According to the US Federal Trade Commission, American consumers lost nearly $8.8 billion in 2022 due to fraud. By comparison, in 2021, losses from fraud amounted to $5.8 billion. Fraudulent activity is becoming a growing concern for businesses, with more cases of fraud happening every day. FinTech businesses, in particular, are highly vulnerable to fraud due to the nature of their operations. As a result, it has become critically important for them to implement anti-fraud solutions to protect themselves and their customers from potential financial losses and to avoid reputational damage.

In this article, we explore recent fraud trends and what businesses should consider when implementing anti-fraud solutions.

What is fraud detection and anti-fraud software?

Fraud detection refers to measures taken to identify and prevent fraudulent activities before they can cause harm. These measures typically involve either implementing software for detecting fraud or educating employees and users about emerging fraud trends. Educating employees and users is a popular supplementary measure among traditional banks and neobanks, which commonly use social media or email campaigns to increase awareness of fraudulent schemes.

Anti-fraud software contains sophisticated tools to detect and prevent fraud without human intervention. It offers a range of functionality such as for identifying duplicates, signaling potentially fraudulent transactions based on preset rules and scenarios, and calculating behavioral risk scores. By adopting anti-fraud software, financial technology companies can enhance their customers’ financial security and protect customers’ assets.

Providers of anti-fraud software constantly monitor the market, closely examining emerging fraud trends and updating their software accordingly. This ensures that the software is able to identify and prevent new types of fraudulent activities.

FinTech fraud trends in 2023

Fraud threats can arise from anywhere and may come from external perpetrators or even your own employees. Types of fraudulent activities vary based on the type of perpetrator and on the ultimate target — a business or an individual.

Let’s take a look at the most common types of FinTech fraud and segment them by target audience.

Business-oriented fraud

FinTech businesses are increasingly becoming targets for fraudulent attacks. These attacks can cause significant financial losses, not to mention the potential loss of customers and reputational damage, making it crucial for businesses to be proactive about detecting and preventing fraud. The types of fraud FinTech businesses usually face include:

- Bank insider fraud: This type of fraud is committed by an employee or insider within a bank or other financial institution. It can involve embezzlement, theft, or other illegal activities that result in financial losses for the bank and/or its customers.

- Invoice fraud: This occurs when a fraudster sends a fake invoice to a company or individual, usually for goods or services that were never provided. The recipient pays the invoice only to later discover that they have been scammed.

- Digital asset scams: Such scams can take many forms, including Ponzi schemes (an investment scam where returns are paid from new investors’ money), fake initial coin offerings (ICOs), and fraudulent cryptocurrency exchanges. Fraudsters may promise high returns or exclusive access to digital assets in exchange for money or personal information.

- Business email compromise: This type of fraud involves a cybercriminal impersonating a high-level executive or vendor and sending fraudulent emails to employees or customers. Through these emails, cybercriminals may request sensitive information or authorize fraudulent transactions, leading to financial losses for the business.

- Money mules: These are individuals who are recruited by fraudsters to transfer money or goods between different accounts. The mules are often unaware that they are participating in illegal activities and may be tricked into transferring money to overseas accounts or buying goods with stolen credit cards.

Individual-oriented fraud

A significant proportion of fraud attacks target individuals’ accounts, transactions, and identities.

- Phishing is a type of fraud that involves tricking individuals into providing sensitive information such as login credentials or credit card numbers through fraudulent emails or websites.

- Synthetic identity fraud involves creating a new identity by combining real and fake personal information. This information is then used to open new credit card accounts or take out loans.

- Account takeover occurs when a fraudster gains access to a victim’s account via stolen credentials and uses it to make fraudulent transactions or steal personal information.

- Transaction fraud involves unauthorized transactions on a victim’s account with the help of stolen payment information.

- A technical support scam is when fraudsters contact individuals and pretend to be from a reputable technical support company, offering to fix a non-existent problem in exchange for money or access to personal information.

