From digital payments to budgeting apps that integrate all your bank accounts and spending history, open banking features have become a cornerstone for millions of consumers and businesses alike. The use of open banking is steadily rising, with global payment transactions projected to skyrocket to $330 billion by 2027, marking an almost fivefold increase from $57 billion in 2023.

By opening up application programming interfaces, APIs, open banking:

- fosters innovation and competition within the financial sector, providing new revenue streams

- offers customers swift and secure access to many financial products and services

- enables FinTechs to build products that increase engagement, reduce costs, and improve the customer experience

As a result, banks are increasingly embracing API initiatives, which are then actively leveraged by third-party FinTech providers.

But for those yet to tap into open banking, navigating this technology might seem confusing due to uncertainties regarding:

- business advantages and return on investment (ROI)

- technical intricacies and ensuring consistent performance

- evolving regulatory frameworks across jurisdictions

- potential solutions and initial steps to take

Our article clears up these matters. As a software development company with deep FinTech expertise, we navigate you through the open banking landscape, revealing its true value for both FinTech businesses and their customers. Additionally, we explain how to get started with open banking and offer a catalog of open API banking providers.

Get top open banking use cases and implementation scenarios for banks, e-commerce platforms, finance management apps, and more.

Download fileWhat is open banking?

Imagine a financial management app that helps track expenses.

- Without open banking, users and personnel would need to manually import transaction data across multiple bank accounts, which is time-consuming and error-prone.

- With open banking, the app can seamlessly connect directly to a user’s bank accounts. Upon securing the user’s consent through an online process, it can securely access details of the latest transactions and reflect them in the interface.

In a nutshell, open banking is the system under which banks and other financial services providers securely share customer data through APIs (with customer permission) to innovate financial services and apps. It has greatly transformed banking, finance, and customer experiences:

See how a FinTech engaged more users in wealth management with open banking features.

Read case studyWhat are the origins of open banking?

Open banking wasn’t born on a specific date, but several milestones have shaped its regulation and implementation:

- 2007: The European Union (EU) took initial steps towards open banking with the Payment Services Directive (PSD), aiming to create a unified payment market and foster secure and advanced payment services.

- 2015: The EU introduced the second Payment Services Directive (PSD2) in response to the rapidly growing FinTech and banking industry.

- 2018: PSD2 came into effect with the introduction of Open Banking standards in the UK, mandating banks to securely share users’ transaction data with other organizations upon explicit user consent.

The UK is now considered the most advanced open banking ecosystem, with over 6.5 million active users of open banking–enabled products. However, open banking’s reach extends beyond Europe. A Mastercard survey of 4,000 US and Canadian consumers revealed that over 80% have linked their bank accounts to financial apps via open banking.

Later in this article, we delve deeper into the global landscape of open banking implementation. For now, let’s explore the value behind this technology.

Main objectives and benefits of open banking for various parties

Open banking aims to enhance the customer experience and expand opportunities for incumbent banks and third-party providers. It unlocks significant potential in the financial services sector by:

- encouraging innovation in isolated traditional banking structures

- unlocking customers’ financial data across institutions to enable holistic financial overviews and personalized services from third-party providers

- fostering healthy competition in an environment where traditional banks dominate the market and consumer choices are restricted

- giving users more control over their data by enabling consent-based financial data sharing

Open banking has become a transformative force, overcoming limitations in closed banking systems and paving the way for innovation and competition:

