For FinTechs, innovation alone won’t sustain success. A core pillar of success is regulatory compliance. Considering it from the early stages of developing your FinTech solution protects your company from legal risks, builds trust with customers, and drives business growth.

Meanwhile, non-compliance can severely impact a company’s finances and reputation. To put this into perspective, in 2022, over 60% of FinTech companies faced fines exceeding $250,000.

To spotlight the importance of FinTech compliance, we teamed up with Jaclyn Schoof, Senior Technical Program Manager at HashiCorp, for a webinar on FinTech priorities. In this article, we share key moments of the webinar along with our insights, a helpful checklist, and expert tips.

Read on to discover:

- What FinTech compliance is and why it protects long-term growth

- The real costs of non-compliance

- Why compliance is actually an innovation catalyst for engineers, not an obstacle

- Real-life strategies for building compliant solutions

- An essential FinTech compliance checklist designed by Yalantis experts

Compliance in FinTech: What it is and why it matters

To establish trust with customers, avoid fines, and maintain operational stability, FinTech companies must follow rules set by government authorities and industry bodies.

Let’s break down the concept of compliance and cover a few key questions.

What is FinTech compliance?

In a nutshell, compliance is a set of processes and procedures that companies must follow to adhere to FinTech industry laws and regulations. By doing so, FinTech businesses:

- demonstrate their commitment to secure data storage and use

- assure end users and industry bodies that they will handle sensitive information responsibly

- safeguard themselves from significant fines and audits

Key procedures to ensure compliance in FinTech include anti-money laundering (AML), fraud prevention, and know your customer (KYC). We explore the details of each later in this article.

Who dictates the rules? US federal agencies that regulate FinTech companies

Federal regulators oversee banking, consumer protection, AML, sanctions, and trading to encourage responsible FinTech innovation and manage risks.

In the United States, four primary federal regulators oversee the banking industry, including FinTech companies that provide banking services:

- Federal Deposit Insurance Corporation (FDIC)

- Office of the Comptroller of the Currency (OCC)

- Federal Reserve Board (FRB)

- National Credit Union Administration (NCUA)

Other US federal agencies oversee the impact of FinTech:

- The Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Industry Regulatory Authority (FINRA) protect investors from FinTech scams and enforce federal laws concerning FinTech-related securities and commodity trading.

- The Consumer Financial Protection Bureau (CFPB) enforces consumer protection laws and supervises FinTech lending and payments.

- The Federal Trade Commission (FTC) safeguards consumers from unfair practices by non-bank FinTech companies.

- The Financial Crimes Enforcement Network (FinCEN) collects financial intelligence to combat money laundering and terrorist financing.

- The Office of Foreign Assets Control (OFAC) administers economic and trade sanctions affecting FinTechs.

Why is FinTech compliance important for businesses?

FinTech compliance is increasingly vital due to the fast growth of FinTech adoption and the associated risks.

E&Y’s global FinTech report, based on interviews with over 27,000 consumers across 27 markets, found that consumer FinTech adoption doubled from 33% in 2017 to 64% in 2019 and continues to climb. What’s driving this growth? Our growing dependence on technology, vast data pools, complex networks of financial institutions, and cost-cutting IT solutions like process automation software.

Growing use of FinTech products has reshaped the industry and regulatory landscape. As a result, these processes are now critical for FinTech companies:

- Addressing expanding risks to consumers, businesses, and financial stability. These include risks related to data privacy, security, and money laundering.

- Adapting to regulator intervention. As regulators step in to mitigate these risks, they establish new rules and guidance. For example, companies must update their AML measures to account for emerging FinTech channels like cryptocurrency exchanges.

- Ensuring technological compliance. FinTech businesses must integrate compliance procedures into their solutions to meet regulatory requirements. This guarantees a secure environment for end users and effective risk management.

Discover FinTech solutions to secure businesses and customers from fraud, data breaches, and other risks

Explore secure solutionsDiscover the link between the rise in FinTech adoption, associated risks, and regulatory responses:

In the meantime, addressing regulatory responses ensures proactive compliance. This benefits both a company and their customers by:

