Increased demand for investment and stock market application development has been driven by the evolution of user preferences: more and more people prefer to manage their money using tablets and smartphones. Robo-advisors and stock trading apps have embraced this transition. Let’s look at some facts:

- Statista reports that 56 percent of Americans in 2021 considered stocks the best long-term investment option.

- A Deloitte survey says that in 2021, the investment management industry fared well despite pandemic-driven market volatility.

- According to a Research And Markets forecast, the global WealthTech solutions sector is predicted to grow to $137.44 million in revenue by 2028, increasing at a CAGR of 14.1 percent between 2021 and 2028.

These statistics illustrate that there’s a place in the market for your cutting-edge mobile product or digitalized investment advisor platform.

Based on our in-depth research and solid expertise, we’ve created this article to help you develop a competitive and trendy investment management platform. Our post will be insightful for:

- investment management companies that need to digitize their customer service

- startups that want to build a consumer platform for self-service investment management

- market players that want to create a SaaS investment management platform tailored to the target audience mentioned in the first bullet.

If you have questions about how to build a stock trading app, keep reading. In this article, we will shed light on the crucial aspects of developing apps for investing money. But first, let’s consider your target audience.

Need FinTech-experienced developers?

We have expertise in developing BaaS, wealth management, and other FinTech solutions

Who is the target audience of your investment management platform?

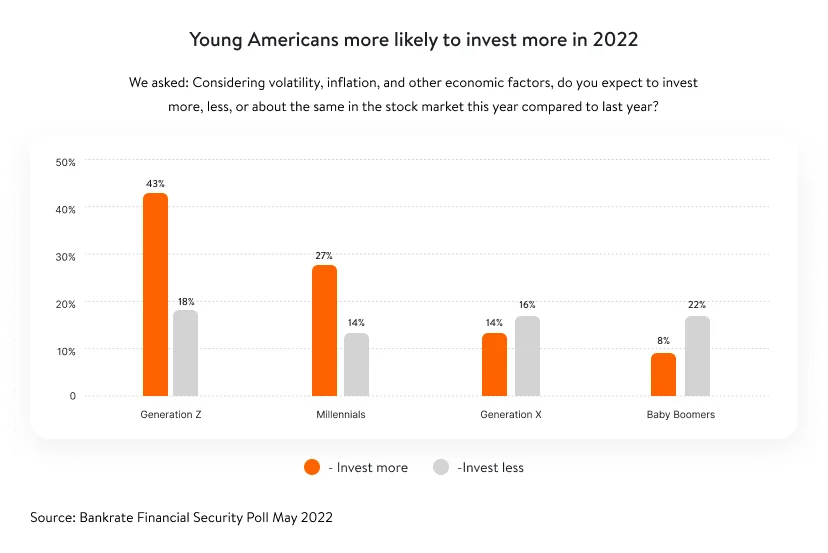

It would be a mistake to think that money management platforms and investment tracker applications are relevant only to older adults. In 2022, younger investors — Gen Z respondents (ages 18–25) and Millennials (ages 26–41) — were more likely than others to make active moves in their investment accounts according to a study conducted for Bankrate by YouGov. Find out how we integrated digital banking services into a wealth management platform to target Gen Z and Millennials.

As the numbers show, Generation X (ages 42–57) and Baby Boomers (ages 58–76) were apt to do nothing in response to inflation and market volatility in 2022. At the same time, respondents aged 45 and older are users of personal investment apps. That means they should also be counted as the target audience, even if they’re less active.

In building a brokerage app or investment platform or during any other financial software development services, Yalantis experts recommend considering the needs of different age groups — Generation Z, Millennials, Generation X, and Baby Boomers — with a slight focus on the younger generations.

Today, when interacting with an investment platform, all users expect an easy-to-use application that offers transparency and an intuitive interface without information overload. But there are still some generational differences in expectations. For younger users, simple functionality and the opportunity to make small investments without paying high commissions will be important. Whereas for older users, it’s necessary to have a lot of charts to help them make informed decisions, as well as educational modules so they can research companies they’re interested in.

Later, we describe how to implement such functionality in your investment app in more detail. For now, let’s pay attention to the latest technologies that are worth considering in 2023.