To protect businesses and individuals from such attacks, anti-fraud software providers implement advanced technologies capable of identifying fraudulent activities.

Fraud prevention solutions for FinTech companies: tried-and-tested technologies and approaches

In this section, we outline which technologies our financial software development company uses to effectively fight fraud and discuss how companies themselves should contribute to lowering the chance of fraud attacks being successful. Working closely with a data engineering company can help streamline data processing and ensure that fraud detection systems are built on solid data infrastructure, providing more accurate and timely fraud prevention capabilities. Further improvements in fraud detection accuracy can be achieved by leveraging data science services that enable in-depth pattern recognition, anomaly detection, and predictive modeling.

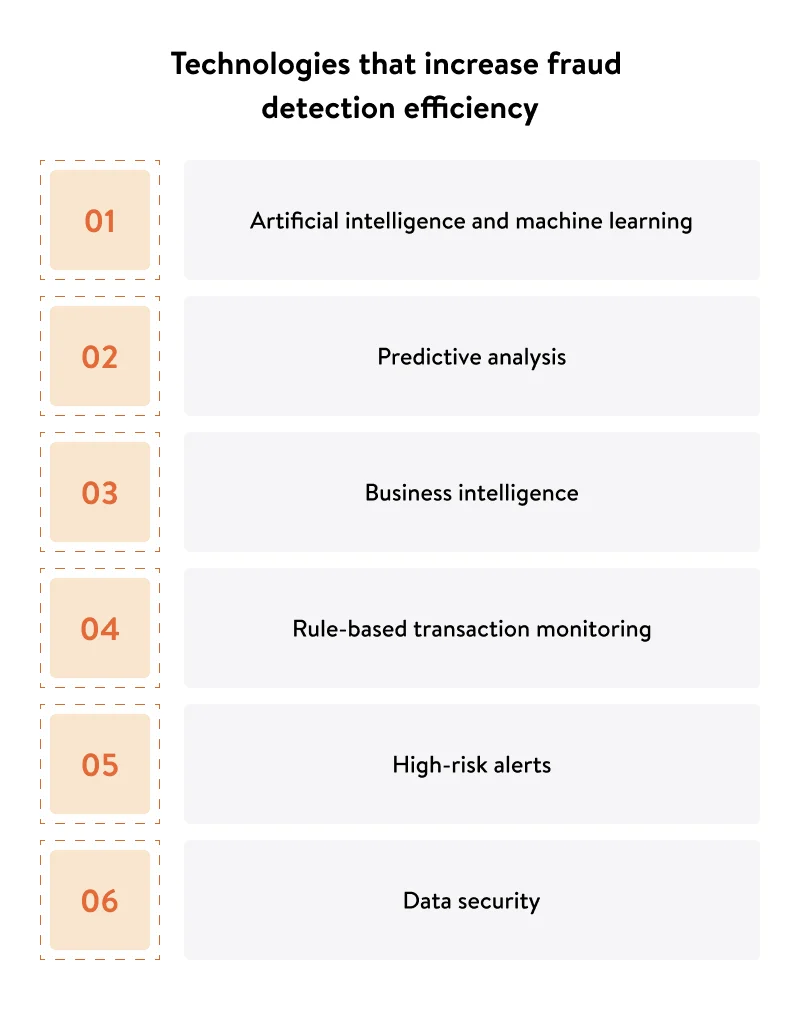

Technologies to use in advanced anti-fraud solutions

As fraudsters become more skilled in carrying out fraudulent activities, fraud prevention software should keep pace by using advanced technologies capable of identifying modernized or new fraudulent schemes:

Artificial intelligence (AI) in combination with machine learning (ML) are increasingly used in fraud detection software due to their ability to process vast amounts of data quickly and accurately (ai ml use cases). AI and ML algorithms can analyze behavioral patterns and identify anomalies that could indicate fraudulent activity. They can also help with predictive modeling, natural language processing (NLP), and image (document) analysis. Collaborating with a machine learning development company can provide the expertise needed to implement these advanced AI/ML solutions for effective fraud detection.