- preventing legal issues

- safeguarding customer data

- building trust

- maintaining the integrity of the financial system

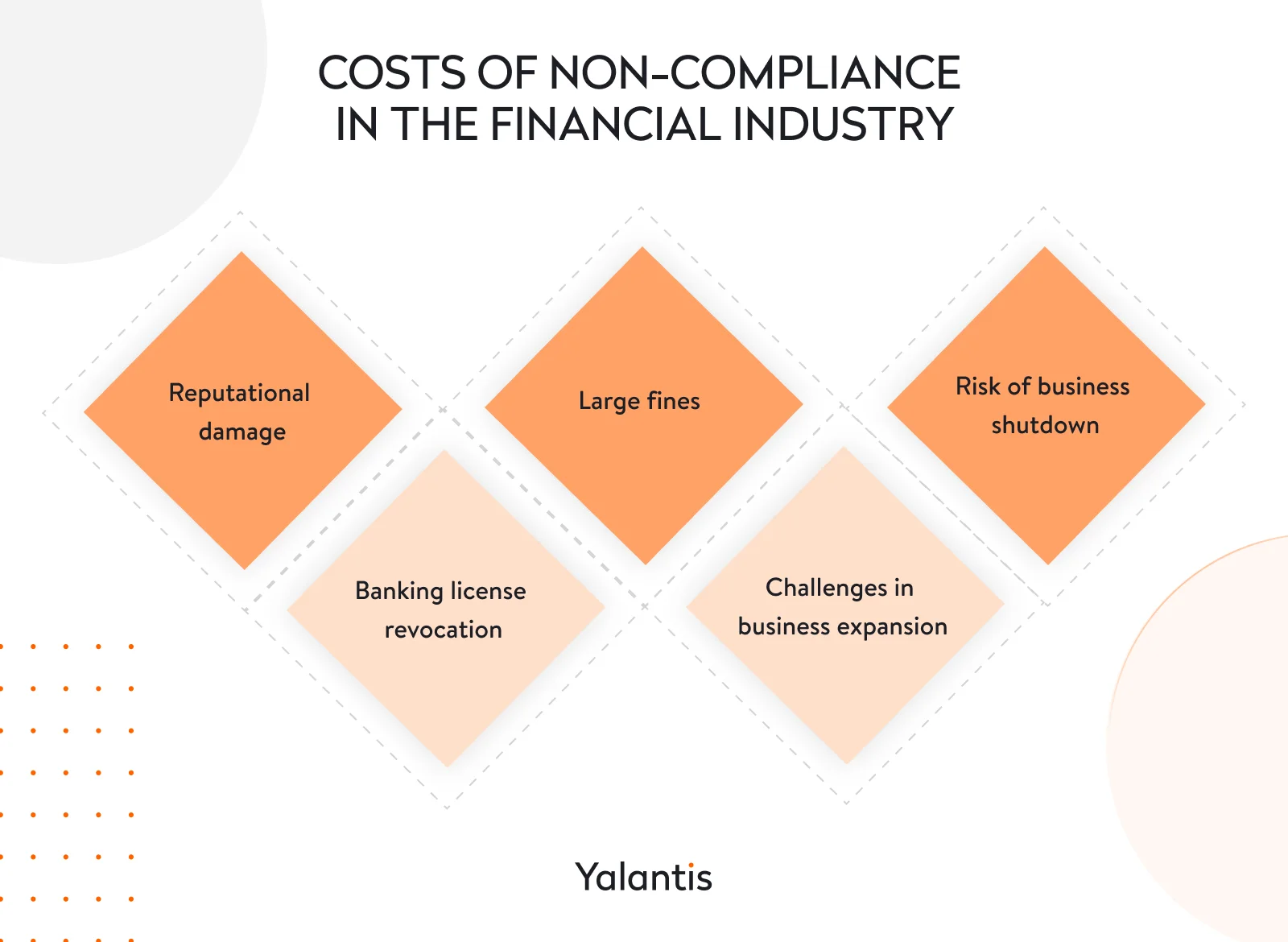

On the other hand, non-compliance can result in financial losses, reputational damage, business expansion challenges, and more. Let’s delve into these potential costs.

Severe consequences of non-compliance in the financial industry: Real-life cases

To start with, the financial harm from non-compliance can be staggering. A notable case is the Consumer Financial Protection Bureau imposing a $3.7 billion penalty on Wells Fargo for illegal practices that caused many customers to lose their homes and vehicles. This marks the largest fine ever imposed by the CFPB on a single financial institution.

And this isn’t an isolated incident.

Take a look at other real-world cases that illustrate the serious consequences of non-compliance:

- Reputational damage. The FTC fined Equifax $575 million in 2019 for a data breach that exposed the personal information of nearly 148 million Americans. This breach raised compliance concerns and led to a 35 percent decline in the company’s stock price.

- Hefty fines. In 2020 alone, banks were fined $14.2 billion, with US banks being the subject of 78 percent of these fines. US banks have overall paid a staggering $243 billion in fines since 2008.

- Risk of business shutdown. In 2021, the financial regulator BaFin fined German online bank N26 $5 million for weak money laundering controls. Later that year, the company was forced to close its business in the US, where it served 500,000 clients.

