Developing a modern medical device requires a balance of hardware engineering, regulated software development, clinical system integration, and strict compliance. Healthtech companies manage all of this while aiming for fast and predictable release cycles. What can be done to effectively handle these demands?

One way to reduce operational pressure is to partner with a reliable medical device development company like Yalantis. A full-cycle provider can expand engineering capacity, support regulatory workflows, and speed up delivery. If you’re evaluating options, here is a curated list of top medical device companies with capabilities across the entire product development lifecycle.

List of the top 10 medical device companies

1. Yalantis

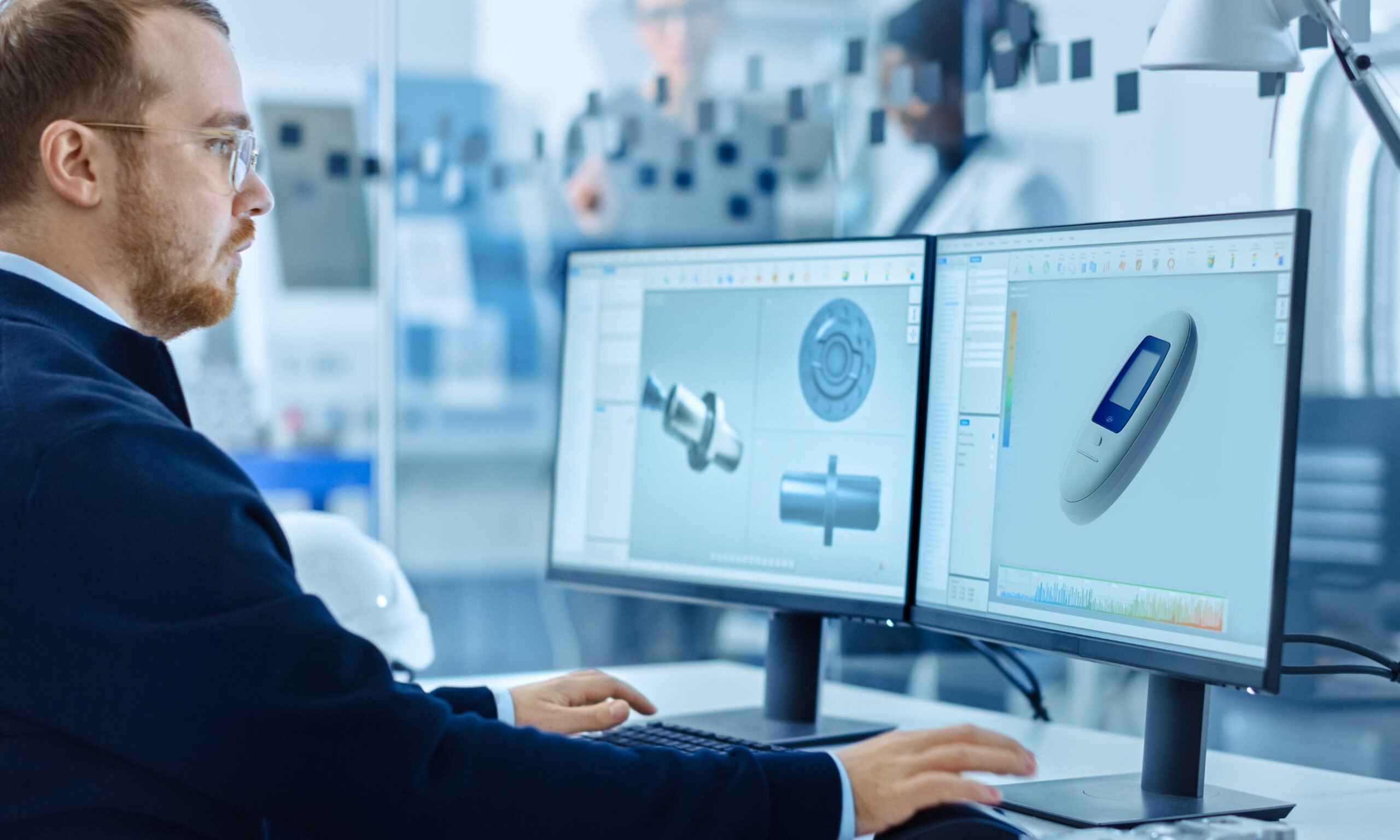

Yalantis is a medical device development company trusted by established healthcare organizations to build complex, software-driven, and connected healthcare solutions. We develop the software and system layer that turns a medical device into a working product.