Predictive analytics is used in fraud detection software to identify and signal potential fraud in real time by analyzing patterns and anomalies in transaction data.

Business intelligence (BI) can be used to analyze historical and real-time financial data and identify areas that are most vulnerable to fraudulent activity. With the assistance of business intelligence services, businesses can achieve cost optimizations by eliminating vulnerabilities and protecting their systems against fraud attacks.

Rule-based transaction monitoring involves setting up predefined rules to detect and prevent fraud by identifying suspicious activity and instantly blocking transactions that don’t meet predefined criteria.

High-risk alerts. Automated high-risk alerts can be generated based on criteria such as unusually large transaction amounts or suspicious transaction patterns. This allows the risk management team to take immediate action to prevent fraudulent activities.

Data interchange security. Anti-fraud software must guarantee security when integrating with FinTech solutions by implementing various security measures such as encryption, secure data transmission protocols, and access controls.

KYC (know your customer) and KYB (know your business). Integrating KYC/KYB services can help to identify and prevent fraudulent activities, including money laundering and identity theft. By verifying the identities of and information about customers and businesses, organizations can ensure that their operations comply with relevant requirements and minimize the risks associated with fraudulent transactions.

Learn how Yalantis built an automated cybersecurity ecosystem for a Fin Tech company

READ CASE STUDYCompany-based anti-fraud strategies and approaches

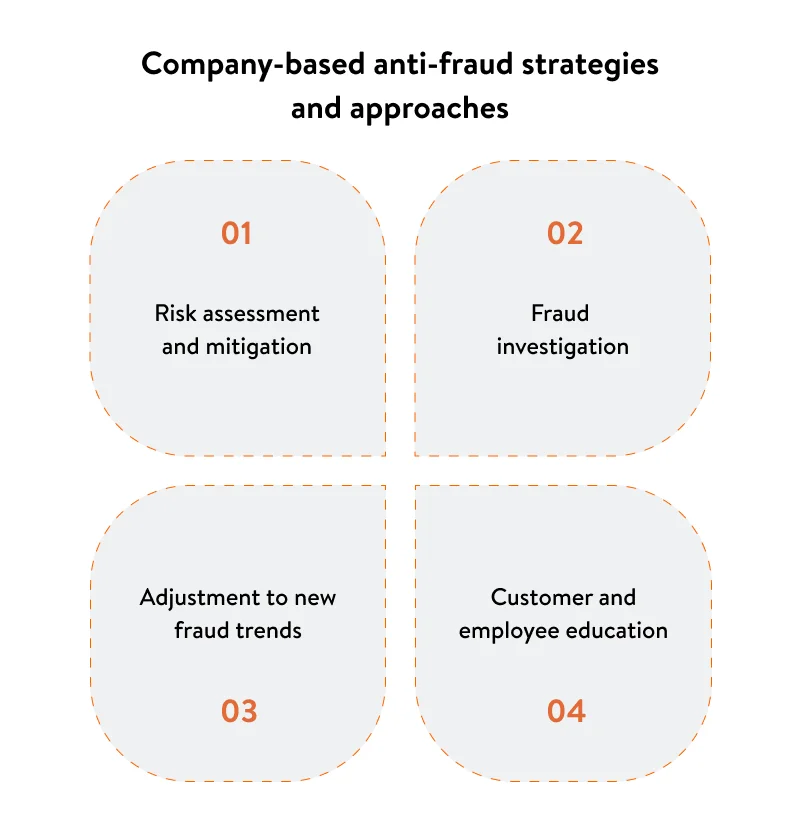

Not only anti-fraud software vendors participate in protecting FinTech organizations. There are also a bunch of responsibilities on the shoulders of the fraud prevention department at these organizations:

- Risk assessment and mitigation. Conducting risk assessments can help identify potential fraud risks and determine proper mitigation strategies to prevent or reduce the impact of fraudulent activity.