- Banking license revocation. In 2023, bank–FinTech partnerships and banking-as-a-service providers face stricter enforcement and regulation. Banks are holding their FinTech partners to high compliance standards and are offboarding those that don’t meet them.

- Business expansion challenges. As of 2023, the digital bank Revolut is pursuing a UK banking license to broaden its services. However, it’s pending approval from the Bank of England. UK regulators have raised concerns regarding Revolut’s crypto trading unit and its approach to KYC procedures. These concerns have been prompted by the company’s auditor expressing doubts about potential revenue misstatements.

To avoid these risks, it’s crucial to follow FinTech regulatory compliance measures. The engineering teams that develop your solution play a key role in this process. They enhance your product with innovations that end users want, all while navigating potential regulatory hurdles.

In this case, balancing innovation in FinTech and compliance can be a challenging task, but it’s not impossible.

Compliance in engineering for FinTech success: How to find a balance between compliance and innovation?

Balancing compliance and engineering can be challenging due to their distinct goals:

- Compliance aims to minimize legal risks and safeguard the company’s reputation and stability.

- Engineering, on the other hand, prioritizes rapid product development for business growth and competitiveness.

These differences can sometimes create friction, as compliance FinTech teams favor thorough processes, which may conflict with the engineering team’s need for speed and agility. However, aligning the priorities of both teams benefits the business and its customers. As Jaclyn Schoof, Senior Technical Program Manager at HashiCorp, explains:

“Building good relationships between the different teams gets our customers what they need and makes us go faster down the line.”