Yalantis supports medical device manufacturers across the full development cycle, from early software architecture to production-ready systems. Our teams take responsibility for embedded software, device connectivity, cloud platforms, and clinical integrations as a single, continuous scope rather than fragmented tasks. This approach allows you to move from early R&D to deployment with one engineering partner handling firmware, applications, backend systems, and data exchange in a coordinated way.

Our delivery process is built around the regulatory frameworks and industry standards that govern modern medical device development:

Our experience includes both connected medical devices and large-scale integration platforms. For instance, we developed ECG and SpO₂ wearable devices supported by a full digital ecosystem for real-time data collection, processing, and visualization. Another example is when we integrated medical devices with backend systems to enable secure data exchange, device monitoring, and clinical workflow support across connected healthcare infrastructure.

Yalantis works as a full-cycle medical device development partner for companies building connected hardware devices and SaMD solutions. We cover embedded software and firmware, hardware integration and prototyping, application development, and clinical system integration as a single, coordinated scope. The result is faster execution with clear ownership and budget economy.

2. Vantage MedTech

This medtech company is a relatively new name, but not a new player. Formed in 2023 through the merger of Sterling Medical Devices and RBC Medical Innovations, the company brings together two engineering teams under one umbrella. Today, operations are split between Lyndhurst, New Jersey, and Lenexa, Kansas.

The medical device manufacturer focuses on Class II and III medical devices. Its engineers work across system architecture, design, application-level software, and the steps required to move early concepts toward products. In-house clinical and commercial manufacturing capabilities allow development teams to transition into production.

3. DeviceLab

Some teams are brought in to scale production. Others are called when the product still needs to take shape. This medical device company resides in the second category. Operating from Tustin, California, since 1998, it works primarily with startups and mid-market manufacturers during the early and middle stages of device development. The focus is on turning ideas into functioning, testable products before large-scale manufacturing enters the picture.

Engineering efforts center on industrial design, mechanical and electrical development, embedded software and firmware, and interface design for medical applications. The company’s engagements typically continue until products are ready for validation or transfer to downstream manufacturing partners.

4. Benchmark Electronics

This medical engineering company has been operating since 1979 and runs a big network of engineering and manufacturing facilities. The company delivers medical device programs that span engineering, industrialization, and production support.

Programs typically start at early engineering stages and extend into manufacturing. Teams cover systems engineering, electronics and mechanical design, embedded and application-level software, and product design. The medical portfolio includes diagnostic equipment, imaging platforms, surgical systems, infusion devices, and connected health technologies.

5. D&K Engineering

This is one of the medical equipment companies that sits at the intersection of product development and manufacturing. Based in San Diego and active since 1999, the company works on medical devices that require a mix of mechanical design, electronics, and software.

Projects typically start with system-level design and move through mechanical and electrical development, embedded software, prototyping, and verification. When products are ready to scale, the same organization handles design transfer and manufacturing, supporting both pilot runs and commercial production through its own facilities.

6. Velentium Medical

On paper, this is a small medical engineering company. In practice, engineering and manufacturing are tightly coupled, allowing medical device R&D and contract manufacturing to run within a single operation rather than being split across vendors.

The work focuses on Class II and Class III devices, with development and production handled side by side. This setup is typically used for programs where design decisions and production constraints need to stay closely connected.

7. Suntra MedTech Solutions

The name is new, but the operating model is not. After more than three decades under the Sunrise Labs brand, the company reintroduced itself and kept working with both startups and established manufacturers on medical device design and engineering. Engagements tend to combine technical development with upfront product definition, especially for devices that introduce new usage patterns or clinical workflows.