See how Yalantis developed an all-around wealth management platform for Lifeworks

Read the case studyEmerging technologies to consider adding to an investment platform

The market dictates the need for digitalization, which, in turn, gives rise to a certain number of startups. FinTech startups using emerging technologies in all sectors — from digital payments to InsurTech, mobile banking, and cross-border payments — are riding the strong focus of investors.

An existing surge in startup investment led to an increase in the number of FinTech unicorns back in 2021. A unicorn is a privately held startup company valued at more than $1 billion. According to CB Insights, as of July 2022, there were 1,100 unicorns worldwide. A lot of them are in the FinTech sector.

Deloitte survey responses show that the most important drivers of digitalization with emerging tech in investment management are improving operational efficiency (45 percent) and creating opportunities that did not previously exist or were not viable (42 percent).

Emerging tech to improve operational efficiency

For traditional investment managers, operational efficiency is becoming increasingly important as the rise of low-cost, passive mobile app investing increases competitive pressures. For private equity firms, effectively sourcing deals and improving portfolio company operations are high priorities as deal values rise. Therefore, companies are increasingly turning to digital technologies to improve operations.

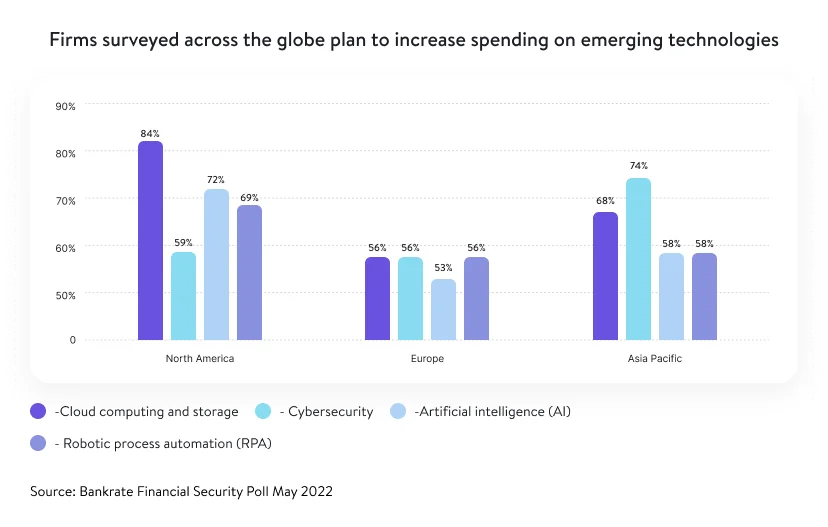

A Deloitte survey also shows that all geographies are expecting a bigger increase in net spending across emerging technologies compared to last year.

For now, it’s worth focusing your attention on the following technologies:

- Cloud computing and storage to support agile operations and increase operational flexibility and efficiency

- Cybersecurity solutions to help companies safely adopt new operating models

- AI and RPA to implement a greater degree of process automation and workflow optimization. These technologies can help reduce development costs and time. For example, Invesco used intelligent automation to save 3 million minutes per year on 35 business functions spanning the front and back offices. Implementing these technologies resulted in annual cost savings of about $2.1 million.

Adopting new technologies can also help generate alpha and better serve customers.

Emerging tech to create new opportunities

It’s also important to mention natural language processing and generation (NLP/G), a type of AI technology, as it helps to summarize structured and unstructured data from diverse sources on investment management platforms. This technology also assists you in reducing the time spent collecting data, allowing you to focus instead on analyzing data with greater potential for insights.