Jaclyn Schoof, Senior Technical Program Manager at HashiCorp

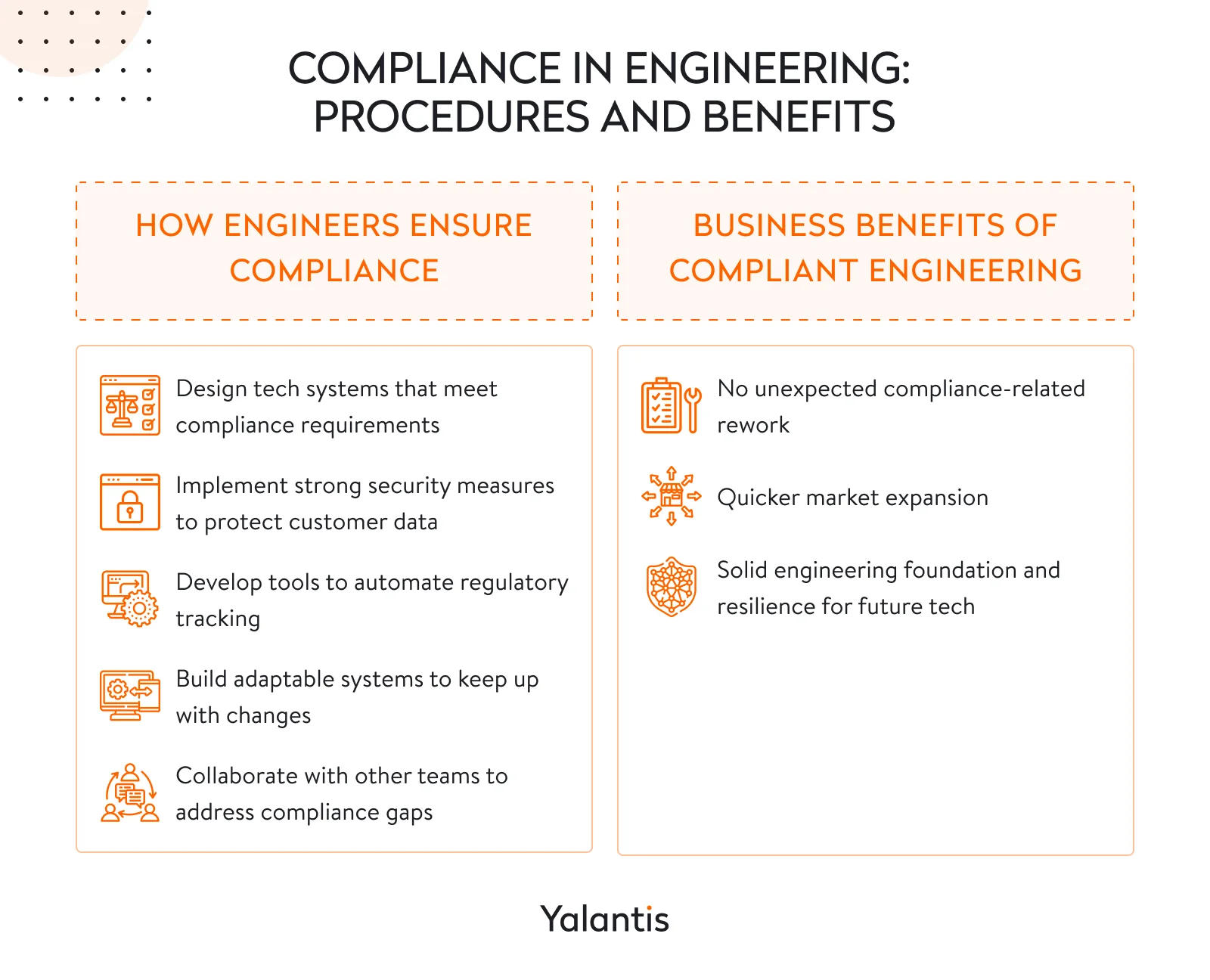

A key thing to understand here is that compliance teams set the rules, but it’s engineering teams who implement them. Engineers do this by:

- creating technological systems and software that meet compliance requirements like transaction monitoring

- implementing strong security measures, encryption, and access controls to safeguard customer data

- developing systems and tools to automate tracking of regulatory changes, which aids compliance teams

- building adaptable systems to keep up with changing requirements

- collaborating with other teams to spot and fix compliance gaps

All of this, in turn, benefits the entire organization, with businesses gaining significant advantages when their engineering teams prioritize compliance. By integrating AI development services, organizations can further bridge the gap between compliance and engineering, ensuring seamless adherence to regulations while maintaining innovation. Let’s explore these benefits.

Benefits businesses get from engineering with compliance in mind

Say your engineering team makes compliance a top priority from the start and works closely with FinTech risk and compliance teams. What benefits does this approach offer, beyond profitability and responsible innovation within known boundaries? Much more than you might think:

- No unexpected compliance-related changes. Prioritizing compliance up front helps reduce technical debt — the cost of future rework resulting from taking shortcuts in the past. This approach avoids the need to rework or rebuild a system to meet compliance requirements, resulting in quicker product launches.

- Faster expansion to new markets. Thinking ahead about expansion into new regions — specifically, requirements for data collection, storage, and security in other regions — allows for the creation of user-friendly apps that support growth. For instance, considering different date formats (US and elsewhere) in advance can save time and resources when working on expanding a solution.

- Solid engineering foundation to withstand future challenges. Compliance brings technical challenges that inspire innovation. Businesses that work with engineering teams capable of delivering compliant solutions can quickly and safely adopt emerging technologies like the blockchain and AI. For instance, they can implement a blockchain for secure transaction records to meet regulatory requirements.

Now that you grasp the importance of engineering teams in addressing compliance, it’s time to explore the specifics of building compliance-focused solutions.

How to build compliant FinTech solutions: Proven tips from industry players

There’s no one-size-fits-all formula for creating compliant FinTech solutions. Yet, some key principles guide the process. Take, for instance, this valuable advice from Jaclyn Schoof:

“The best approach is gathering product business and compliance requirements up front. Once you get those signoffs, document and curate them somewhere so you know what you’re going to be delivering.”

Jaclyn Schoof, Senior Technical Program Manager at HashiCorp

We stand by Jaclyn’s approach and understand the importance of compliant software development from the start. At Yalantis, we have a well-established approach to engineering with compliance in mind.

To gain a deeper understanding of what it takes to build compliant FinTech products, you can refer to our work process. When developing compliant solutions, we:

- Integrate compliance from the start. We address all compliance requirements up front and extend them to design and architecture. By incorporating compliance into the discovery stage, we identify and resolve potential compliance issues early. This prevents delays and obstacles in later development.

- Understand the regulatory landscape. Our architects and analysts keep tabs on FinTech compliance regulations, laws, and security standards like the GDPR and ISO standards to understand the boundaries we have to work within.

- Validate requirements. We engage our compliance experts to monitor and meet service level agreements (SLAs). We then validate all compliance requirements with the client to be on the same page.

- Design compliant architecture. Compliance shapes our client’s solution architecture. This involves integrating with region-permissible third-party services, adapting to region-specific data collection and storage policies, and implementing mandated security measures. For example, if standards dictate data storage in specific countries like the US or India, we incorporate these requirements into our architectural plans.

- Build in flexibility to avoid risks. We design our systems to be easily adaptable to changing industry circumstances, client requirements, and end-user preferences. Whether it’s the ability to switch between cloud providers or alter data storage strategies, by ensuring architectural flexibility and leaving room for improvement, we mitigate around 90% of potential risks our clients may face while navigating a complex regulatory landscape.

