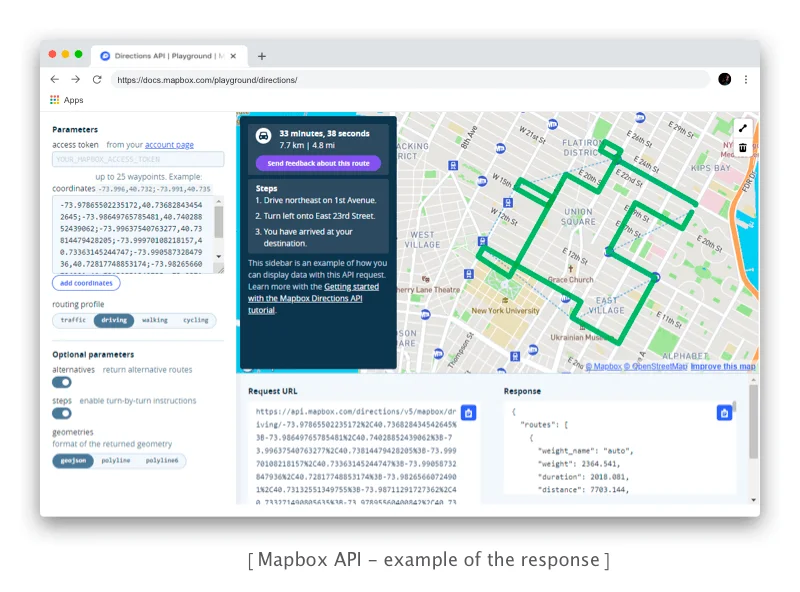

Mapbox

Mapbox is a popular alternative to Google Maps that has wide functionality represented by multiple APIs for different needs. Mapbox also presents a set of solutions for logistics companies. In our previous article, we compared Google Maps and Mapbox and discussed the pros and cons of both tools.

Here, we pay attention to the Mapbox Navigation service, which offers a solution for routing and navigation powered by real-time traffic information. In particular, Mapbox Navigation has a Directions API that provides users with the following functionality:

- Calculating optimal routes for driving, cycling, or walking, taking traffic and incident information into consideration (optionally and only for listed regions)

- Turn-by-turn navigation

- Creating routes with up to 25 waypoints without traffic consideration, or with up to three waypoints based on traffic data

- Excluding tolls, motorways, or ferries when building a route

- Choosing desired arrival and departure times (currently in public beta)

There’s also the Isochrone API, which shows areas that are reachable within a specified amount of time from a chosen location.

Mapbox uses a pay-as-you-go pricing model but offers a free tier. Up to 100,000 requests per month are free, after which the price is $2 per 1000 requests if you don’t exceed 500,000 requests.

- HERE API

The Routing API by HERE is a good solution for web or mobile applications with a complex architecture. It provides a route optimization solution and allows you to calculate routes for multiple waypoints, edit routes, update past routes, and calculate a matrix of routes, taking into consideration various destinations and starting points.

Routing API functionalities include:

- automatic accounting for real-time traffic, incidents, public transit timetables and historical information;

- specifying parameters, such as speed, ascent, descent and auxiliary to calculate fuel or energy consumption for your vehicles on a given route;

- accurate matching GPS traces to the HERE road network to get the most probable route your moving assets have been on.

Another service worth mentioning is HERE Fleet Telematics, which was built specifically for the needs of logistics companies.

HERE Fleet Telematics functionalities include:

- Geofencing, route building, and matching capabilities

- Calculation of tolls

- Information about height and slope values, curvature, speed limits, and traffic lights

The Tour Planning REST API, which is part of the Fleet Telematics solution, is responsible for optimizing multi-vehicle routes.

It helps logistics managers solve variations of the vehicle routing problem, taking into account constraints like capacity, time windows, maximum travel time, and driver breaks.

HERE has several plans:

- Freemium. The number of monthly active users can’t exceed 5,000 and the number of overall transactions is limited to 250,000. Otherwise, you need to pay $1 for every 1000 additional transactions. Also, the Freemium plan offers 5 GB of database storage and allows you to transfer up to 2.5 GB of data.

- Add-on. This plan extends the limits of the reemium plan.

- Pro plan. You get HERE Data Layers for two city map tiles with data refresh, customer support via HERE’s support portal, and an AI-powered Live Sense SDK.

Building a route planning algorithm from scratch

Building a route planning algorithm from scratch is another option that takes significant development effort but provides exceptional customization, allowing you to set custom rules and build routes that fully cover your needs. Below, we give an example of a simple route planning algorithm that finds the shortest possible route from point A to point B.