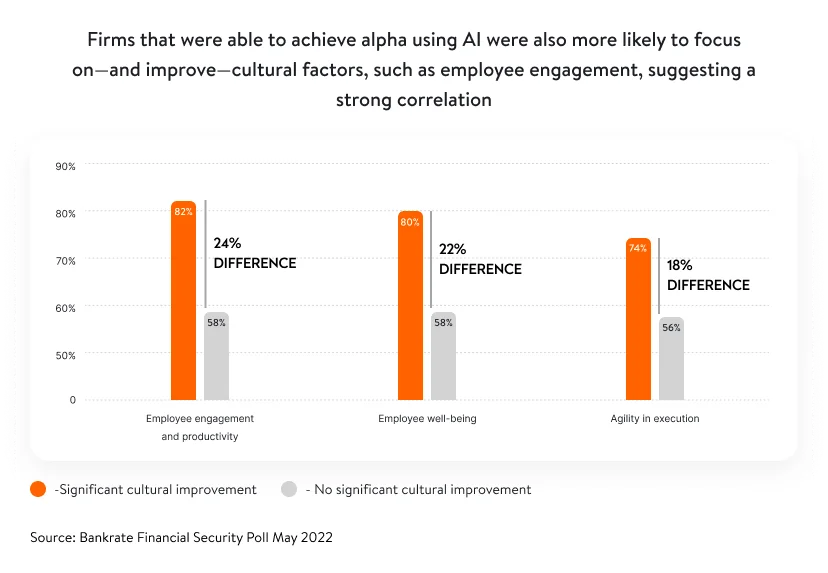

The majority of Deloitte survey respondents using AI solutions in the pre-investment phase agreed that AI helps them generate alpha. In addition, there was a strong correlation between the ability to generate alpha and increased employee engagement, productivity, well-being, and responsiveness. The combination of these factors is also likely to lead to an increase in alpha generation revenue in 2022.

Due to emerging tech, investment managers can also engage with clients in a new way. Companies tend to create personalized customer interactions using data analytics by identifying customer interests, preferred content formats, and frequency of interaction. Personalized communications help customers get the information they’re looking for. This capability, in turn, can enable advisors to close deals faster. Because investment management is largely a relationship-driven business, companies that can better engage with clients and meet their expectations can become more successful.

Regardless of what you aim to achieve on your platform with the latest technology, you may encounter problems. Let’s discuss a few issues that are worth your attention.

Implementing the latest technology for an investment platform: things to consider

Most Deloitte survey responses faced challenges in implementing AI (67 percent), cybersecurity (58 percent), and cloud computing (54 percent). Generally, there are two reasons:

- The complexity of implementation is the top barrier to implementing AI (29 percent) and cloud technologies (31 percent).

- Cybersecurity implementation is stifled by reliance on legacy systems (16 percent).

To make the most of technologies like cloud computing, cybersecurity solutions, AI, and RPA, you need to build the right data infrastructure. For example, as data is the building block of AI models, you may need to implement a data warehouse that aggregates and stores clean data.

Similarly, an effective RPA implementation may require robust exception handling to ensure that systems perform as expected. Intelligent automation that uses AI and RPA, either separately or in combination, can allow you to cut costs, increase revenue by being more precisely targeted to customers, and execute processes two to three times faster than humans can without these advanced technologies.

More considerations when developing a trading app and an investment platform

There are many important factors beyond implementing the latest technologies that are essential to consider during investment platform development, payment app development, or when improving an existing investment product.

Expand functionality to gain a competitive advantage when developing a stock trading app

To be trustworthy, investment platforms or apps have to be transparent about their fee structure and need to have customer support and educational resources. Advanced functions that can appeal to even more users include the following:

- Charting useful capabilities. When line, candlestick, and volume charts are available in a mobile money investment app, investors can get information and tools to make informed investment decisions.

- Educational content on how to invest safely (like online webinars, financial calculators, and newsletters).

- Automated counselors. Integrating robo-advisors (automated online investment assistants) into your robo investing app and FinTech software is a top priority. Users would gladly take personalized advice from a computer algorithm if their stock market investment apps offered it.

- Wide range of assets. The more investment assets are supported, the the more users will find your app attractive. You can try to expand your line of stocks, ETFs, and other funds in an investing app.

- Offering spare-change investing or round-up investments will allow users to invest small amounts in specific stocks. Investing apps typically connect to a debit or credit card of users, so they round up purchases to the nearest dollar and automatically invest the difference. For example, if a user spends $3.75 on a cup of coffee, $0.25 will be put toward a chosen stock.

You also can consider implementing the following in your investment platform to enhance efficiency in the use of financial services and increase customer retention through speed and convenience:

- Aggregating customer financial data

- Managing financial goals

- Providing real-time reports

- Functionality for opening/monitoring investment accounts

- Routine automation for operational efficiency

- Customer portals for optimized collaboration. Users can do simple operations on their own without the need for a consultant.

Once the investment management platform functionality has been properly chosen for your particular case, it’s worth thinking about the next important step: design.

Ensure a sophisticated design for your investment platform and trading application

Ensure a sophisticated design for your investment platform and trading application

Consumers are spoiled for choice, which is why hyper-personalized solutions and deeper insights on investments allow you to stay competitive in the market.