Its portfolio spans systems engineering, mechanical and electrical design, embedded software, and usability-focused development. Many projects involve wearables, minimally invasive devices, or connected systems with attention to form factor and user interaction.

8. Kapstone Medical

This medical equipment company operates as a small, specialized group focused on helping to move early-stage medical devices from concept toward market readiness. Based in the United States, it often works with physician-led teams and startups that need structure around engineering, quality, and regulatory preparation.

The scope usually includes mechanical design, prototyping, quality system setup, and regulatory documentation support. Manufacturing, when required, is coordinated through partners rather than handled internally. The work is common in areas such as orthopedic devices, surgical instruments, and other mechanically driven products where regulatory groundwork is as important as the design itself.

9. Plexus

Scale changes the nature of medical device development. At this level, engineering decisions are closely tied to supply chains, test automation, and long-term production realities across regions.

The company runs engineering and manufacturing operations that support medical devices from development through sustained production. Teams work across electronics, mechanical systems, embedded software, and test engineering, with an emphasis on repeatability and process control.

The medical portfolio spans diagnostic systems, infusion devices, dialysis equipment, and other complex products produced at commercial volumes. Programs are designed to move from early builds into long-term manufacturing without changing infrastructure or partners.

10. Jabil

When production volume and global distribution become the main constraints, medical device development shifts toward industrial execution. At that point, global medical device companies operate at a different scale. This organization runs an engineering and manufacturing network, supporting medical devices alongside other regulated healthcare segments.

The work centers on manufacturability and production readiness. Engineering teams focus on product design, tooling, automation, and test systems, while manufacturing sites handle high-volume output. Medical programs typically include wearable injectors, diagnostic devices, surgical tools, and other products designed for long-term commercial manufacturing rather than rapid iteration.

Key trends shaping the medical device industry in 2026

Medical technology continues shifting toward connected, software-driven, and data-intensive products. Device manufacturers are investing in AI, cloud-based ecosystems, and digital care models while operating under increasingly strict regulatory requirements. Alongside the fundamentals you’d expect from established medtechs, these capabilities were a key factor in how we evaluated and selected the companies featured below.

Edge AI in medical devices

Edge AI has become a defining shift in how medical devices are designed and used. Integrating AI with medical devices now often means running models directly on the device, not in the cloud, so data gets processed at the moment it’s captured. Such an approach reduces latency for time-sensitive signals and limits how much patient data leaves the hardware.

IoT-enabled devices and remote monitoring

IoT-powered medical devices open possibilities that traditional standalone devices couldn’t offer. A sensor or wearable device can now send health data in real time and support continuous monitoring instead of occasional check-ins. Such connectivity allows more timely interventions and gives care teams a better view of a patient’s status between visits.

Digital twins in medical devices and care

Digital twins mirror the real-world behavior of medical devices as well as patients’ organs. A digital twin can track equipment wear and help predict failures before they impact clinical use. At the patient level, digital twins can represent specific organs or physiological systems, using real data to simulate disease progression or treatment response.

Digital therapeutics and software-driven care

As software becomes a direct therapeutic mechanism, the focus shifts from delivering information to influencing real clinical outcomes. Digital therapeutics deliver structured treatment programs, guide patient behavior, and collect outcome data that would be impossible to track manually. Their value comes from the feedback loop they create: every interaction informs the next step in care.

Home-based devices and patient-managed systems

More care now happens outside clinical settings, and devices must work reliably in everyday conditions. Patients need tools that are simple to operate, stay connected to their mobile apps, and protect health data even on consumer networks. When connected healthcare systems perform consistently, they support long-term condition management and reduce unnecessary in-clinic visits by keeping patients and clinicians in sync between appointments.