- Fraud investigation. In the event that fraud occurs, companies must conduct a thorough investigation to identify the root cause and any possible vulnerabilities revealed by the attack that must be addressed.

- Awareness of fraud trends. As new fraud techniques emerge, companies must adapt their fraud prevention strategies to stay ahead of the threats. This may involve implementing new technologies, updating policies and procedures, or investing in additional employee and user training.

- Customer and employee education. Educating customers and employees on fraud prevention best practices can help reduce the risk of fraud by raising awareness and promoting good security practices.

When it comes to implementing anti-fraud software, companies face a challenging decision: choose a ready-made solution or invest in custom software development. Let’s talk about each option in detail.

Ready-made vs custom fraud detection solutions

While both options offer benefits and drawbacks, the choice ultimately depends on the business’s specific needs and resources. First, it’s important to examine what ready-made solutions may provide you with.

Top 3 anti-fraud products in 2023

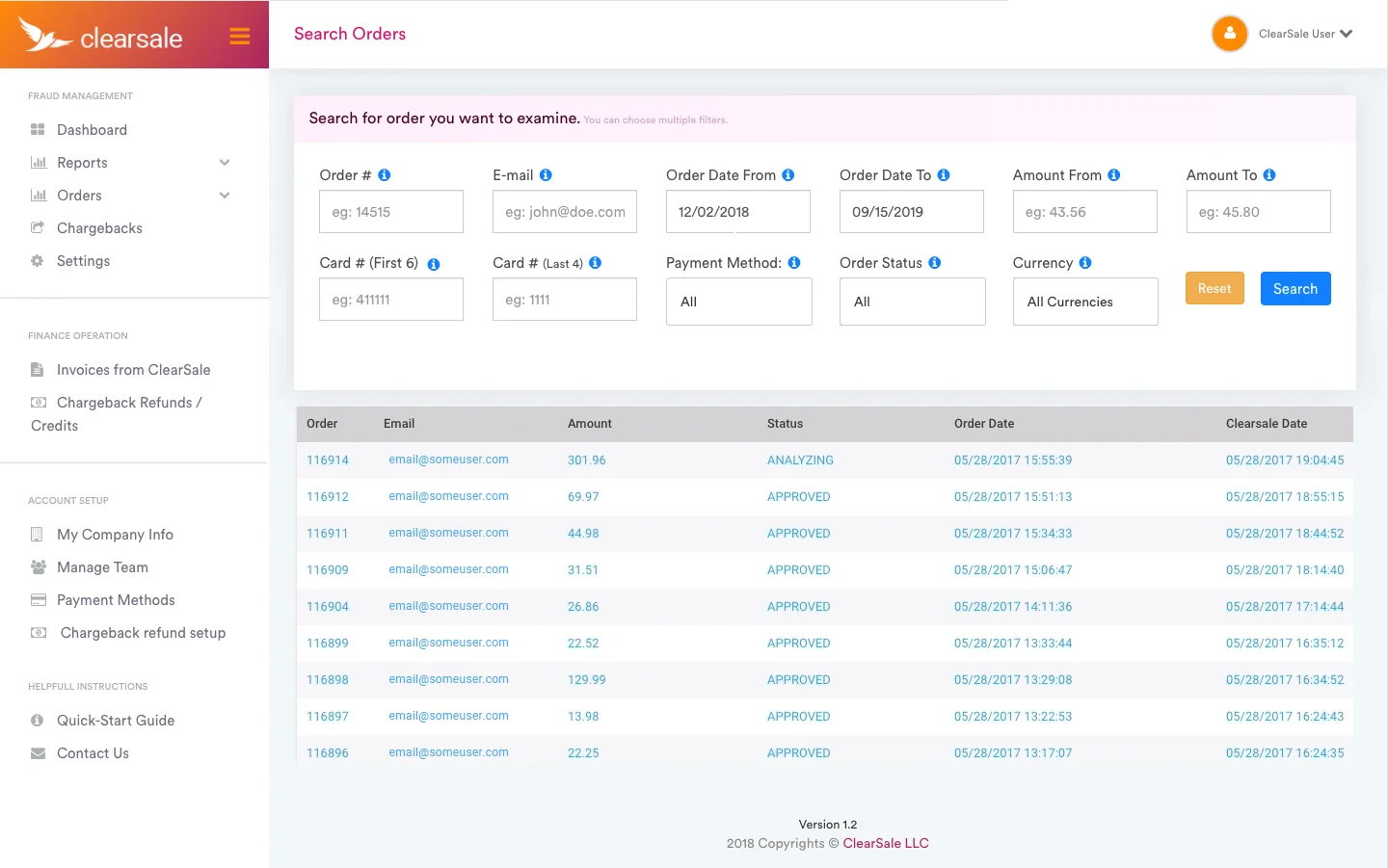

ClearSale is cloud-based fraud protection software that uses advanced algorithms and artificial intelligence to identify and prevent fraudulent activities across multiple channels. Its key functionalities are:

- Multi-layered fraud detection using artificial intelligence, machine learning, and expert human analysis