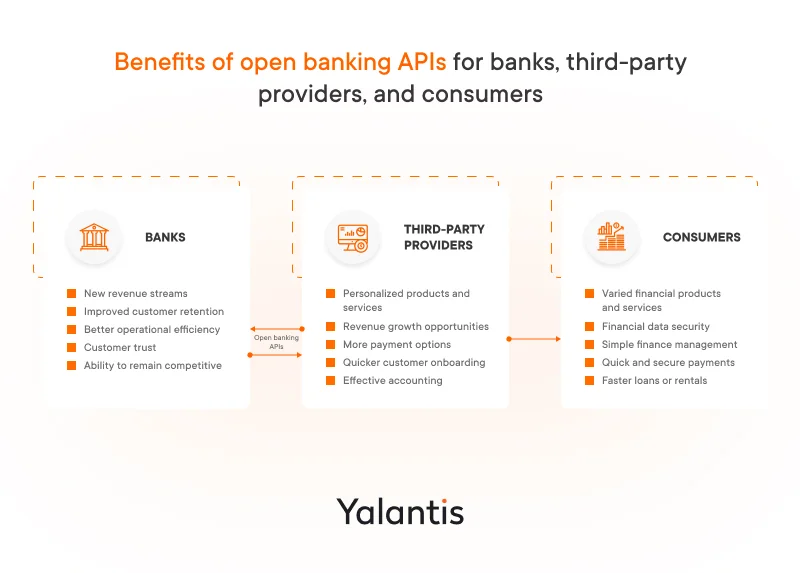

The value behind open API in banking for banks, third-party providers, and consumers

Open banking transforms how banks interact not only with non-bank financial companies and each other but also with consumers, bringing value to each party.

Open banking benefits for banks

According to McKinsey, APIs are growing in strategic importance within banks, which have increased efforts to prioritize and build API roadmaps. Although banks initially started their API journey to comply with regulations like PSD2, the focus has shifted to capturing cost savings and reaping other benefits.

By providing access to their open banking channels or connecting to channels of other financial institutions, banks can:

- unlock new revenue streams by leveraging open APIs to promote bank services via third-party providers (TPPs), create new partnerships, and unbundle offerings, such as by becoming banking as a service — BaaS — providers to FinTech partners

- remain competitive by keeping up with innovation and partnering with relevant FinTechs to leverage specialized expertise

- improve customer experience and retention by using consent-based open banking user data to gain richer insights into customers’ needs and behaviors and better serve customers with new services, personalized offers, and more

- enhance operational efficiency by automating processes and lowering operational costs over time, such as through optimizing customer onboarding with open banking know your customer (KYC) capabilities (we explain this use case later)

- retain ownership in a multi-party ecosystem by playing the role of trusted data custodians and primary financial relationships as customers adopt third-party services

Open banking benefits for third-party providers

Thanks to open banking capabilities like access to the financial institution APIs and initiation of bank transfers, third-party providers such as financial management platforms, e-commerce services, and others can reap a range of benefits:

- Personalized insights and new offerings tailored to user needs and behaviors thanks to access to customers’ financial data via bank APIs

- New revenue streams by developing new paid services or leveraging open banking payment capabilities

- Streamlined customer onboarding by enabling customer sign-up and verification through open banking identity/KYC capabilities

- Wider range of payment options by enabling instant bank payments for customers with lower fees, fraud risk, and processing overhead

- Effective accounting due to real-time transactions and an accurate snapshot of the current financial position

- Reduced liability and overhead by relying on licensed banks to handle regulatory obligations around data privacy, security, payments, and more

Consumer benefits of open banking

Open banking considerably improves the quality of services for consumers:

- Greater choice of financial products and services. Open banking disrupts traditional models, fostering competition and welcoming more players and diverse services into the market.

- Enhanced security of financial data. Through standardized protocols and regulated data sharing, consumers gain more control and transparency over their data, minimizing unauthorized access and ensuring a safer financial environment.

- Simplified finance management. Open banking–powered apps like Revolut, Monzo, Chip, and Plum consolidate data from multiple bank accounts, simplifying budgeting and providing a comprehensive financial overview.

- Quick, easy, and secure payments. Open banking facilitates instant payments through real-time, direct transactions between consumers and businesses and offers various user-friendly digital payment methods like QR codes.

- Streamlined verification for financial services. With consumer consent, regulated entities use open banking to swiftly evaluate consumers’ income and expenses for faster decisions on loans or rentals without the need for manual document submissions.

Discover the value of open banking for its key players in this recap:

Technical aspects of open banking: Functionality, open banking API examples, and more

Open banking powered by APIs connects banks, third-party developers, and consumers to enable secure financial data access and innovative services. This section explains the key players and components facilitating open banking.

How does open banking work?