Interoperability and data exchange

Medical devices rarely operate alone anymore. Hospitals expect them to feed data into EHR systems, exchange information with clinical platforms, and fit into established care workflows. HL7 and FHIR standards make this possible, but turning them into a working integration requires clean data structures, reliable APIs, and a deep understanding of how clinical systems operate in practice. Devices that communicate well usually earn faster adoption because they reduce manual work and make clinical processes smoother.

Cybersecurity and regulatory compliance

With great connectivity comes great exposure to cyber risks. Every device that sends or receives data becomes a potential entry point, so manufacturers must treat security as part of the product’s core design rather than an afterthought. Secure firmware, encrypted communication, and cloud environments built for regulated data help reduce vulnerabilities. Strong compliance practices reassure both regulators and clinical buyers that a device is ready for real-world use.

The comparison list of the best medical device companies

To help you choose the right medical device development partner, we compared the companies in terms of capabilities that matter most in today’s medtech landscape. Look at the table below to discover how each vendor aligns with the trends we discussed earlier.

How to read the table:

- Core is something the company does constantly and intentionally, with real projects, repeatable processes, and teams built around it;

- Partial means capability exists and is used in projects, but it usually plays a supporting role rather than driving the work;

- Limited is when the company touches this area occasionally, often through partners or isolated tasks, without deep or sustained ownership.

The goal of this comparison is not to rank vendors from “best” to “worst,” but to show where each company is strongest and where gaps may appear depending on the type of medical device you’re building.

Why should you choose Yalantis for medical device development?

Full-cycle medical device development

Yalantis delivers full-cycle medical device development, covering software, hardware, and device prototyping. Teams work across embedded software, electronics, connectivity, cloud platforms, and clinical-facing applications, supporting products from early concept and validation to production-ready systems.

Mature, enterprise-oriented delivery processes

Yalantis operates with established delivery and governance processes designed for enterprise-scale products. Teams work with predictable planning, clear ownership, and controlled change management, helping clients keep timelines and budgets under control.

Experience in connected and data-driven product development

Our company has delivered solutions for connected medical devices and healthcare data systems with stable connectivity and scalable data pipelines since 2008.

AI-powered product development lifecycle

Yalantis applies AI across the product development lifecycle to reduce delivery time and development cost while improving release quality. Our clients get earlier validation of product decisions, fewer surprises late in the lifecycle, and more stable release planning.

Strong expertise with regulated healthcare environments

Our teams work within regulated development workflows and support projects that require traceability, risk management, validation support, and alignment with regulations expected for software-driven devices in your country.

Security-first development

Our approach is secure by design since security shapes the architecture. Teams define trust boundaries early, control how data moves between devices and platforms, and continuously address vulnerabilities as the system evolves.

Scalable delivery model without losing engineering focus

Yalantis combines dedicated teams with structured delivery processes, allowing clients to scale development without fragmenting ownership across multiple vendors.

FAQ

What are medical device companies?

Medical device companies design and develop products used to diagnose, monitor, or treat medical conditions. These products range from wearable sensors and diagnostic tools to implantable devices and connected monitoring systems. Modern medical device companies combine hardware, software, and data platforms to deliver clinically useful and regulated solutions.

How is AI transforming the medical device industry?

AI is turning medical devices into systems that actively interpret real-time data. Machine Learning models can spot subtle patterns in signals, flag issues earlier, and surface insights that would be easy to miss with manual analysis. The results are faster clinical decisions, more tailored treatment paths, and better use of continuous device data.

What’s the role of software in medical device development?

Software defines how modern medical devices actually work. It controls device behavior, processes signals, manages connectivity, and turns raw data into information clinicians can use. In connected devices, software also determines how safely data moves between the device, the cloud, and clinical systems. Because of that, software quality directly affects clinical reliability, regulatory outcomes, and patient safety.

How can Yalantis help medtech companies innovate?

Yalantis helps medtech teams turn devices into complete digital systems. The company builds embedded software, device connectivity layers, cloud platforms, and user-facing applications that allow medical products to collect, process, and act on data in real-world conditions. Its teams work within regulated development workflows, aligning software delivery with compliance and scalability needs.