- Adapt to regulatory changes. When we start working with a client, we commit to compliance. If new requirements emerge, we’re ready to outline a step-by-step plan for implementing corresponding changes as soon as possible and according to our clients’ SLAs.

- Create scalable solutions. We build our applications with scalability in mind, including for clients planning to enter new markets. When it comes to existing products, our strategy involves duplicating code and deploying it in another region with modifications required by new business processes. In all cases, we make sure to comply with regulations and laws of the target market.

Read also: Security best practices for web and mobile app development

The bottom line is that we determine regulatory requirements in advance, customize our systems accordingly, and remain adaptable to regulatory changes.

Now that we have discussed the business benefits of compliance with industry requirements, it’s crucial to explore the actual process of ensuring compliance. Our FinTech compliance checklist will guide you through it.

Mandatory compliance practices for the financial industry: FinTech compliance checklist by Yalantis

Yalantis’ six-step checklist is based on our experience providing FinTech solutions to a diverse range of companies, from small businesses to large American neobanks. It highlights crucial practices to safeguard both your business and your customers:

Let’s go through each step.

-

Step #1: Verify customer identities via know your customer (KYC) and know your business (KYB) procedures

KYC and KYB procedures help to confirm customer identities and prevent fraudulent activities. They involve collecting and validating customer information, including first and last name, email, date of birth, social security number (SSN), address, device status, and more.

Benefits of KYC and KYB procedures

- Minimize fraud by detecting and preventing the use of fake identities for account opening, transactions, or loan applications

- Implement advanced risk management to identify high-risk customers and businesses, allowing for additional checks to deter fraud

- Enable quick action to prevent fraud in its initial stages

- Ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations

One of the KYC/KYB-based procedures Yalantis follows when developing a FinTech solution includes a two-stage process to verify customer identities:

- The first stage involves document verification using the Jumio identity verification tool.

- The second stage is additional verification of documents and personal data entered with the Socure tool, a predictive analytics platform for digital identity verification.

See how KYC/KYB functionality helped an investment bank with AML compliance and fraud prevention.

Read case study-

Step #2: Monitor transactions via anti-money laundering (AML) programs

FinTech AML compliance refers to the steps FinTech companies take to adhere to anti-money laundering (AML) rules. These rules aim to prevent criminals from exploiting the financial system for money laundering. AML compliance involves due diligence, fraud prevention, and timely corrective actions when necessary. This entails a dual approach:

- Establishing robust business processes. Rule-based systems to monitor behavior make it challenging for fraudsters to launder money.

- Real-time monitoring and investigation. In case suspicious transactions do occur, strategies to maintain compliance include:

- using off-the-shelf tools to verify the legitimacy of transaction senders

- implementing a suite of data dashboards and tools for real-time transaction flow monitoring

- identifying potentially fraudulent patterns and reacting to them in real time

- risk and fraud specialists taking necessary steps, including account blocking, transaction reversal, and legal actions when needed

- regularly updating AML processes to adapt to changing regulatory requirements and emerging fraud tactics

For instance, we use the ComplyAdvantage risk and fraud detection tool to monitor transactions. Additionally, tools like Power BI based on business intelligence (BI) and data engineering assist in transaction analysis and verification. They help to identify fraudulent cases that automated tools might overlook and offer the benefit of manual review for risk and fraud specialists.

-

Step #3: Protect personally identifiable information (PII)

Crucial practices for safeguarding PII involve collecting only essential information necessary for the task, using robust protection mechanisms like encryption and security monitoring, and having a plan in place for responding to data breaches.

Additionally, it’s important to take steps to prevent PII leaks within the development team. For example, at Yalantis, we follow these procedures:

- Routine security checks. Regularly audit applications to identify and fix any vulnerabilities that could lead to PII exposure.

- Establishing clear policies. Define precise rules for role allocation and access management. For example, implementing code access controls and conducting code reviews prevents unauthorized access to PII and its improper use.

- Security training. Our developers are trained in handling PII securely, with a focus on secure development practices and OWASP top 10 security risks.

-

Step #4: Follow anti-fraud strategies and approaches

To prevent fraud, there are two key areas FinTech companies should pay attention to:

- Advanced technologies

- Company-based strategies

Some robust technologies for fraud prevention include:

- AI and machine learning (ML) to analyze behavioral patterns, detect anomalies, and predict fraudulent activities with the help of predictive modeling, natural language processing (NLP), and image (document) analysis (ai/ml use cases).

- Predictive analytics to identify real-time fraud by analyzing patterns and anomalies in transaction data.

- Business intelligence to analyze historical and real-time financial data, identifying vulnerable areas prone to fraud and optimizing security measures.

Discover how business intelligence reduced a neobank’s fraud-related financial losses by 40%.