- Global fraud protection with a focus on cross-border transactions

- Customizable fraud rules and thresholds based on business requirements

- Real-time decision-making and order review

- Chargeback guarantees and fraud insurance to protect against losses

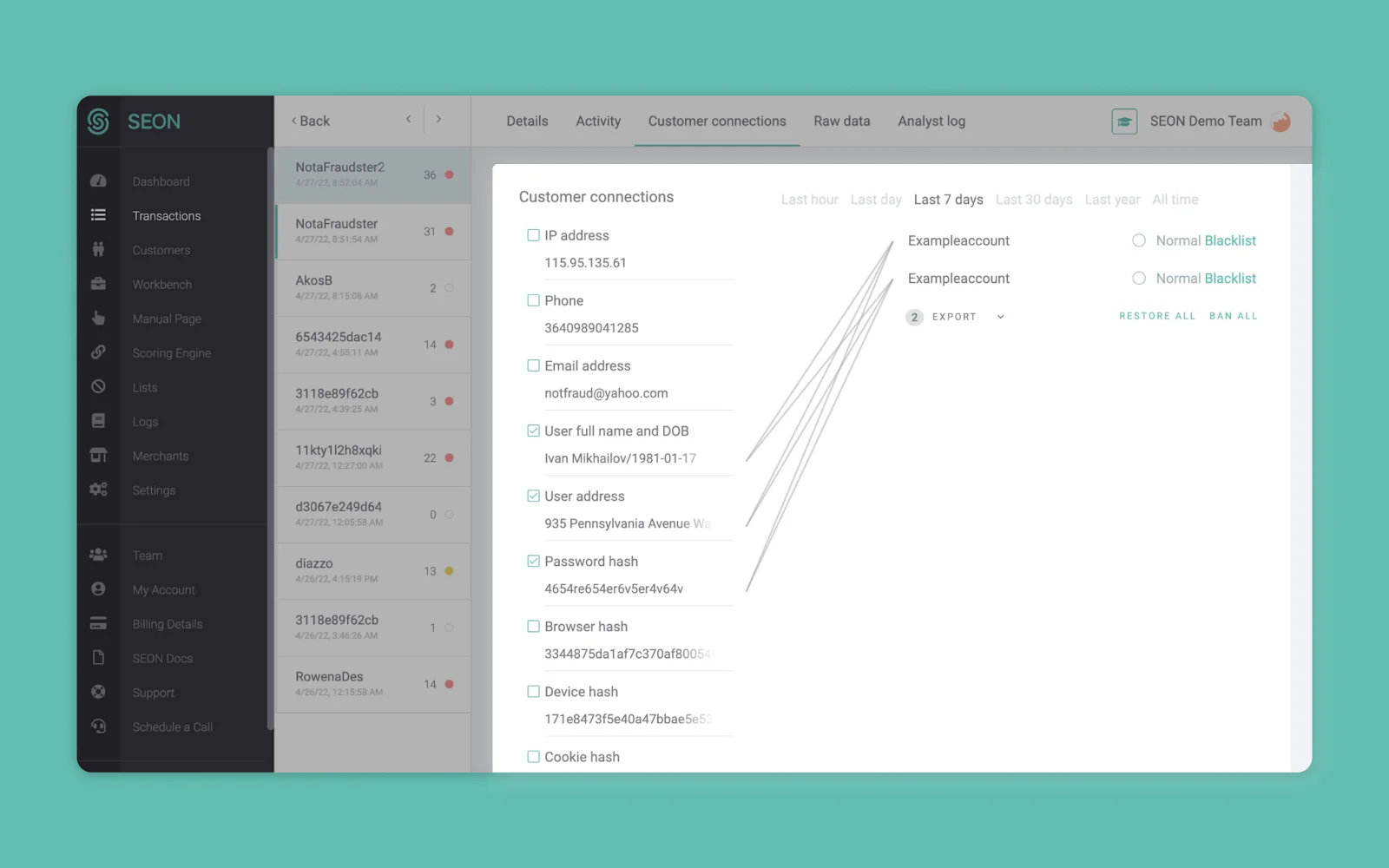

2. Seon

Seon is fraud prevention software that combines data enrichment, behavioral analytics, and machine learning to identify and prevent fraudulent activities in real time. The Seon fraud prevention solution is flexible and customizable, and its feature set includes:

- Real-time fraud detection using data enrichment and behavioral analytics

- Customizable fraud rules and thresholds based on business requirements

- Advanced device fingerprinting to detect and prevent device-related fraud

- Transaction monitoring to identify patterns and anomalies in transaction data

- Chargeback protection and fraud management tools to streamline the dispute process

3. Tookitaki

Tookitaki is an anti-money laundering (AML) tool that utilizes machine learning and artificial intelligence to detect, investigate, and report suspicious activities while reducing false positives and streamlining compliance processes. To successfully implement such solutions, businesses often turn to artificial intelligence consulting services that help them align AI technologies with their specific fraud detection goals and infrastructure. Tookitaki provides the following functionality:

- Risk-based real-time alert generation for detecting suspicious activity

- Automated transaction monitoring for AML compliance

- Advanced analytics and reporting for enhanced risk assessment

- Machine learning algorithms for accurate identification of suspicious patterns

- Continuous monitoring and screening for ongoing AML risk management

Yalantis has experience working with Tookitaki on mobile banking development project which involved building a reliable anti-fraud protection system for a large US-based neobank. The results of our work were a 40% decrease in fraud-related financial losses within a quarter.

Limitations of anti-fraud software

Despite its efficiency, an average anti-fraud solution has the following limitations:

- False positives. It’s not possible to guarantee that financial fraud detection software is capable of identifying all fraudulent activity, as user behavior varies and deviates from patterns. This creates the risk of suspecting the wrong users or damaging a company’s reputation.

- False negatives. Fraud detection software relies on historical data and predefined rules to identify fraudulent activities, and it may not always identify new or emerging fraud patterns. In addition, fraudsters may be able to avoid detection by using sophisticated tactics that the software isn’t designed to detect. This can result in fraudulent activities going undetected, leading to financial losses for the business.

- Incompatibility with legacy systems. Legacy systems often use outdated technology and may not be compatible with modern fraud detection software. This can make it difficult and time-consuming to integrate anti-fraud software with existing systems, requiring additional resources and expertise.