Your users should find financial guidance, account aggregation, goal setting, investing, and banking options to be both user-friendly and seamless to navigate. Let’s start with key points about the user experience.

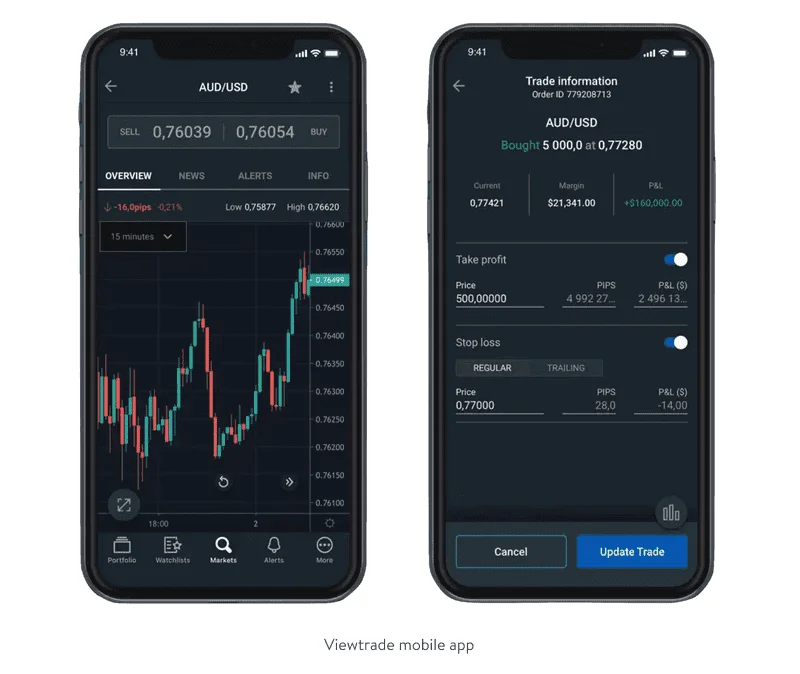

1. Meaningful UX. When thinking about what an investment platform should look like to help users, it’s worth taking into account the needs of the vast majority. In other words, when creating your platform, we recommend creating something in between the minimal functionality of simple stock investing apps and the complex functionality of heavy trading platforms like Binance. A mobile app should satisfy both those users who enter the app once every two weeks to buy a stock for $10 and active investors who pay attention to daily market noise and buy and sell for large sums. An example of such an application is Viewtrade mobile app.

For the desktop platform, intuitiveness will be an integral part of success. You can compare Orbis Pro Trader, a platform that is visually overloaded, with the modern Lifeworks platform.

To be in demand on the market in 2023, both platforms and apps should have a smooth UX so users can easily understand how to navigate. It’s extremely important to not let your stock investment application become a case of information overload that turns off users who are not as enthused about stock trading as their heavily invested counterparts.

If users don’t understand how to make a trade, don’t know where to find educational information, or don’t understand the charts, it’s unlikely they will continue to invest or work with your product, as there are also huge sums at stake.

2. Simple UI. During investment app development, you should implement a conversational user interface (CUI). A CUI will help you connect with users simply and intuitively to provide a realistic feel while interacting with the system, increasing user attention. In investment platforms, Yalantis experts use conversational user interfaces that leverage NLP. This allows the system to understand, analyze, and create meaning from human language data structures.

In addition to the fact that design is an essential part of a competitive modern app for investment, there are several complexities that exist beyond design.

Consider investment platform and stock market app development challenges

The first challenge to consider when it comes to apps for investing is cybersecurity.

Cyber threats

Data breaches are unacceptable because investment platforms are quite sensitive and contain confidential information about users, such as social security numbers.

Here are some steps that Yalantis’ experts follow to ensure the complete security of your application:

- Two-factor authentication. This helps protect users’ accounts by requiring two sources of authentication to sign in: something users know (such as a password) and something users have (such as a one-time verification code or a device approval request). Every time a user logs in or makes changes to the account, they will be required to verify their identity before completing the action. This helps to protect the account even if someone knows or guesses the password.

- Encryption. Sensitive information, such as social security numbers, should be encrypted before it’s stored. In addition, your platform can securely communicate with your servers using the Transport Layer Security (TLS) protocol with up-to-date configurations and ciphers. TLS helps to ensure that anything users send to your servers remains private — including personal and account information such as passwords and bank account credentials.