Read case studyThe main company-based anti-fraud strategies are:

- Fraud investigation to uncover causes and vulnerabilities when faced with a fraud incident. The company can then create an action plan to prevent future incidents.

- Awareness of fraud trends to stay updated on emerging fraud techniques and adapt prevention strategies through new technologies, policies, and procedures.

- Customer and employee education on fraud prevention best practices to raise awareness and promote security practices.

Explore more technologies and approaches in our comprehensive article on fraud detection.

-

Step #5: Perform risk management

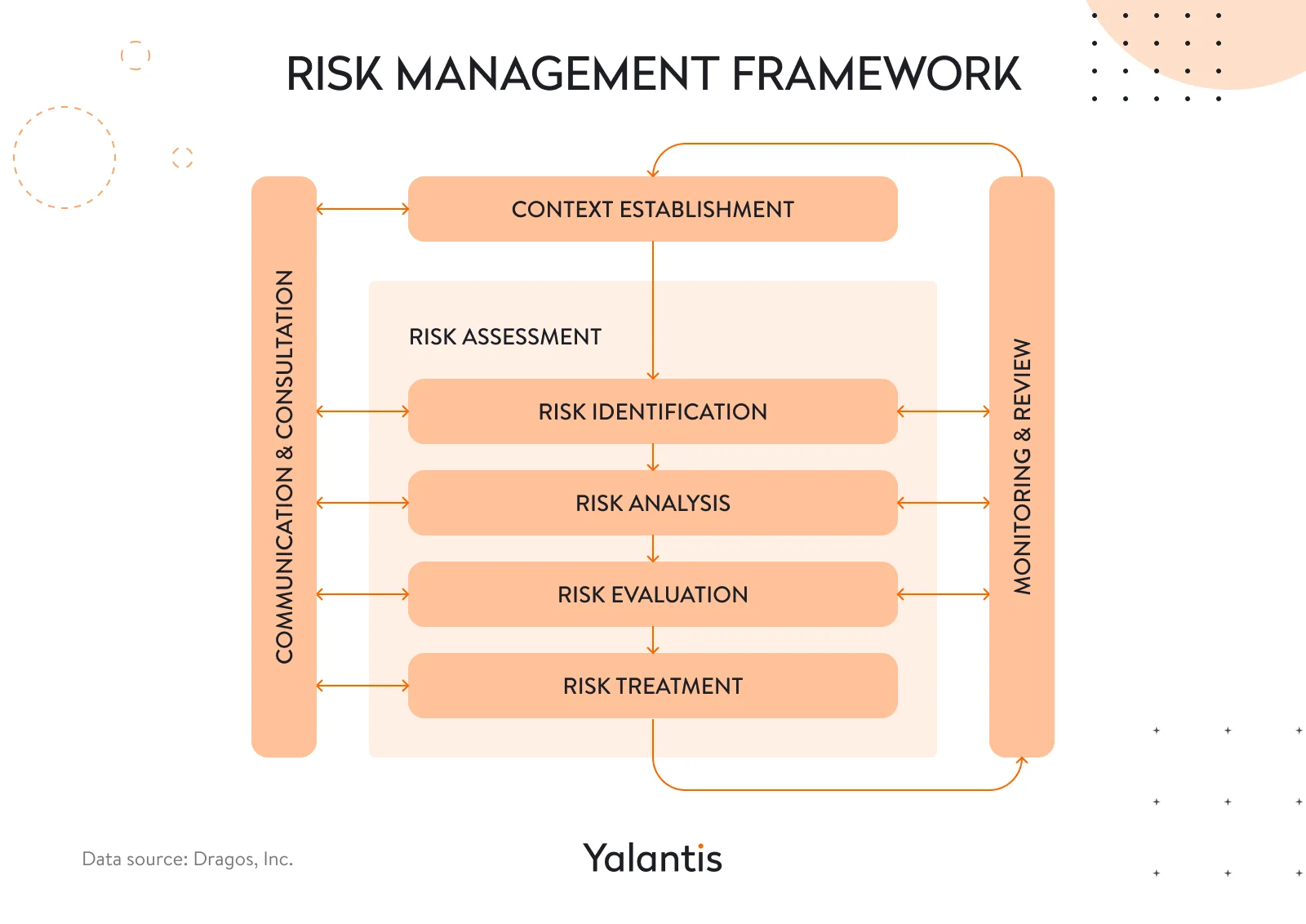

The following steps constitute a robust risk management framework:

- Establish the context. Define roles, responsibilities, and risk awareness, setting criteria for acceptable risk.