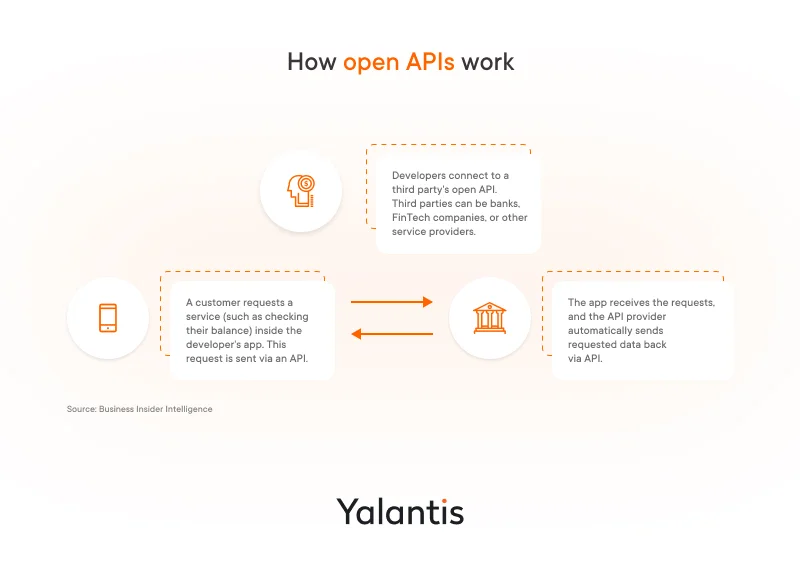

On a basic level, three main players are involved in open banking:

- Banks and other financial institutions that hold customers’ financial data

- Non-bank financial companies (NBFCs) that fetch and process that data

- Consumers that provide the data

See what open banking enables for each player:

- Banks securely share customer data with authorized third parties, allowing them to focus on core services and cultivate new digital revenue streams.

- Non-bank financial companies, with explicit user permission, retrieve data directly from users’ bank accounts to facilitate payments, provide personalized services, and more (we cover other use cases later).

- Users gain greater control over their data across bank accounts held by various institutions and can access new products and services.

Does open banking expose consumers’ financial data to all?

No, open banking doesn’t mean that customer’s financial information is accessible to every provider out there. Instead, it’s about controlled data sharing. Authorized third-party FinTech companies fetch a customer’s financial data only with the customer’s explicit consent. Banks opening up their APIs is what enables this secure data sharing with third parties.

What’s the role of a banking API in open banking?

- An application programming interface, or API, allows third-party applications to communicate with other services. It works in the background to handle transactions or communications between apps, devices, and people.

- In banking, open API allows external third-party developers of FinTech companies to securely access users’ requested financial data from banks and other financial institutions.

How to create a RESTful developer-friendly API

Read the articleHere’s how open APIs work in more detail:

Types of open banking APIs

- Account information APIs provide access to consumer details on bank accounts, including balances and transaction history. They are useful for personal finance management applications like YNAB.

- Payment initiation APIs enable payments to be authorized and initiated directly from bank accounts. They’re useful for e-commerce payments, bill pay features, and other digital payment flows.

- Funds transfer APIs power the movement of money between accounts. They’re useful for services like peer-to-peer (P2P) transfers.

Open banking API examples from leading banks

Many banks worldwide are opening up their APIs to third-party developers to create new products and services and transform financial services. Examples of open banking API platforms leading the way in this space include:

- Capital One DevExchange API: This API platform by Capital One, one of the largest US banks, offers financial APIs enabling developers to access account details, transaction history, and reward points to build custom integrations and apps that offer personal finance management, rewards tracking, and much more.

- Citi Developer Hub: Citibank’s open API bank platform provides APIs for payments, account management, credit card rewards, and compliance needs, such as a Know Your Customer API. It allows developers to access APIs for various Citi services as well as build and test their own applications.

- BBVA API Market: Another open banking API example, Spanish BBVA bank offers a wide array of APIs for account information, payments, and real-time money management. It provides comprehensive developer resources like documentation and code samples.

Open banking APIs enable approved external parties to access customer transaction data, take payments, develop applications using banking services, and more. This builds an open ecosystem for financial services. Let’s see how your business can become part of it.

Getting started with open banking: What you need for successful implementation

In this section, we outline essential steps to implement an open banking solution:

- Understand all key players that enable a secure and regulated open banking ecosystem

- Evaluate regional regulatory frameworks

- Identify appropriate API solutions or partners

- Leverage strategic consulting and technology expertise

Explore a complete open banking ecosystem for stable FinTech operations

Earlier, we identified three key players within the open banking system:

- Banks

- Third-party providers (non-bank financial companies)

- Consumers (end users)

Banks hold and share customers’ financial data with third-party providers through APIs when requested, and customers provide and consent to sharing that banking data. Yet, there are two other essential players that enable secure and regulated open banking:

- Technology service providers (TSPs) supply the essential tech infrastructure for communicating and exchanging data between banks and third-party services.