- Password safety. Our recommendation is to hash user account passwords using the industry-standard BCrypt hashing algorithm and never store them in plaintext. This means they will be stored in an encrypted format, making them harder and more time-consuming for attackers to crack.

- Perform real-time threat analysis and fraud prevention based on AI and ML tools.

- Keep application programming interfaces (APIs) safe. The following practices may be helpful: cataloging all available APIs, identifying potential attack vectors based on the API’s function, and restricting API output to only expose the minimum necessary data.

If you implement these practices and keep your security policies up to date, you will provide a high level of security for your product.

Laws to keep users’ money safe

The financial laws of each state vary, with implications concerning the legal status of the investment stock app providing financial services, the presence and size of the authorized capital, licenses, taxation, and reporting requirements.

Ignorance of important legal requirements and inadequate reporting on which digital transformation takes place can lead to significant financial, legal, and reputational consequences. Firms that are putting governance and control mechanisms in place as they go along their transformation journey are likely to have the upper hand when financial measures become mandatory compliance requirements.

What we recommend focusing on:

- If your business is located in Europe, you must comply with the General Data Protection Regulation (GDPR).

- If you want to work in the EU market, you have to fulfill the requirements of the PSD2 Directive. You’ll have to put up with a thorough review of all the data you provide and follow rules to protect consumers’ rights to payment services.

- In the US, you need to take into account the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). They regulate brokerages and stock investing apps. Both SEC- and FINRA-registered apps for stock investing have to meet certain requirements.

- If you need to track your automatic investing app, you can do so by searching for your firm at advisorinfo.sec.gov or brokercheck.finra.org. In addition, most trustworthy brokerages and automated advisors offer insurance with the Securities Investor Protection Corporation (SIPC). This is a nonprofit membership corporation that protects money invested in a brokerage that files for bankruptcy or encounters other financial difficulties.

Finally, yet importantly, let’s talk about challenges with payment for order flow (PFOF) transparency.

Transparency around payment for order flow

PFOF statistics are usually published by brokers. They’re the best way for investors to ensure accurate and timely trade executions. PFOF is going to be important when evaluating online brokers going forward because most online brokers have joined the no-fee movement. According to the SEC, payment for order flow is a method of transferring some of the trading profits from market making to the brokers routing the orders.

Why is it important to comply with the PFOF method? The popular investment tracking app Robinhood paid out $65 million to settle the charges of The Securities and Exchange Commission as a result of PFOF. According to SEC estimates, Robinhood’s poor order execution cost its customers $34.1 million from 2016 to 2019. Robinhood also seemed to hide the fact that PFOF was its primary way of making money.

By taking all of the abovementioned factors into account when developing your product, you can avoid a variety of turbulent stages.

Yalantis insights on building an investment management platform for business growth

Based on our extensive experience in investment advisory platform development, we will highlight a few things that can help you improve your platform.

Mitigate conduct risks

In addition to the latest technologies we mentioned at the beginning of the article, technological solutions that can help mitigate a heightened level of conduct risk (a form of risk that refers to potential misconduct of individuals associated with a firm, including employees, third-party vendors, etc,) include:

- enhancement of personal account monitoring

- prioritization of higher-risk events

- data analytics on alert metadata

- restrictions on the use of high-risk communications systems.

Furthermore, establishing appropriate intelligent third-party risk management and real-time monitoring systems and verification of third-party responsible operation claims can help mitigate the third-party risk.

Choose a digitization strategy

A firm’s core technology infrastructure generally has a significant bearing on its digitization strategy. Depending on what you’re starting to develop the platform with, there are several options:

- Firms with modernized core infrastructures can increase their in-house technology spending on advanced technologies to enhance their investment decision-making process and client service.

- Less digitized firms can turn to third-party cloud-based asset servicing platforms to get a unified view of client data across the extended organization. Such an approach allows firms to rapidly derive insights from data and develop products faster while mitigating some of the risks associated with substantial technology development projects.

- Those with legacy infrastructure may have to adopt a different approach to efficiently use advanced technologies and data analytics. So it might be worth performing a legacy code audit first, then applying a better-suited technology stack.

All of these aspects and many others the Yalantis team takes into account when developing a custom investment management app or platform. To determine where to start with development or how to improve it, it’s worth consulting with an appropriate provider, who you should primarily choose before starting the development.

Want to build an investment app?

Consider working with Yalantis