- Limited detection capabilities. Some fraud detection software may not be able to detect all types of fraud, such as identity theft or social engineering scams, which require human intelligence and intervention. In addition, fraudsters may be able to bypass fraud detection systems by using new or emerging techniques that the software isn’t designed to detect.

- Maintenance and updates. Fraud detection software requires regular maintenance, updates, and even staff retraining to stay effective, which can be time-consuming, costly, and process-disruptive.

Obviously, such limitations may put obstacles in the way of error-free and stable integration with anti-fraud software. Besides these limitations, there are also technical challenges to integrating with fraud detection solutions.

Common challenges FinTech companies face when implementing fraud prevention software

There are three challenges FinTech companies commonly face when implementing fraud prevention software:

- High costs. Сompanies have to spend a lot of time and money on research to find the right anti-fraud software that will be technologically compatible with their platform and have all necessary functionality. It’s especially important if your solution has legacy code. Then after the right solution is found, the company has to spend resources implementing it and ensuring its stable performance.

- Scalability. The fraud prevention solution you’ve chosen has to keep up with your platform. Your business will likely grow, and you will process more transactions, serve more end users, and become a target for more fraudsters. As such, your fraud detection software should be capable of detecting fraudulent activities on a greater scale. If you initially choose a weak solution, you will have to switch to a scalable one (which also will cost quite a penny); otherwise, you’ll lose a lot of money.

- Third-party services. Implementing anti-fraud software requires integrations with third-party services, which presumes exchanging data. In this case, a business should ensure that software providers have proper security measures in place and aren’t vulnerable to data breaches. This means additional monitoring and the implementation of supplementary security measures.

Custom fraud detection software as a solution to the imperfections of ready-made tools

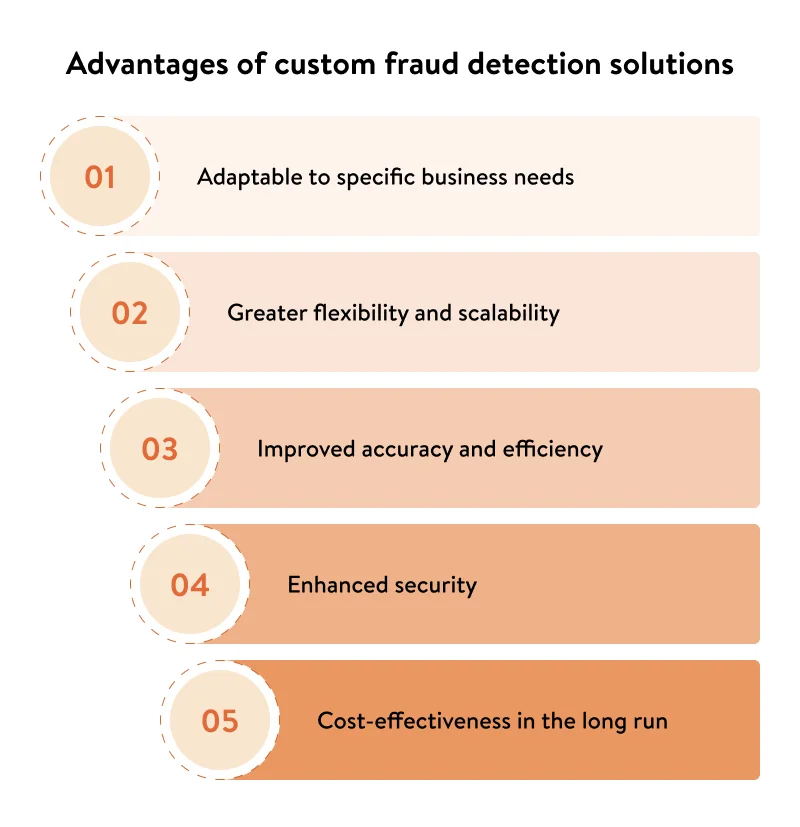

Unlike ready-made solutions, custom software can break through limitations that may be present in off-the-shelf products, allowing for a more efficient and effective fraud prevention system. Among the business benefits that custom anti-fraud solutions offer are:

- Adaptable to specific business needs: Custom anti-fraud software will be developed to meet the specific needs of a business. This means that software engineers take into account factors such as the industry, the size of the business, and unique risks and vulnerabilities that are specific to the business, making the software more effective in detecting and preventing fraud.