- Risk assessment comprises three main phases:

- Risk identification. Identify key risks, including those related to cybersecurity, data privacy, and AML across products and technologies.

- Risk analysis. Evaluate identified risks by estimating their likelihood and potential impact using qualitative or quantitative methods.

- Risk evaluation. Prioritize risks based on severity to guide mitigation efforts.

- Risk treatment. Develop controls and action plans to reduce risks. Examples include adding multi-factor authentication (MFA), allowing account freezing in suspected fraud cases, and providing instant access to the dispute department for fraud investigations.

- Monitoring and review. Continuously monitor key risk indicators, such as suspicious transactions and data breaches. Periodically review and update risk management policies, controls, and priorities.

- Communication and consultation. Foster ongoing two-way communication between risk managers and staff using risk dashboards, registers, and training for effective risk management.

-

Step #6: Stay informed of regulatory updates

Compliance and FinTech standards are always evolving. This makes it essential to have compliance experts continuously monitoring changes. When updates happen, revise your policies and procedures accordingly.

While this process can be resource-intensive, technology provides solutions. For example, robotic process automation (RPA) software enables businesses to reduce time spent on repetitive tasks with an RPA bot. It can improve regulatory and legal monitoring while serving as a knowledge base for employees addressing compliance-related queries.

We’ve tested this approach at Yalantis and have taken it even further with AI development. The result is an AI chatbot for internal use that provides instant access to the most recent information on FinTech laws and regulations in real time. Here’s how it works:

- Our experts monitor regulatory changes and update the chatbot’s knowledge base accordingly.

- The chatbot can answer inquiries about current policies, laws, industry specifics, and more.

- AI technology enhances the chatbot with natural language processing (NLP) for better understanding, ML for improved accuracy, and contextual awareness for personalized, relevant responses.

These real-time, AI-driven solutions ensure our teams are well-prepared to navigate regulatory changes.

Need a compliant FinTech solution but unsure where to begin?

Ask our experts how to ensure compliance for your FinTech business.