- Regulators set rules, policies, and technical standards while overseeing compliance and security across the ecosystem and balancing innovation and consumer protection.

See the complete open banking ecosystem:

Navigate open banking regulations your business can’t ignore

While the overarching goal of promoting competition and innovation in the financial services sector remains consistent, specific approaches and implementation timelines differ across regions. Here’s a summary of the current landscape:

Regions with strong open banking frameworks:

- European Union — PSD2

- UK — Open Banking Implementation Entity (OBIE)

Regions with emerging frameworks:

- North America — The Consumer Financial Protection Bureau (CFPB) in the US has proposed a Personal Financial Data Rights rule. Canada is in the consultation phase for developing its open banking framework.

- Asia–Pacific — Australia has the Consumer Data Right (CDR). Singapore and Japan are developing open banking frameworks tailored to their specific markets.

- Latin America — Brazil leads the region with its Open Finance framework. Mexico and Colombia are exploring open banking initiatives.

Regions with limited adoption:

- Africa — Initiatives like the Open Banking API Standard are paving the way for future development.

There is also Open Banking Excellence (OBE) — an industry-led organization responsible for promoting open banking around the world.

Furthermore, every entity involved in open banking must comply with data protection laws. For example, in the EU that’s the General Data Protection Regulation (GDPR), which includes fines of up to €20 million, or 4% of the company’s turnover, for noncompliance with data protection.

With key regulatory requirements covered, let’s move on to technology service providers that offer ready-to-use banking APIs to help companies tap into open banking.

Get a list of open banking API solutions categorized by functionality and region

The open banking ecosystem is getting more intricate as more APIs open banking offers emerge. Our breakdown by function and region will introduce you to this diverse landscape.

Open banking API providers by functionality:

- Financial data aggregation from multiple accounts — Plaid, Tink, Envestnet | Yodlee, Yapily, Salt Edge, Finicity

- Payment initiation from a user’s bank account — TrueLayer, Tink, Token, Dwolla, Form3

- Transaction categorization for financial planning and personalized financial insights — YNAB, Moneyhub

- Lending and credit assessment — Upstart, Prosper, Tink, Envestnet | Yodlee, TrueLayer

- Investment and wealth management — Tink, TrueLayer, Yapily, Stash, Wealthfront, Betterment

- Data insights into customer behavior and analytics — FICO, TransUnion, Dun & Bradstreet

Bank API providers in different regions:

- Europe — Strongest adoption due to PSD2 regulations, with leading providers like Truelayer, Tink, and Yapily

- North America — Rapid growth, with open banking APIs in USA like Plaid and Finicity dominating account aggregation, and Stripe and PayPal leading in payments. In Canada, Salt Edge, Finicity, Flinks, and MX offer open banking-like functionality.

- Asia–Pacific — An emerging market with regional players like Akurateco (Indonesia), Frollo (Australia), and Plaid (expansion into India and Japan).

- Latin America — Early stage, but strong potential due to growing FinTech adoption. Zoop, Nubank (Brazil), and Belvo (Mexico) are key players.

- Africa — Limited adoption, but a promising future due to mobile money adoption and increasing financial inclusion efforts. Okra, OnePipe, and Png.me are notable players.

Want to save this list for future reference? We’ve got you covered:

Open banking API providers by functionality and region

Download the catalogUnderstanding the intricacies of regulations across jurisdictions as well as evaluating the technical architecture needed to implement open banking makes expert IT consulting the critical first step for companies to get open banking capabilities. Yalantis can help in all scenarios, whether you’re thinking about:

- opting for a third-party banking API provider

- building open banking capabilities in-house from the ground up

- outsourcing the building of an open banking module to an expert team

Tap into open banking with Yalantis expertise: How we can help implement your solution

Instead of ensuring compliance with complex regulations, handling security vulnerabilities, and integrating with legacy banking systems on your own, the easier and more effective way to implement open banking is with IT consulting services from Yalantis.

