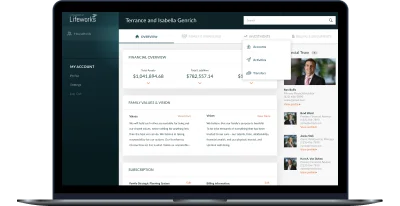

Legacy modernization for Lifeworks

Learn how we helped our client modernize their wealth management platform by upgrading the solution’s technology stack, improving the UI/UX, building a client portal, and automating certain processes.

-

industry

FinTech

-

Country

USA

-

team size

20+ IT experts

-

Collaboration

2019 – 2020

About the client

Lifeworks Advisors is a US-based wealth management company that assists clients in managing their finances, carrying out long-term financial planning, and designing personalized investment strategies.

Learn more about our client’s experience working with us

Business context

Yalantis helped Lifeworks Advisors develop a unified wealth management platform tailored to their needs. With this solution, Lifeworks Advisors wanted to:

- reduce their staff’s workload

- streamline business processes

- improve operational efficiency

- optimize the platform’s performance

- enhance the platform’s feature set to better assist with operational and financial processes within the company

Solution overview

-

Performing a legacy code audit

To achieve their aims, Lifeworks needed to optimize legacy code. Yalantis requested project assets and technical details from the previous development company, and once we received them, we audited the code. We discovered the following obstacles:

- Project documentation was insufficient and inaccurate

- The UI and UX had not been fully designed

- The chosen technology stack didn’t match the project’s goals

- Most features were not yet developed or had only minor elements in development

-

Applying a better-suited technology stack

To modernize Lifeworks’ legacy code, our specialists:

- Held a set of consulting sessions with the client to complete functionality descriptions and break them into detailed user stories

- Created a light and informative UI and UX along with detailed user flow descriptions

- Checked the technological feasibility against Lifeworks’ business goals and requirements

- Switched from Microsoft Azure to AWS and from Angular to React, as they better suited the project’s goals and the required development performance

- Provided detailed estimates on the time required for reworking legacy code

-

Implementing a client portal for optimized collaboration

To save advisors’ time on communicating informational updates and clarifications, we added functionality to the client portal for:

- managing clients’ financial profiles and goals

- reporting on financial situations and investments

- contacting advisors

-

Automating routines for operational efficiency

Calculating and charging commission for wealth management services was another time-consuming routine for advisors. They spent over 320 hours each quarter drawing up bills for their clients and manually charged each bill, which took even more time. Yalantis experts created a system that, using a third-party online payment tool by Menklab LLC:

- automatically bills clients

- automatically charges clients

Value delivered

Our work on system modernization brought the following results:

-

Reduced manual labor: The platform automatically bills and charges clients, saving over 320 hours that were previously spent on client billing per quarter.

-

Legacy code optimization: With the new technology stack and optimized UI/UX, the platform is better suited to meeting the client’s business goals, has stable performance, and offers a better user experience.

-

Convenient clientportal: A convenient client portal provides details on a client’s finances in real time so clients don’t need to call advisors for updates.

OPTIMIZE YOUR LEGACY CODE FOR BUSINESS EXPANSION

Yalantis can update legacy code or develop a solution from scratch based on your time and budget constraints

More projects

-

BaaS for a wealth management solution

A user-friendly and scalable wealth management platform with digital banking functionality

-

Automated cybersecurity ecosystem

A solution for automatically detecting software vulnerabilities

-

Digital banking application optimization

Increasing user engagement by improving the app’s UI/UX and implementing BI