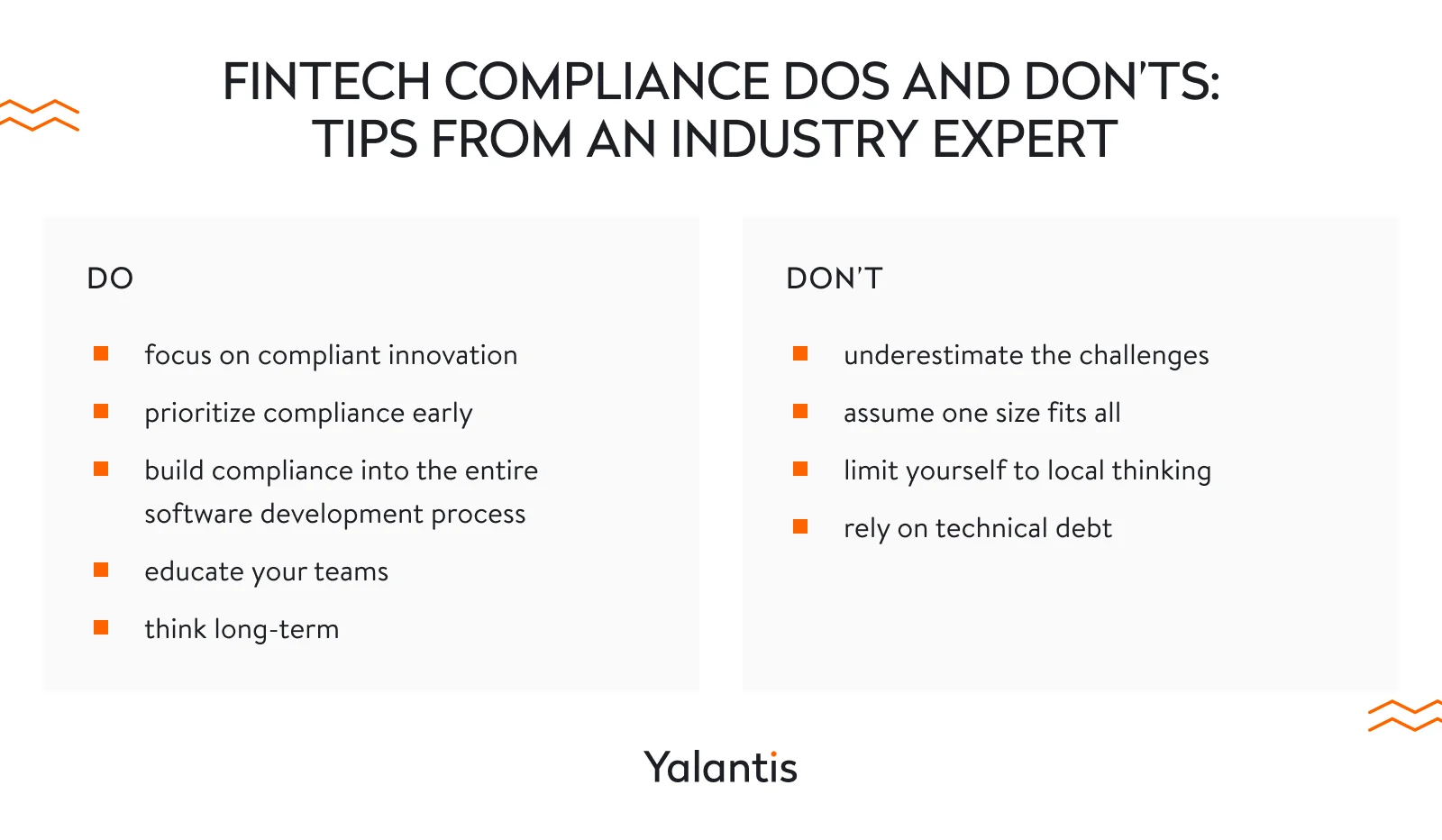

FinTech compliance dos and don’ts: Tips from an industry expert

Jaclyn Schoof, with her extensive experience in the tech field, highlights the first must-do:

“Have compliance early on in that [development] process and make sure that you’re keeping it abreast the entire time.”

Jaclyn Schoof, Senior Technical Program Manager at HashiCorp

Let’s explore more key points.

Do:

- Focus on compliant innovation. Build creative solutions within known constraints.

- Prioritize compliance early. Gather compliance requirements up front to avoid rework and financial losses.

- Integrate compliance throughout. Include compliance checkpoints throughout your software development lifecycle.

- Educate your teams. Ensure your engineering teams understand the basics of compliance to effectively collaborate with compliance and legal teams.

- Think long-term. Adopt a strategic approach for lasting compliance success.

Don’t:

- Underestimate the challenges. Compliance comes with complexity you shouldn’t take lightly. Take into account the intricate regulatory landscape and the resources required for success, like efficient data collection and reporting systems.

- Assume one size fits all. Be prepared to adapt and potentially revise your KYC procedures when expanding or developing new products.

- Limit yourself to local thinking. Consider scalability and plan for modular changes to accommodate new regions.

- Rely on technical debt. Avoid compromising on quality to meet compliance requirements; aim to strike a balance that minimizes technical debt.

FinTech compliance can be complex, but a dependable financial technology partner can provide valuable support.

How Yalantis can help ensure compliance with FinTech requirements

Achieving FinTech compliance doesn’t have to be overwhelming. Partnering with Yalantis, an ISO-compliant and trusted FinTech software development company, offers you the following benefits:

- Tailored FinTech solutions. From banking software to lending app development, we provide scalable, compliant solutions that support business expansion and support your specific business processes and requirements.

- Proven success. We’ve delivered numerous compliant solutions using advanced technologies that enhance cybersecurity, safeguarding businesses and customers from risks like fraud and data breaches.

- Cybersecurity expertise. With hands-on experience in common security regulations, laws, and standards like the GDPR, PCI DSS, ISO 27001, SOC2, HIPAA, and FedRAMP, we ensure your security requirements are met.

- Risk mitigation. Our custom security management process identifies and mitigates security gaps and cyber threats, fostering long-term business continuity.

- Guided compliance. We perform thorough gap assessments and help you meet industry-specific compliance requirements for sustainable growth.

Seeking a secure and compliant FinTech solution?

Check out our expertiseFAQ

What are the three pillars of FinTech?

The three pillars of FinTech are:

- Technology. Fintech companies use a variety of technologies such as artificial intelligence (AI), the blockchain, and cloud computing to provide financial services.

- Regulation. FinTech companies are subject to a variety of requirements, including anti-money laundering (AML) and know your customer (KYC). FinTech companies need to comply with them in order to operate safely and legally.

- Innovation. FinTech companies are constantly innovating and developing new ways to provide financial services. This innovation is driven by the need to meet compliance requirements, meet customers’ needs, and stay ahead of the competition.

What is meant by compliance in FinTech?

FinTech compliance refers to the processes and procedures FinTech companies implement to follow industry regulations, standards, and laws. It includes critical elements like anti-money laundering (AML), fraud prevention, and know your customer (KYC) procedures.

What is the AML policy in FinTech and why should businesses implement it?

FinTech AML compliance involves preventing money laundering through real-time transaction monitoring and investigation and regular updates to adapt to changing laws and regulations and emerging fraud methods.