Machine learning for delivery route planning

Machine learning (ML) is one way to create and optimize routes. There are different ways to use machine learning services along with ready-made solutions for planning routes. We’ll take a look at a relatively new ML algorithm called ant colony optimization. The idea is that a machine learning algorithm mimics the behavior of ants in search of the shortest route from their colony to a food source. Here’s how it works:

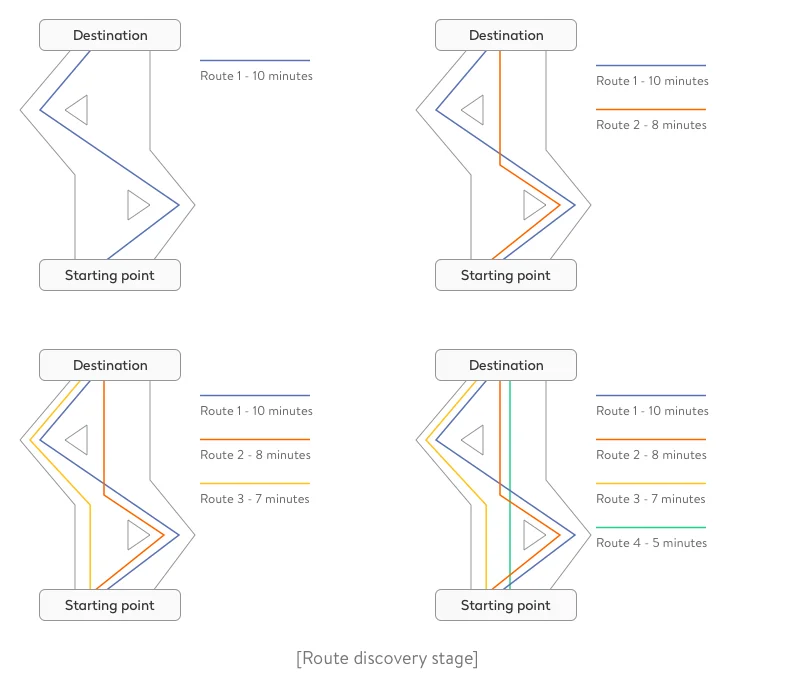

1. During the first calculation, the algorithm finds any possible route to the destination. Next, it goes back to the starting point and searches for other routes.

2. After discovering all possible routes, the algorithm compares their efficiency by seeing how many times they can be covered in a given time frame (for example, in 10 minutes).

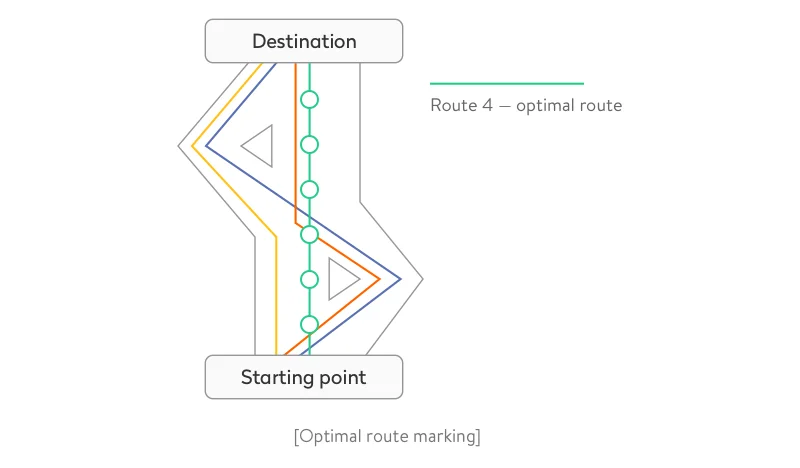

3. In our example, the algorithm will eventually highlight Route 4 as the optimal route, as it can be covered the most times in 10 minutes.

If new variations of the same route (or entirely new routes) appear, the algorithm will consider them in recalculating the optimal route. Such a machine learning algorithm is good not only for planning routes but for optimizing couriers’ delivery schedules.

Using state-of-the-art route optimization software is the best way for any business to efficiently deliver on time. Transportation management systems help managers and logistics companies plan routes, adjust delivery points, track drivers in real time, and edit routes manually. The results will be increased operational efficiency, decreased fleet idle time, and improved overall delivery performance.

If you’re thinking about implementing a modern TMS as a route optimization solution, you can rely on Yalantis. With expertise creating logistics tracking software and, in particular, creating algorithms for route modeling, we’ll find the most cost-effective solution that brings valuable results.

Rate this article

4.5/5.0

based on 106 reviews