- Greater flexibility and scalability: Custom fraud prevention software will be more technologically flexible and scalable than off-the-shelf solutions. This allows for easier integration with existing systems and the ability to adapt to changing business needs. With a custom fraud detection solution, you will have the software needed to grow and evolve as your business expands or changes.

- Improved accuracy and efficiency: Anti-fraud systems developed from the ground up are usually optimized for specific types of fraud that a business typically faces. This specialization increases the accuracy and efficiency of detection and prevention efforts. The software can be designed to detect subtle changes in patterns, identify unusual behaviors or transactions, and identify other suspicious activities, resulting in quicker and more accurate fraud detection.

- Enhanced security: Custom anti-fraud software is built with security in mind, exploiting advanced encryption and other security features to protect sensitive data and prevent unauthorized access. Such software should meet specific security standards and compliance requirements.

- Cost-effectiveness in the long run: Although developing custom anti-fraud software may require higher upfront investment, it can be more cost-effective in the long run. Since the software is tailored to the specific needs of the business, it can reduce the risk of financial losses due to fraudulent activity. This also eliminates the need for ongoing licensing fees for off-the-shelf solutions. Custom software can also provide a higher return on investment (ROI) due to improved fraud detection and prevention, leading to greater customer trust.

Conclusion

Fraud detection software is of the utmost importance in today’s business environment, where fraudsters are constantly developing new tactics to deceive and steal from companies and their customers. With the increasing demand for this type of software, businesses must be considerate in selecting the right solution that suits their unique needs.

While off-the-shelf solutions may seem attractive in the short term, custom software development offers greater flexibility and customizability, allowing businesses to tailor the solution to their specific requirements. By investing in custom fraud detection software, businesses can better protect themselves from financial losses and reputational damage caused by fraudulent activities, giving them confidence to focus on their specific operations and growth.

Ensure strong anti-fraud protection for your FinTech organization

Yalantis will help you protect your business with our experienced and industry-savvy team

FAQ

Why does your FinTech company need an anti-fraud solution?

Companies need anti-fraud software to protect themselves from financial losses, reputational damage, and legal liabilities. With the increasing complexity and frequency of fraudulent schemes, it has become critical for companies to implement effective fraud detection and prevention solutions. Anti-fraud software from a fraud detection company can help identify and investigate suspicious transactions, analyze data patterns to detect anomalies, and monitor internal controls and compliance. By using advanced technologies such as artificial intelligence and machine learning, anti-fraud software can provide real-time protection against fraudsters and minimize the risk of financial crimes.

What technologies do you use when developing a fraud protection solution?

When developing fraud protection software solutions, we use the technologies that will work best for our clients, considering the specifics of their business. Such technologies include AI in combination with ML, predictive analytics, and rule-based transaction monitoring. These are must-have technologies, especially for large organizations that need reliable financial fraud detection software. Depending on the type of business, we also develop customized protection mechanisms that meet specific business requirements.

What experience do you have developing anti fraud software?

Yalantis has been working in the FinTech industry for over seven years. We have developed solutions for traditional banks, neobanks, wealth management platforms, stock operations management platforms, and other FinTech institutions. All of them have required reliable anti-fraud systems to prevent financial losses and secure customers’ transactions. We’ve worked on holistic anti-fraud systems and rule-based fraud detection algorithms according to our clients’ needs.