With a track record in FinTech and expertise in building secure, scalable solutions, we can:

- help navigate the complex regulatory landscape

- recommend optimal infrastructure setups for security and reliability

- mitigate risks and simplify adoption of this new financial paradigm

Once we determine the best solution for your needs, our support extends to:

- identifying and integrating the best bank API provider, along with educating your in-house teams for stable performance and risk mitigation

- crafting a custom open banking module tailored to your business requirements

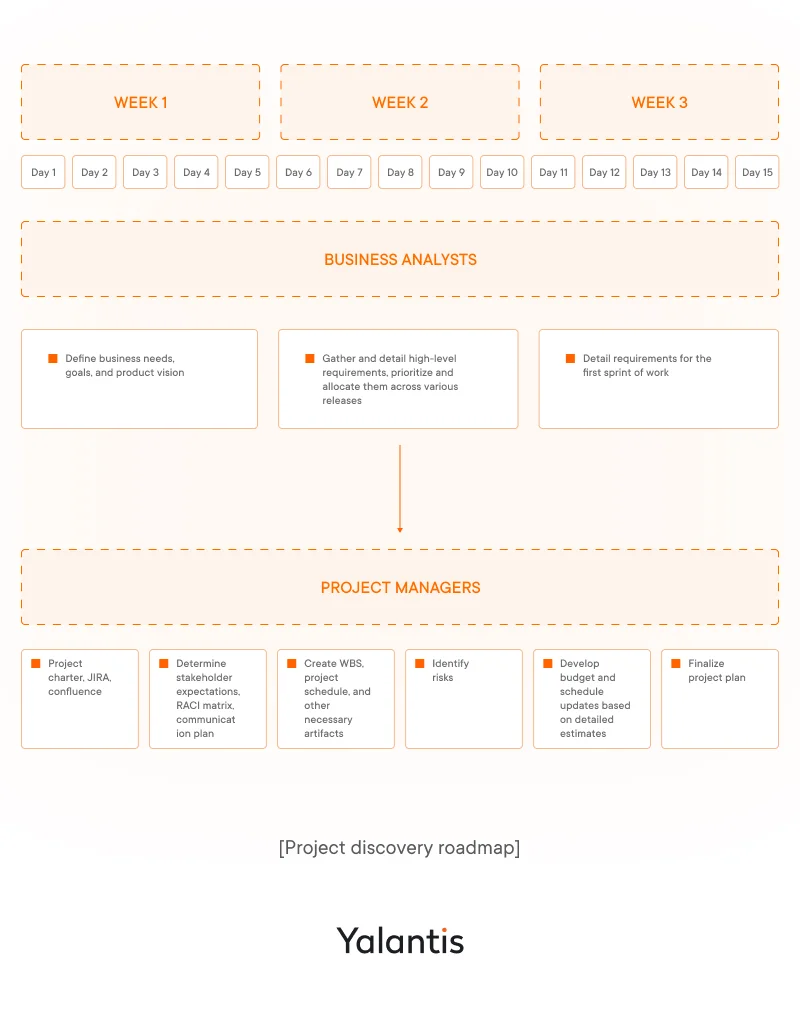

Here’s our approach to kickstarting your open banking project:

As open banking is transforming the financial services industry and presenting new revenue avenues, it’s high time to embrace this technology to stay competitive and reap its benefits.

Discover the perfect open banking solution for your business with expert guidance.

Explore our IT consulting servicesFAQ

How can Yalantis help my business implement an open banking API solution?

With deep expertise in building secure and scalable FinTech solutions, we can:

- navigate nuanced regulatory considerations

- recommend optimal infrastructure setups for security and reliability

- design an infrastructure architecture aligned to performance and scalability needs

- guide security implementation including access controls, encryption, and fraud monitoring

Don’t hesitate to contact us for more details and get started with open banking APIs.

What types of technology infrastructure services do you offer?

We offer a full spectrum of infrastructure technology including cloud, data centers, networking, hardware, and security solutions. These provide the foundation for scalable, reliable, and compliant open banking platforms.

How do your services facilitate the adoption of open banking?

Yalantis provides specialized services for enabling open banking capabilities that rely on factors like security, reliability, and integration with core banking systems. We can:

- provide secure cloud hosting for open banking APIs

- build out scalable infrastructure to handle transaction data flows

- ensure ubiquitous connectivity across systems

- implement cybersecurity controls

- assist with migrations from legacy to modern microservices-based banking infrastructure aligned with open banking